Pay your debt, grow your savings

With personalized tools and spending trackers, strike the perfect balance between minimizing debt and saving money.

Connect all of your accounts, use custom budget calculators, and make paying down debt part of the plan.

With personalized tools and spending trackers, strike the perfect balance between minimizing debt and saving money.

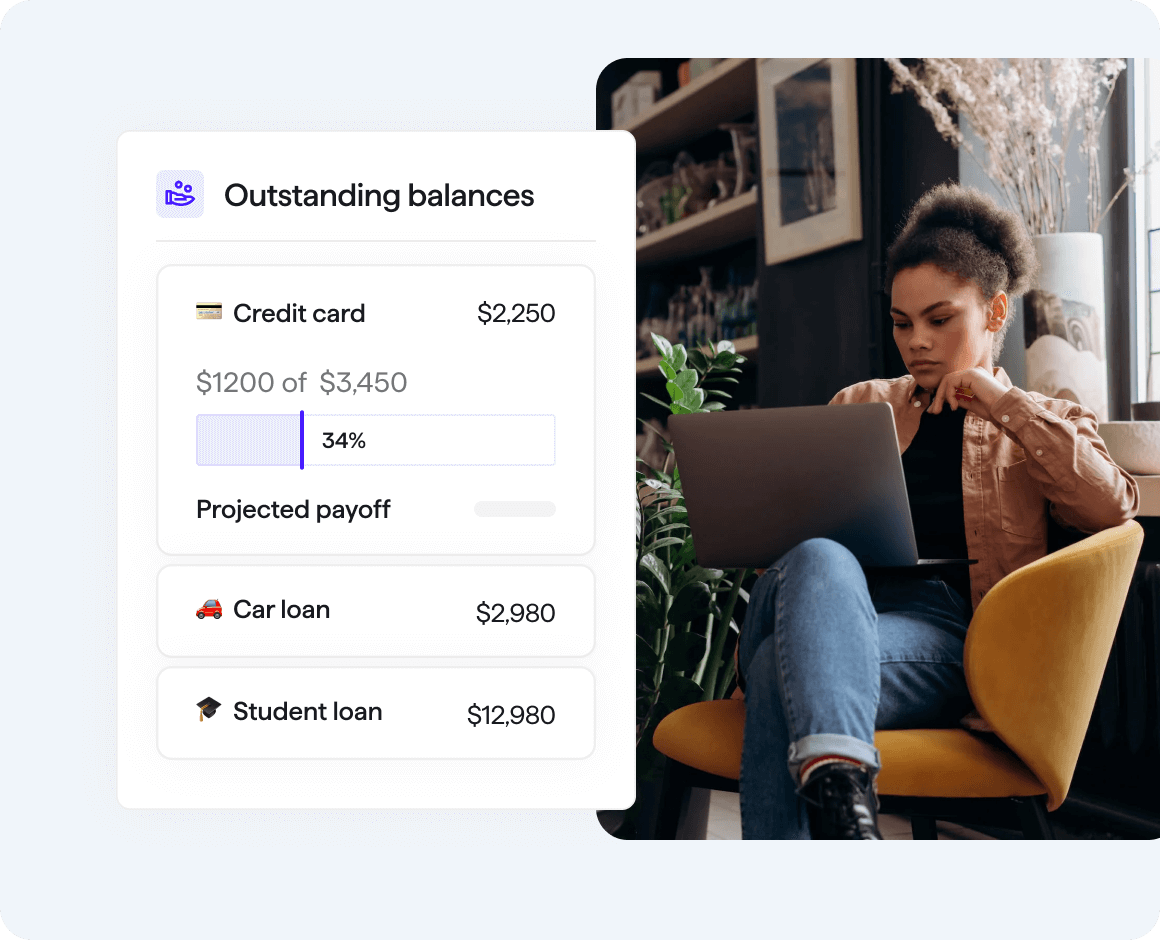

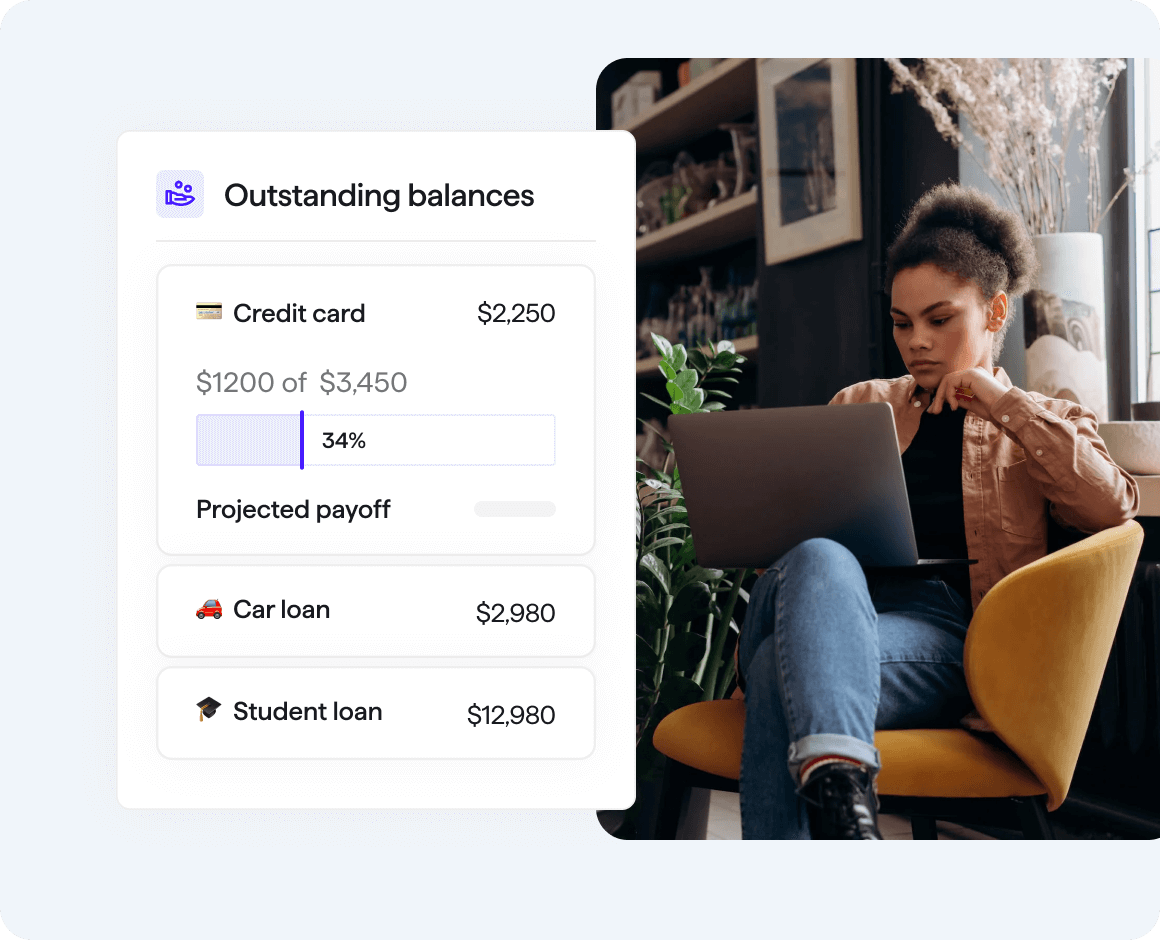

Treat debt repayment like any other expense. Budget for monthly payments and work to pay off your debt in full.

