Features

|

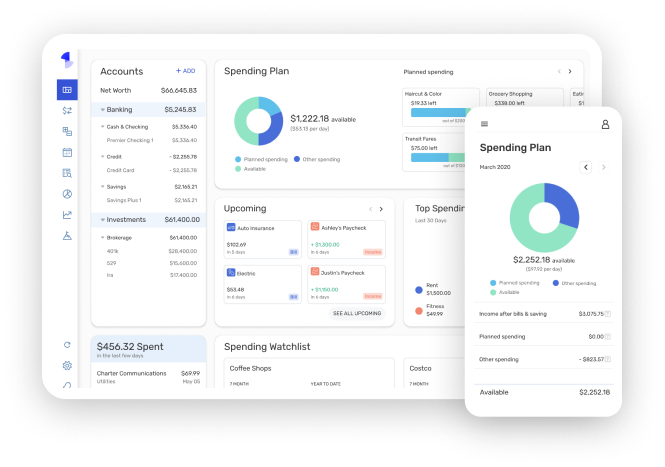

Simplifi

Mobile & Web app Mobile & Web app

|

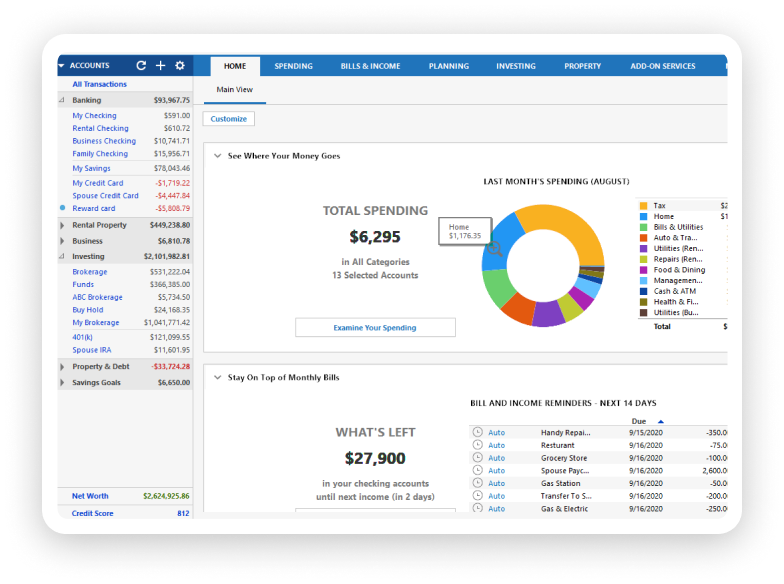

Home & Business

Windows onlyDesktop app Windows onlyDesktop app

|

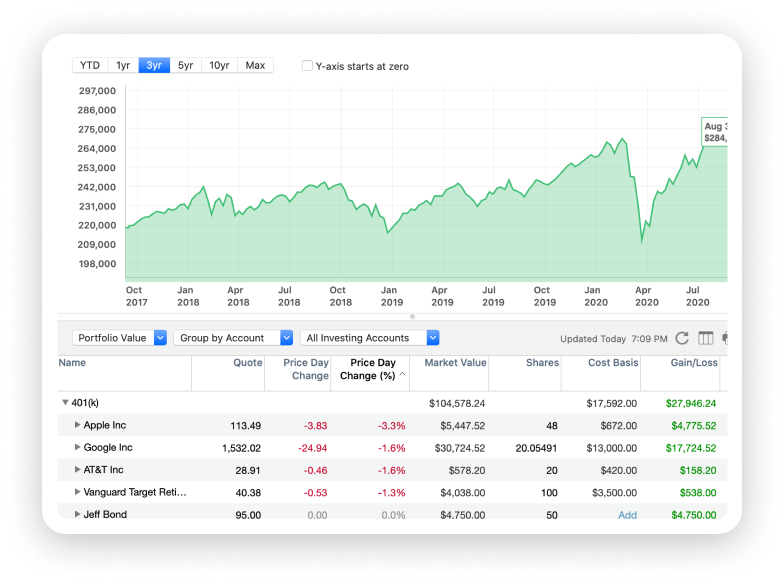

Premier

Desktop app Desktop app

|

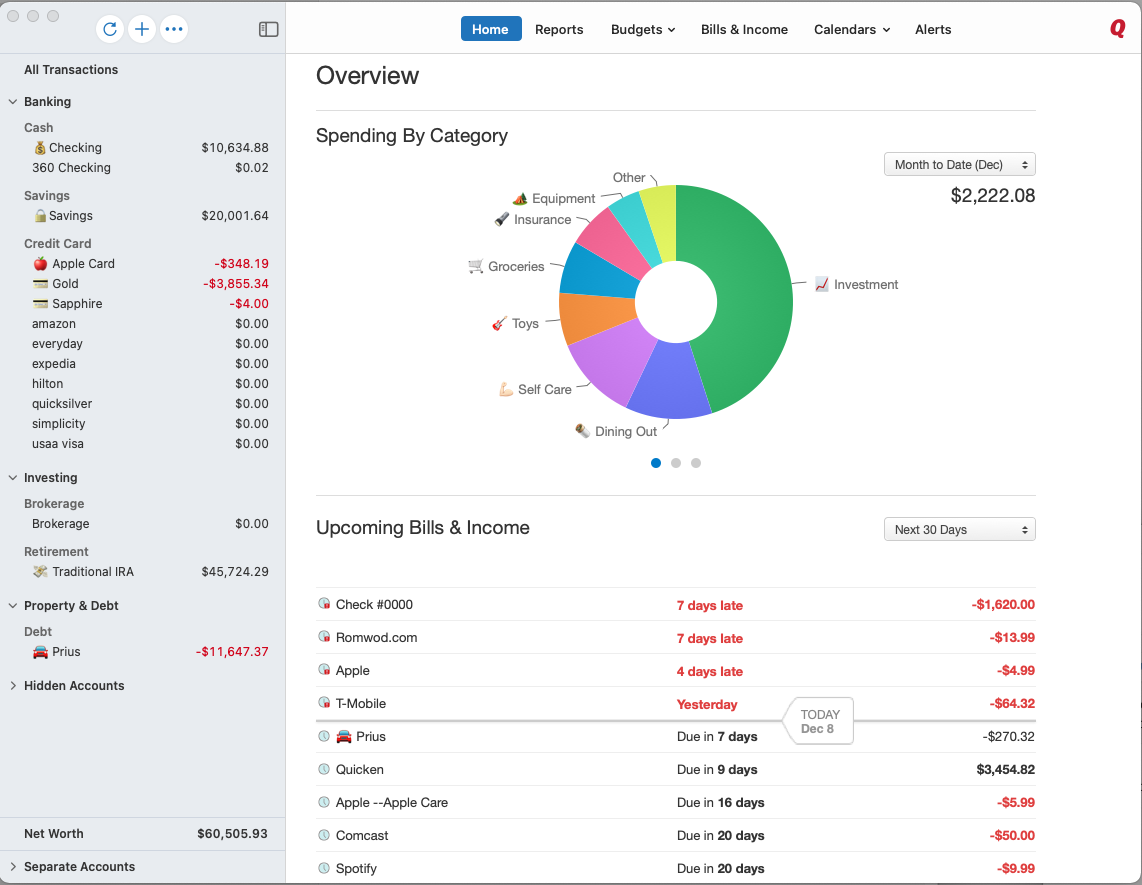

Deluxe

Desktop app Desktop app

|

| Manage your money anywhere | Syncs with Quicken mobile companion app for iOS and Android, and Quicken web companion app | |||

| Free Quicken phone and chat support | Premium Support | Premium Support | ||

| Automatic download of all transactions | ||||

| Add manual accounts | ||||

| Automatic categorization of income & expenses and define custom rules | ||||

| Create custom income and expense categories | ||||

| Create tags to group spending across multiple categories | ||||

| Split transactions to track multiple categories | ||||

| Manually review new transactions (optional) | ||||

| Add notes & memos to transactions | ||||

| Create custom Savings Goals | ||||

| What-if analysis |

Personalized monthly spending plan

Automatically generated based on your income, bills & subscriptions, leaving the money that’s available to spend. Highly customizable and tracks your progress as you spend.

