|

|

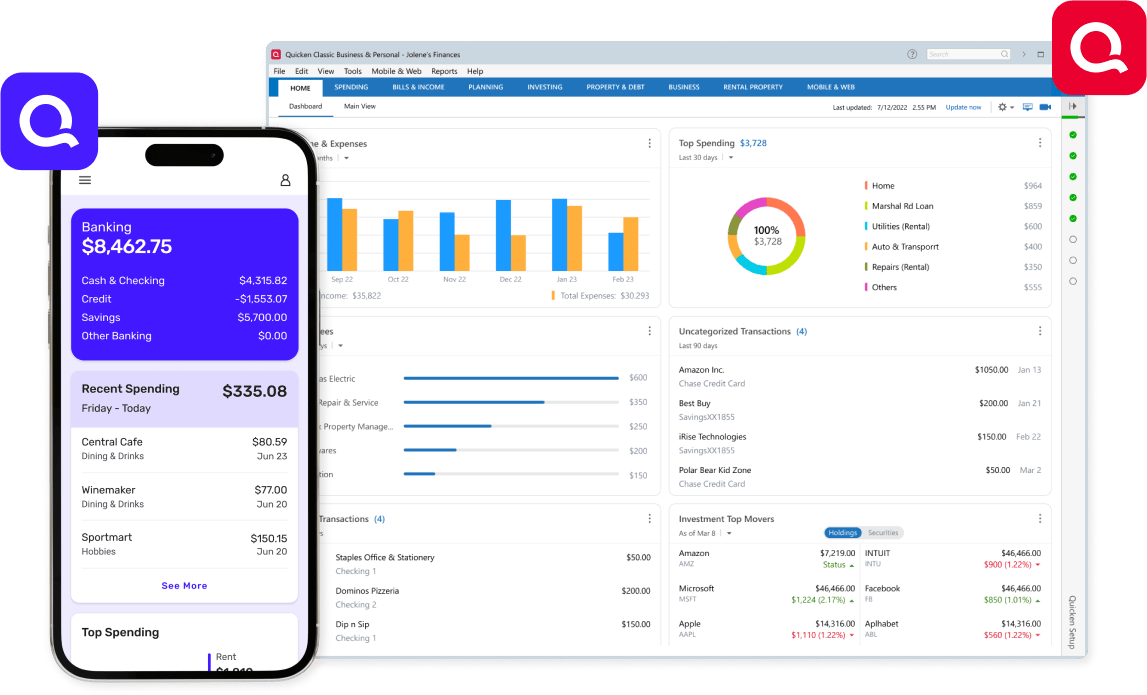

Quicken Personal |

Quicken Business & Personal |

|---|---|---|

|

|

Best for budgeting, saving & investments |

Best for self-employed & small business owners |

|

Track spending, bills and subscriptions |

|

|

|

Stay on budget |

|

|

|

Save more money |

|

|

|

Get insights with built-in & customizable reports |

|

|

|

Projected cash flows |

|

|

|

Analyze investment performance |

|

|

|

Plan for retirement |

|

|

|

Manage business cash flow |

|

|

|

Simplify business tax prep |

|

|

|

Manage multiple businesses |

|

|

|

Unlimited clients, projects, & invoices |

|

|

|

|

|

|

Personal

Business

Quicken Simplifi

$2

.

99

$5.99

/month

Billed annually

-

Always know what you have left to spend or save

-

Get better insights with reports & real-time alerts

-

Make informed decisions about your investment portfolio

-

Plan for the future with projected cash flows

Quicken Business & Personal

$3

.

99

$7.99

/month

Billed annually

-

Get all Quicken Simplifi features plus business tools in one cloud-based app

-

Track cash flow with detailed performance reports

-

Use invoicing tools to get you paid faster

-

Simplify tax time with built-in Schedules C, E & F

Classic

Choose a version

Premier

Deluxe

$4

.

19

$6.99

40% off

/month

Billed annually

$2

.

99

$4.99

40% off

/month

Billed annually

-

Best-in-class investing tools

-

Built-in tax reports

-

Reconcile to the penny

-

Track & pay bills in Quicken

-

Set budgets, manage debt, create a retirement plan

-

Create multiple budgets

-

Manage & reduce debt

-

Simplify tax time

-

Create a secure retirement

Quicken Simplifi

$2

.

99

$5.99

/month

Billed annually

-

Always know what you have left to spend or save

-

Get better insights with reports & real-time alerts

-

Make informed decisions about your investment portfolio

-

Plan for the future with projected cash flows

Quicken Business & Personal

$3

.