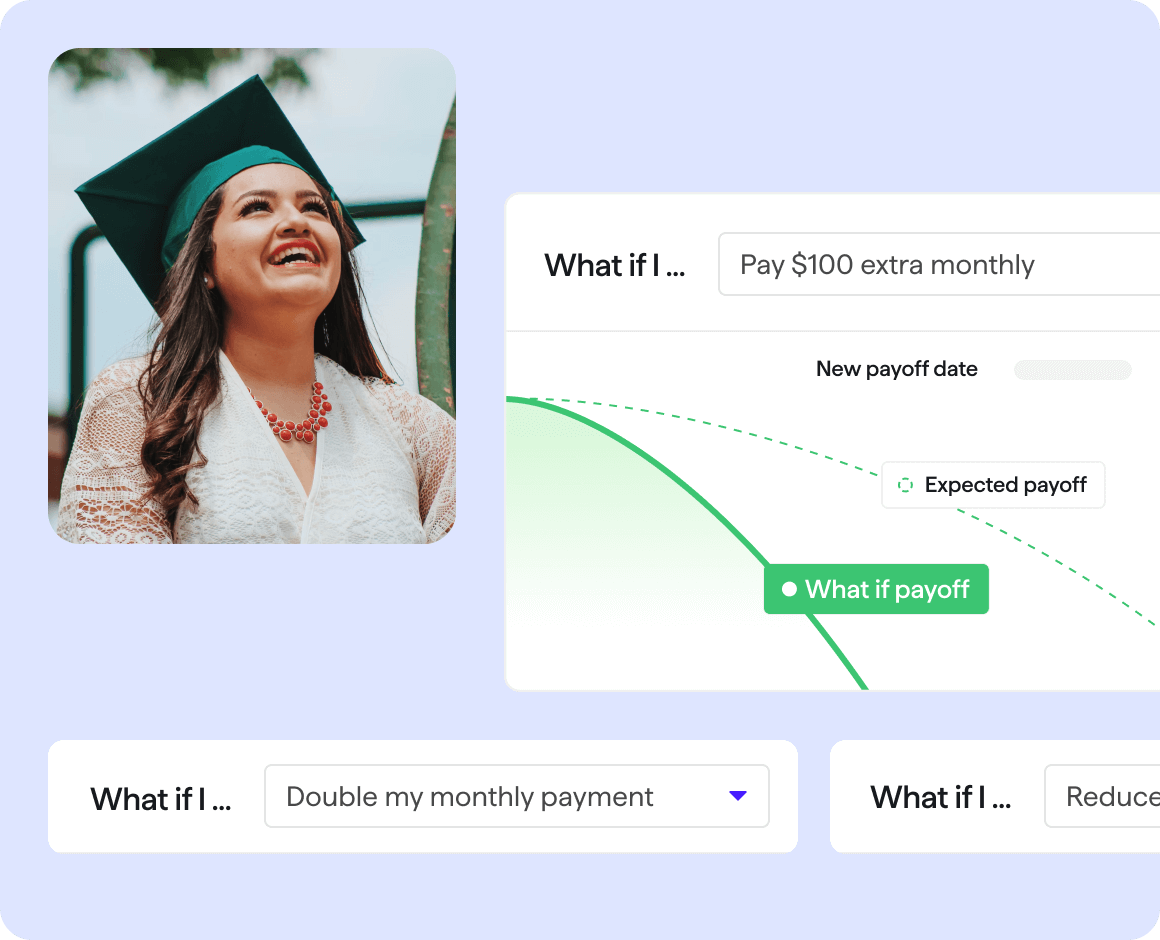

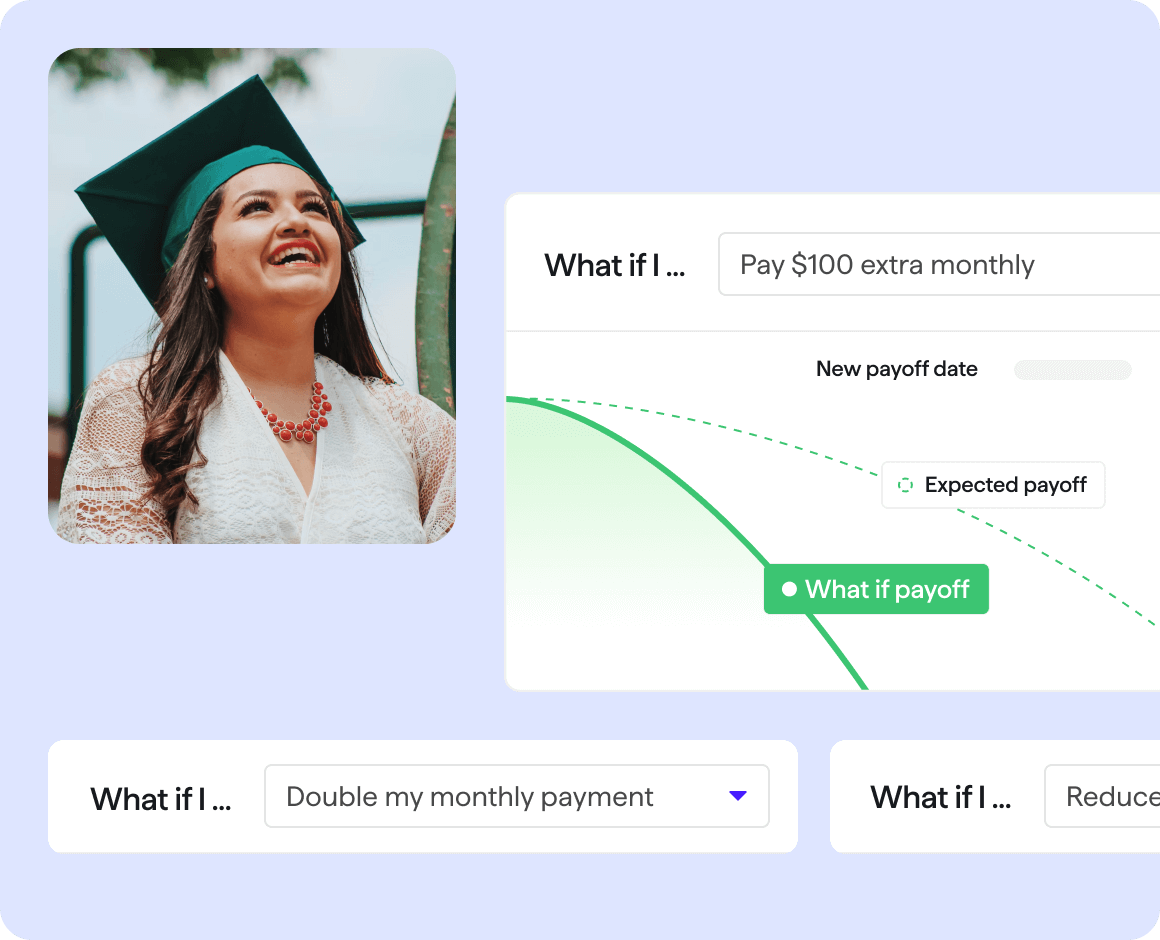

Ever wonder how much extra you need to pay to clear your debt faster? “What-if” tools can help you figure it out.