Traditional category-based budgeting

Set amounts for spending in each category. Highly customizable, including ability to set different values each month, rollover budgeting & more.

| Simplifi | Home & Business | Premier | Deluxe |

| Create a 1-month budget | ||||

| Ignore transactions from monthly spending plan | ||||

| Budget for savings goals | ||||

| Budget transfers to other accounts | ||||

| Suggestions based on spending history | ||||

| Create multiple budgets | ||||

| Rollover budgeting | ||||

| Calendar/Fiscal Year budgeting |

| Checking, Savings & Credit Card Accounts | ||||

| Loans, Assets & Brokerage Accounts | ||||

| Education (529) and custodial accounts | ||||

| Retirement: 401(k), IRA, 403(b) | ||||

| Track home value | ||||

| Track net worth | ||||

| Updated home value with Zillow (1) |

| Track bills & subscriptions | ||||

| Automatically separate bills & subscriptions | ||||

| Auto-detect bills | ||||

| Manually add bills | ||||

| Alerts for upcoming & unusual bills and when bills are paid | ||||

| Projected Cash Flow | ||||

| Download online bIlls from thousands of connected billers | ||||

| Bank bill pay | ||||

| Make same day online payments | Additional fee, starting at $9.95 per month | |||

| Generate check payments to any address in the US Pay by physical check |

Additional fee, starting at $9.95 per month |

| Track tax-related spending & Income transactions | ||||

| Detailed tracking of Taxable & Tax-deferred accounts | ||||

| Export tax-related data to tax software like TurboTax | ||||

| Import tax information from TurboTax | ||||

| Track investing gains & create Schedule D tax reports | ||||

| Schedule A | ||||

| Schedule B | ||||

| Schedule C (Small Business) | ||||

| Schedule E (Rental Property) |

| Connect to investment institutions to automatically download transactions | Connects to 750 investment institutions; downloads holdings, positions & cash | Connects to 395 investment and retirement institutions for Windows (237 for Mac); downloads detailed investment transactions | ||

| Add manual investment accounts | ||||

| See change in portfolio value over time | ||||

| Download security prices and history | ||||

| See change in portfolio value over time | ||||

| Customize your portfolio view to meet your investment needs | ||||

| Automatic download of security prices every 15 minutes | ||||

| Buy/sell tool to model tax implications of planned transactions | ||||

| "What If" tool for estimating Capital Gains or what to sell | ||||

| Evaluate individual holdings in ETF/mutual funds with Morningstar's® Portfolio X-ray® tool | ||||

| Banking reports | ||||

| Net worth reports | ||||

| Comparison reports | ||||

| Spending reports | ||||

| Basic tax reports | ||||

| Advanced tax reports | ||||

| Investing reports | ||||

| Business reports | ||||

| Rental property reports |

| Categorize & separate personal, business & rental income/expense | ||||

| Download property values from Zillow (1) | ||||

| Track Business/Rental Income & Expense with IRS categories | ||||

| Track Accounts Payable, Accounts Receivable, P&L & Cash Flow | ||||

| Email custom invoices from Quicken with payment links | ||||

| Generate business-related tax schedules for your accountant | ||||

| Track income & expenses across multiple businesses | ||||

| Track tenants & rent across multiple properties |

With Simplifi, you can manage your finances in under 5 minutes per week. Try risk-free for 30 days.

Get Started Meet SimplifiOur newest app, named Best Budgeting Apps & Tools by The New York Times Wirecutter

See your finances all in one place

Get a consolidated view of your bank accounts, loans, credit cards, and investments in a single dashboard

Achieve your savings goals

Track and see your progress toward short & long-term goals

Easily track your spending

Know where your money is going, from essential expenses to occasional splurges

Budget the easy way

Get a personalized budget that tracks your progress as you spend

Get powerful, timely insights

Use insights to maximize your savings, optimize your spending and reach your goals faster

Home & Business

Take control of your personal and business finances with Quicken Home & Business. Try risk-free for 30 days.

Get StartedOur all-inclusive plan for your personal, business, and property investment needs

Separate & categorize business & personal expenses

Manage both personal and business finances in one place

Contains everything you need to manage your small business finances

Accounts Payable, Accounts Receivable, P&L, Cash Flow and more

Grow your business with the tracking and reporting tools you need

Invoices and bills automatically tracked as payables and receivables

Generate business-related tax schedules for your accountant in just a few clicks

Tax support for Schedule C (Small Business) and Schedule E (Rental Property)

Syncs with the Quicken web & mobile companion apps

Premier

Maximize all of your finances and investments with Quicken Premier. Try risk-free for 30 days.