99

$7.99

/month

Billed annually

-

Get all Quicken Simplifi features plus business tools in one cloud-based app

-

Track cash flow with detailed performance reports

-

Use invoicing tools to get you paid faster

-

Simplify tax time with built-in Schedules C, E & F

Classic Premier

$4

.

19

$6.99

40% off

/month

Billed annually

-

Best-in-class investing tools

-

Built-in tax reports

-

Reconcile to the penny

-

Track & pay bills in Quicken

-

Set budgets, manage debt, create a retirement plan

Classic Deluxe

$2

.

99

$4.99

40% off

/month

Billed annually

-

Create multiple budgets

-

Manage & reduce debt

-

Simplify tax time

-

Create a secure retirement

Quicken Business & Personal

$3

.

99

$7.99

/month

Billed annually

-

Get all Quicken Simplifi features plus business tools in one cloud-based app

-

Track cash flow with detailed performance reports

-

Use invoicing tools to get you paid faster

-

Simplify tax time with built-in Schedules C, E & F

Classic Business & Personal

$5

.

99

$9.99

40% off

/month

Billed annually

-

Separately manage all finances from one location

-

Simplify your tax prep and maximize deductions

-

Keep financial documents organized with ease

-

Manage P&L, cash flow, tax schedules, and more

Pick any two to compare

Budgeting, saving & investing

Experienced investing

Traditional personal finance

Robust & feature-rich

Best for serious investors

Platform

Web & mobile app

Windows & Mac desktop

Windows & Mac desktop

Save more

Custom savings goals

Custom savings goals*

Custom savings goals*

Create/track custom saving goals

Set goals for emergency, home & more, and track progress

Include savings goals in budget

Can choose to incorporate savings contributions into spending plan

Spend from savings goal

Spend from a goal to use money you've saved toward the goal

Stay on budget

Based on your income & bills

Traditional & category-based

Traditional & category-based

Auto-generated spending plan

Personalized based on your income & expenses; customize to meet your needs

Traditional, category-based

Set amounts for spending in each category. Highly customizable.

Know what’s left to spend/save

Always know what's left based on actual spending (not just what's budgeted)

Ignore select transactions

E.g. commission checks, stock sales, and/or tax payments

Multiple budgets

Roll over spending

Roll overspending and underspending into the next month

Fiscal & calendar year budgets

Know where your money is going

Proactive tools & reports

Spending reports

Spending reports

Custom spending watch lists

E.g. coffee or Amazon. Alerts if you're approaching the spending target

Auto detect bills/subscriptions

Automatically identifies bills & subscriptions you might have forgotten

Customizable spending alerts

Set alerts for large deposits/purchases, low balances & more

Refund & return tracker

Keep track of money expected from returns and returns

Built-in spending reports

Built-in spending reports plus ability to customize to suit your needs

Track & pay bills

Track bills

Track & pay bills

Track bills

Download bills

Download online bills from thousands of connected billers

Pay bills from Quicken

Pay anyone in the US by check or make same-day online payments from Quicken

Manage your debt

Set goals & track debt

Debt reduction tool*

Debt reduction tool*

Set goals & track debt

Set goals & keep track of your debt repayment schedule

What-if

Use “What-If” to see how changing payments could speed up loans payoff

Faster ways to pay off debt

See how changing payments could speed up your debt payoff

Manage & grow investments

Performance tracking

Investment optimization

Performance tracking

Consolidated performance tracking

Track individual accounts & your entire portfolio in one consolidated view

Custom investment news feed

News related to your portfolio, which might impact investment performance

Real time quotes

Up to the minute prices

Customizable portfolio views

Customizable views, including cost basis, total gain/loss & over 100 fields

Capital gains estimator

Preview capital gains before selling multiple securities or even mixed lots

Assess impact of buys/sells

See whether your buys/sells out or under-performed vs holding positions

Advanced performance options

Portfolio value vs Cost Basis, Growth of 10K snapshot, Avg Annual Return

Morningstar fund ratings

Updated monthly & downloaded into your portfolio directly from Morningstar

Morningstar Portfolio X-ray

Uncover portfolio strengths, weaknesses, concentrated positions, & more.