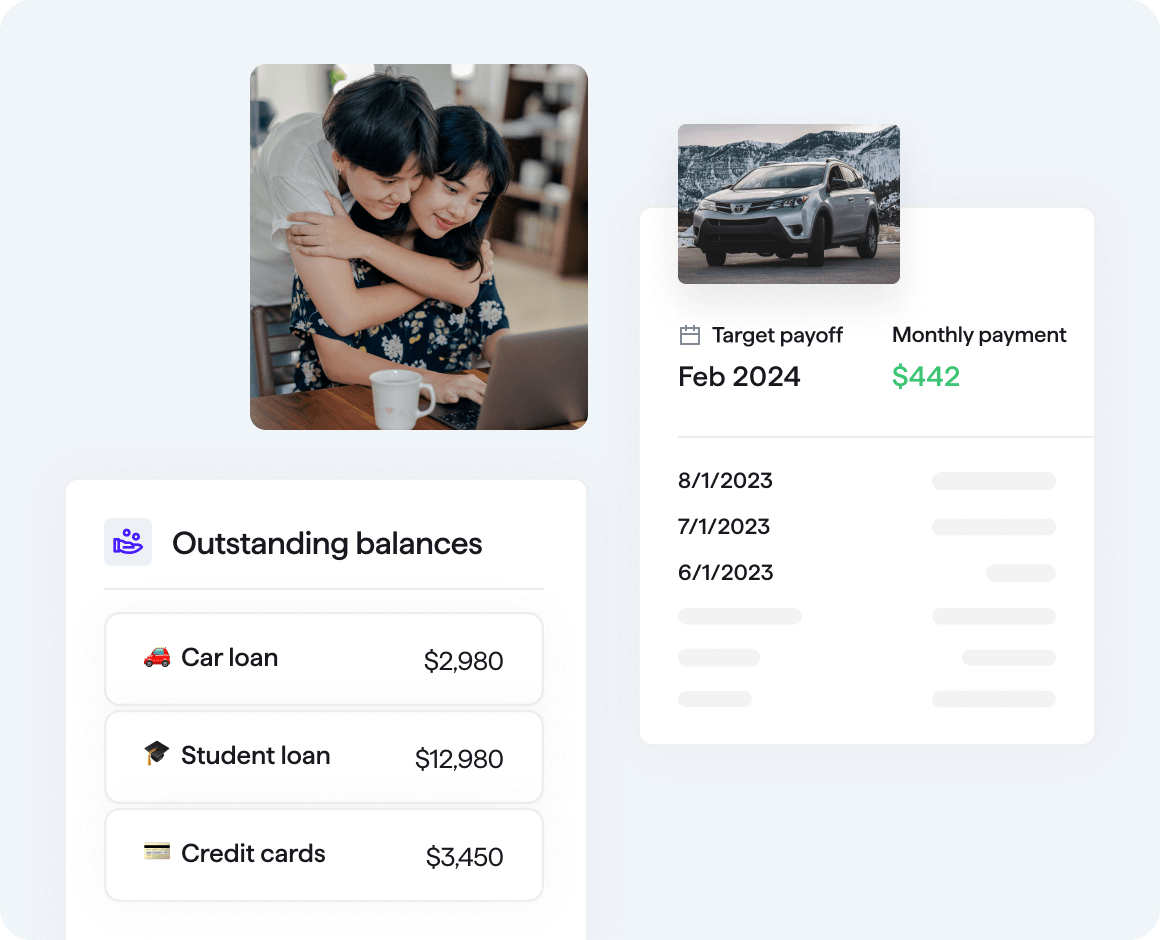

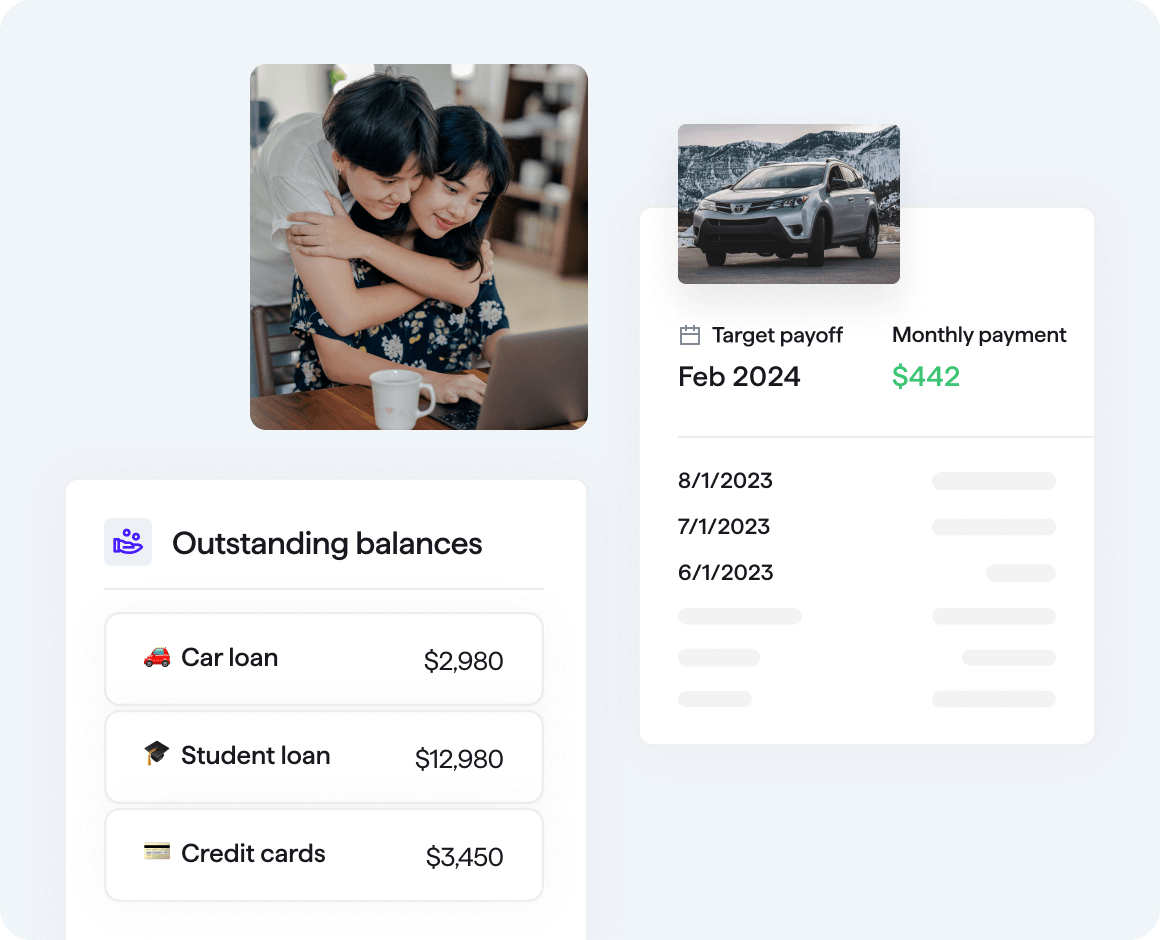

Whether you want to pay off your smallest balances first or attack high-interest loans first, getting out of debt requires having a plan in place.

Look at each outstanding balance. You’ll need to decide when you want to have each debt fully paid — and determine how much you can afford monthly.

Use quick insights and run scenarios with “what-if” tools in order to adjust your plan for unexpected life events, unplanned expenses, or income changes.