Get StartedOur premium plan loaded with best-in-class features to maximize your finances and investments

Enjoy the most comprehensive investment tracking tools on the market

Maximize the market with watchlists, benchmarks, target allocations*, and more

Track and pay all your bills right inside Quicken

Pay bills online and by mail for free

See updated home value with Zillow

Get the latest estimated market value so you know what your home is worth

Get priority access to customer support

Enjoy premium, live customer support with minimum wait times (a $49 value)

Syncs with the Quicken web & mobile companion apps

*Windows only

Deluxe

Manage all of your finances and investments with Quicken Deluxe. Try risk-free for 30 days.

Get StartedOur most popular plan for taking control of your finances and investments

See all your accounts in one place

Manage and track your banking, credit card, debt, assets, and investments

Create a customizable 12-month budget

Plan your finances for the future

Get robust financial planning tools that help you save

Reduce expenses, save on interest, pay off debt faster, and more

Track your money however you want

Create your own tags to quickly see where your money is going

Syncs with the Quicken web & mobile companion apps

Frequently Asked Questions

What’s the difference between Quicken and Simplifi?

While Simplifi and Quicken offer many similar abilities, such as automatically downloading and categorizing transactions, there are a few critical differences between the two.

The most notable difference is that Simplifi is a web and mobile app, meaning there isn’t a desktop application that needs to be installed. Instead, you can access Simplifi through any supported web browser or download the Simplifi Mobile App to use on your mobile device.

Simplifi is not the mobile version of Quicken — it's an entirely different personal finance app, designed for web and mobile, and is available to use on iOS, Android, and web platforms.

By comparison, the Quicken Mobile app offers mobile access to Quicken data for Quicken subscribers, and the Quicken Web app lets Quicken subscribers access their Quicken data from any computer with an internet connection. You have to be an existing Quicken desktop user in order to access the Quicken companion apps.

For more information on the differences between Quicken and Simplifi, you can see our Plans & Pricing chart or read this support article.

Can you export your Quicken data to Simplifi or your Simplifi data to Quicken?

Both Quicken and Simplifi let you export your transaction history so you can have a picture of your income and expenses.

Can you import transactions into Quicken products?

Of course! For Quicken users, follow these Quicken import instructions. For Simplifi users, follow these Simplifi import instructions.

To download new data automatically you will need to connect your account in the product you wish to continue using.

How do I know my data is secure?

Can I use Quicken products outside of the U.S.?

Can you share an account with another user?

For Simplifi users, you can share your finances with a spouse or significant other, an accountant, or even a friend, without sharing your login credentials. You can share your Space with one additional member who will have full read and write access to your Simplifi data.

Each member will need to create their own Quicken ID and password if they do not already have one. However, an additional Simplifi subscription is not required — just an invite from you! You need to use the web version to send out invitations and manage user access. Once they’ve accepted your invitation, they can use Simplifi on mobile or on the web.

Unfortunately, this feature is not available for Quicken products.

Can I use Quicken products on more than one computer?

Does Quicken have a web app?

Yes!

Simplifi is built for both web and mobile so you can stay on top of your money from anywhere.

Quicken also includes Quicken on the Web, a companion browser experience to your desktop Quicken products. For more information on Quicken on the Web, check out this support article.

What are the system requirements?

For Simplifi, all you need is an up-to-date browser or smartphone with internet access.

For Quicken Windows, Quicken Mac, Quicken Mobile, and Quicken on the Web requirements, check out the Quicken System Requirements.

How are Quicken products different from other personal finance apps?

At Quicken, Inc., we’re committed to helping you manage your finances with the best personal finance management solutions in the US and Canadian markets. We stand above our competition with the most comprehensive and customizable tools available to help you reach your financial goals with confidence, and we back that commitment with a 30-day, money-back guarantee on all of our products.

- COMPREHENSIVE: Quicken’s suite of personal finance plans can help you take control of your spending, savings, debt, retirement, investments, and even your business and real estate rentals. Get a consolidated view of all your finances in a dashboard that’s clean, simple, and easy to understand.

- CUSTOMIZABLE: See your finances the way you want to. Our built-in features let you customize just about anything — categories, limits, tags, notifications, reports, budgets, and more — for the ultimate control over your finances in a solution that’s tailor-made just for you.

- TRUSTED: Over 20 million members have trusted Quicken for more than 35 years to plan and grow their finances.