Plan for the future

Projected balances & cash flow

What-if, Lifetime Planner

What-if, Lifetime Planner

Projected cash flows

See your projected cash flows & the impact on your account balances

Track upcoming payments & impact

Track your upcoming payments & see the impact on your income and expenses

What-if tools

Debt, investments

Calculators

Calculators for retirement, college, refinancing, savings, debt

Lifetime Planner for retirement

Create a retirement roadmap; project scenarios to see how your plan changes

Simplify tax time

Tag tax-related transactions

Built-in tax reports

Create tax reports

Tag tax-related expenses

Keep track of any tax-related transaction during the year, e.g. donations

Create custom tax categories

Map any transaction or category to a specific line on IRS tax forms

Create custom tax reports

Any IRS line/schedule, e.g. charitable contributions, Schedule F, H & more

Built-in Schedule A, D

Built-in Schedule A Itemized deductions & Schedule D Capital Gains & Losses

Built-in Schedule B, FBAR

Built-in Schedule B: Interest & Dividends & Foreign Bank Account Report

Reconcile your accounts

Mark transactions as "reviewed"

Compare vs bank statements

Compare vs bank statements

Mark transactions as "reviewed"

Manually check bank total vs Simplifi to see if there is a match

Compare bank statements to Quicken

"Reconcile" to check bank statement vs Quicken' & share difference if any

Share your finances

Share with partner or advisor

Share with partner or advisor

Share with partner or advisor

Dataset sharing

Give access to your data without sharing login credentials

Track assets

See updated values

See updated values

See updated values

Track real estate assets with Zillow

See your updated Zestimate as part of your net worth

Credit score report

See your free credit score

See your free credit score

See your free credit score

Cloud storage

Built into app

Add-on: $1.99/month

Add-on: $1.99/month

Free customer support

Free phone & chat

Premium phone & chat

Free phone & chat

: All Platforms

: Web

: Mobile App

: Windows

: Mac

: Add-On. Starting at $9.95/mo

Frequently asked questions

What makes Quicken better than other personal finance apps?

Quicken has been trusted for more than 40 years by 20+ million customers. With Quicken, you get a financial partner for life — with everything you need and the customization you want, all in one place. Our financial management features lead the industry. Many customers start out simply tracking their spending and end up creating intricately personalized investment systems to grow their net worth into the millions.

What are the differences between Quicken Simplifi and Classic?

Quicken Simplifi is your go-to choice for managing budgeting, savings, and investments in an intuitive web and mobile app. Our Classic line is a great option for those who prefer to work on Windows or macOS — and comes with companion web and mobile apps.

What are the differences between Quicken Simplifi and Quicken Business & Personal?

Quicken Business & Personal offers all the personal finance features of award-winning Quicken Simplifi, including budgeting, savings, and investments, plus business financial tools designed to help small business owners and the self-employed manage their business cash flow, taxes, profitability, and more.

Can I use Quicken outside of the U.S.?

Quicken is intended for subscribers in the U.S. and Canada, since we are only able to support banks from these regions at this time. For more information on our Quicken Classic Canadian products, please visit our Quicken Canada site. For more information on our Quicken Simplifi Canadian product, please visit your mobile App Store or Google Play.

What makes Quicken Business & Personal better than other business finance apps?

Quicken Business & Personal is designed specifically for small business owners, freelancers, and people who are self-employed. It features exactly what you need without the bigger business extras you’ll never use and don’t need to pay for. The result is an easy-to-use tool that simplifies managing both business and personal finances — all in one app, with separate views, at one low price. Automated features help you manage your cash flow, invoicing, and expenses easily and help you get paid faster. You’ll also have access to reporting tools, transaction categorization, and receipt storage to make tax season painless. And only Quicken also includes a full suite of personal finance tools, such as budgeting, savings, and investment tracking. You’ll have full control over all your finances — business and personal — without bouncing between different apps to get it.

What are the differences between Quicken Business & Personal and Quicken Classic Business & Personal?

Both products allow you to manage your business and personal finances all in one place. Quicken Business & Personal is a cloud-based app designed for web and mobile, offering complete financial management anytime, anywhere. If you prefer to manage your finances from a local desktop application, Quicken Classic Business & Personal integrates to your native Mac or Windows OS.

How many businesses can I manage with one subscription?

With Quicken Business & Personal, you can manage up to 10 different businesses, plus all your personal finances for one low subscription price. Classic Business & Personal also gives you the flexibility to manage multiple businesses. So whether you’re managing one business or keeping track of income from a few side hustles, you’re covered.

Can I use Quicken products on my computer or mobile device?

Quicken Business & Personal is available by mobile app & web app. Quicken Classic Business & Personal is available on desktop with companion web and mobile apps.

Can I use Quicken outside of the U.S.?

Quicken is intended for subscribers in the U.S. and Canada, since we are only able to support banks from these regions at this time. For more information on our Quicken Classic Canadian products, please visit our Quicken Canada site. For more information on our Quicken Business & Personal Canadian product, please visit your mobile App Store or Google Play.

What are the system requirements?

For Quicken Business & Personal, all you need is an up-to-date browser or smartphone with internet access. For Quicken Windows, Quicken Mac, Quicken Mobile, and Quicken on the Web requirements, check out the Quicken System Requirements.