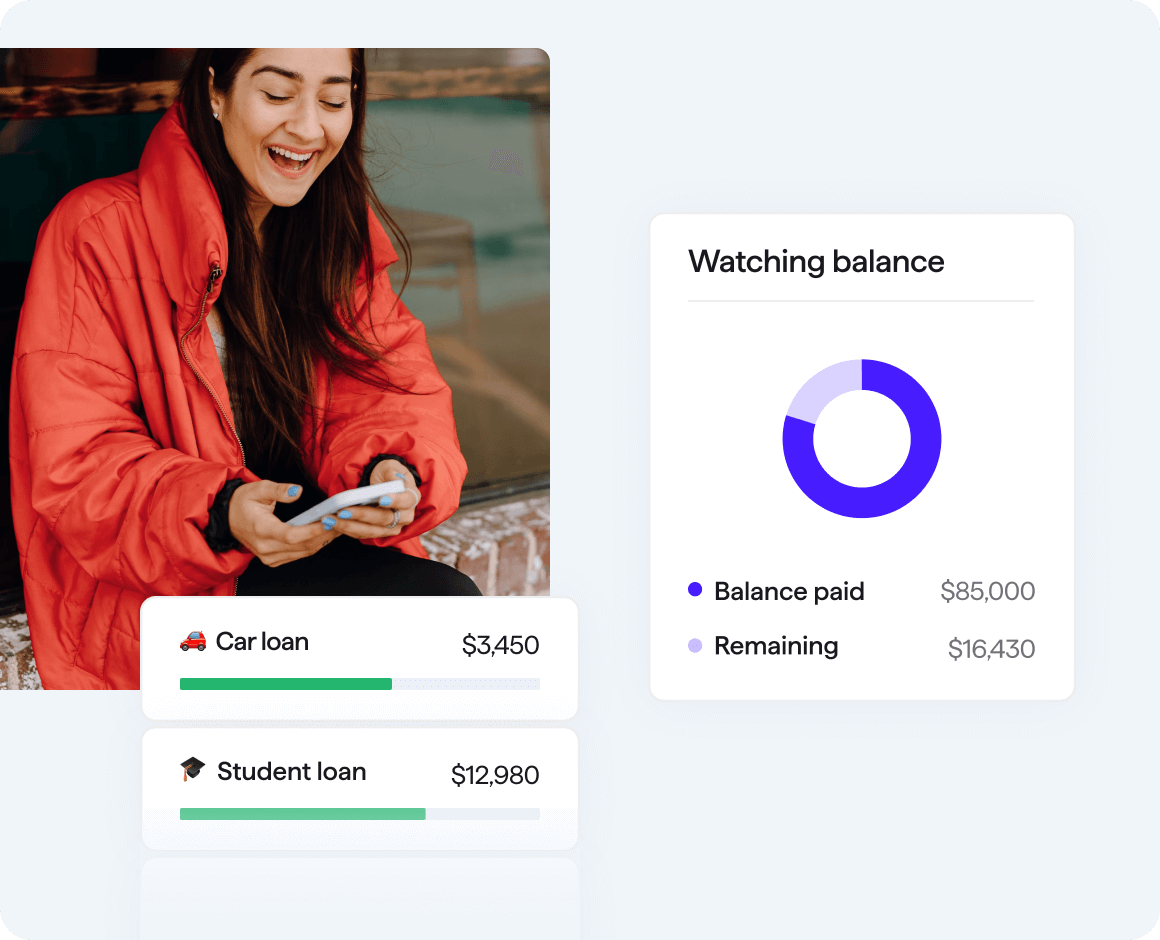

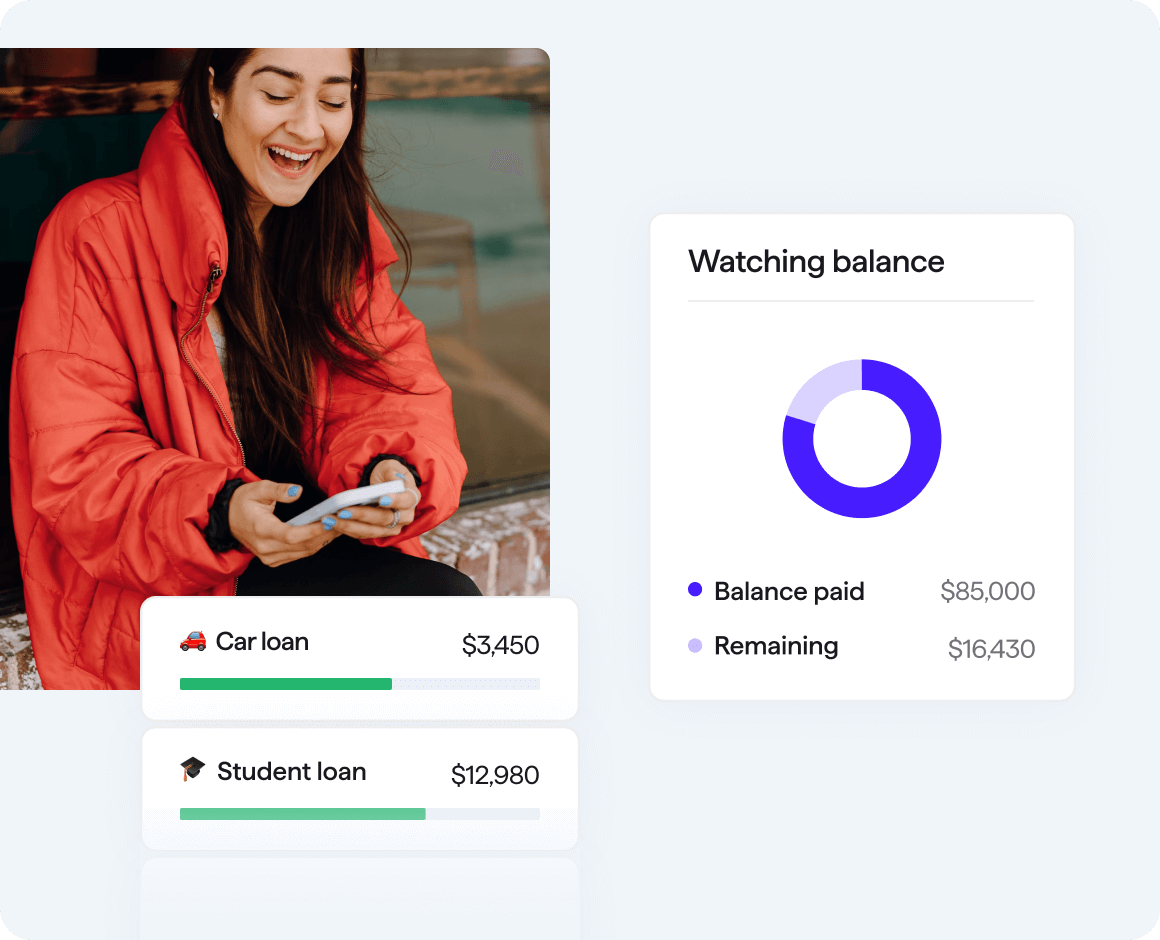

Stick to your plan and your balances will decrease. Celebrate reducing balances, paying off obligations, and feeling in control of your finances.

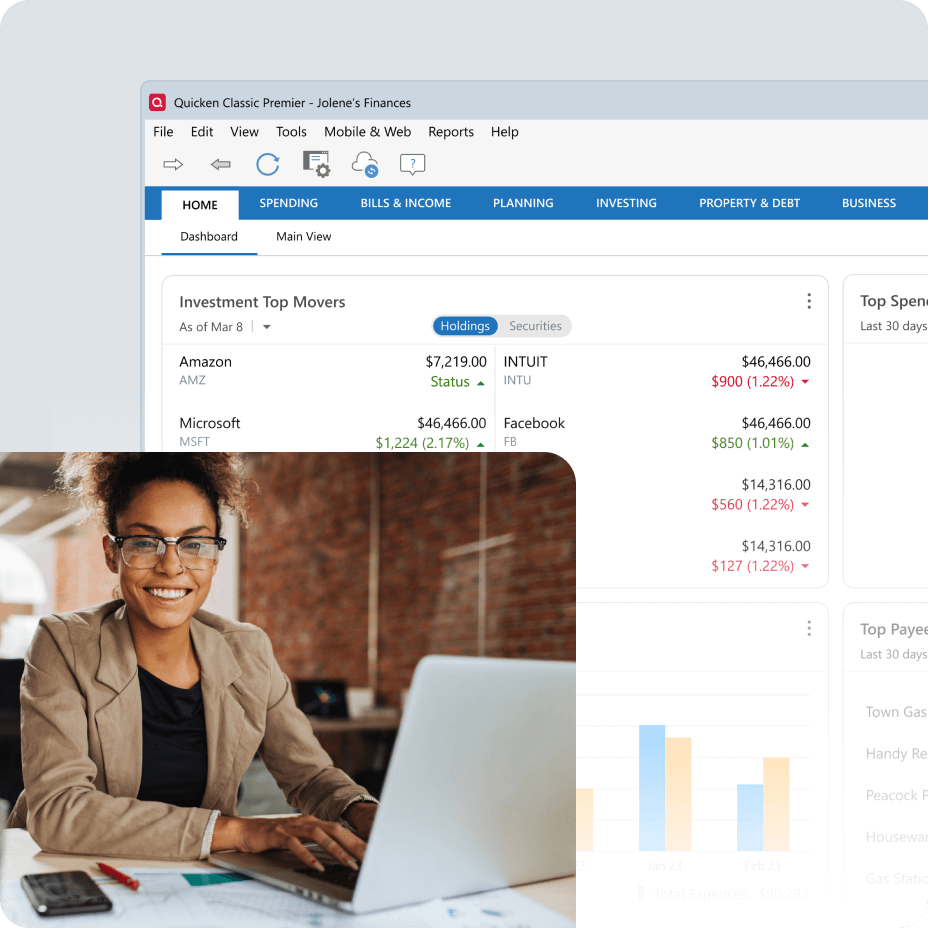

Classic

Choose a version

#1 best-selling with 20+ million customers over 4 decades.

We protect your data with industry-standard 256-bit encryption.

Rest assured, we’ll never sell your personal data.

No hidden fees or annoying ads. What you see is what you get.