10 Tax Deductions You Might Not Have Considered

As many accountants will tell you, it’s not how much you make it’s how much you keep that counts. The difference is the taxes you pay. Claiming tax deductions and credits can help reduce your tax bill and keep more money in your pocket.

Whether you use tax preparation software or work with an accountant, knowing what you can claim on your taxes can help you plan for the upcoming tax year and minimize your tax burden.

Here is a list of 10 tax deductions, credits, and tactics that might help you save money:

1. The Student Loan Interest Deduction

If you have qualified student loans, you may be able to deduct up to $2,500 that you paid in interest payments each year whether you took out the loan for yourself, your spouse, or a dependent. (For example, the interest you pay on Parent PLUS loans that you took out for a child or grandchild can qualify.) You can also deduct credit card interest if the credit card is solely used for qualified educational expenses like tuition, fees, books, and supplies.

The deductions start to phase out when your modified adjusted gross income (MAGI) is $70,000 to $85,000 ($140,000 to $170,000 if you file jointly), and you can’t claim it if you’re a dependent or you file using the married filing separately status.

You can also claim this deduction even if someone else is making the loan payments. So, if your child is repaying the Parent PLUS loan, you get to take the deduction if you qualify. Or, if you’re helping a child repay their loans, they may be eligible for the deduction if they’re no longer a dependent. But remember, only one person—the person who’s responsible for the debt—can take the deduction when eligible.

2. The Lifetime Learning Credit

If you’re going to school—even if you’re taking a class for fun or professional growth and aren’t pursuing a degree—you may be able to claim the lifetime learning credit. If you qualify, the lifetime learning credit is worth 20% of your qualified expenses, up to a $2,000 maximum tax credit each year.

Students who are enrolled at least part-time in a degree program, and in their first four years of higher education, may be better off claiming the potentially more valuable American Opportunity Tax Credit. It’s worth up to $2,500 each year.

The Internal Revenue Service (IRS) has an interactive tool that can help you determine what education credit you can claim on your taxes.

3. Charitable Contributions

If you itemize deductions, your charitable contributions can be a personal tax write-off. Nonprofit organizations will often send you an email or letter showing your deductible donation amount.

You may also be able to deduct charity-related expenses. For example, you might buy and donate food every Thanksgiving or regularly drive to and work at a charitable organization. You may be able to take a tax deduction for the cost of the groceries and for each mile you drive. (You can’t claim a deduction for the value of your time when you’re volunteering, though.)

It helps to track these deductions in your budgeting software to make getting ready for tax time easier.

4. Gambling Losses (Including Lottery and Raffle Tickets)

State laws vary, but you have to report gambling winnings in your federal taxable income. If you win big, the payer will even send you a tax form (a W-2G). However, gambling losses, as well as lottery and raffle losses, can be deductible against your winnings.

You can only deduct up to the amount you won for the year, and it’s an itemizable deduction. But if you have excess losses, you can roll those over and use them in the future.

5. Jury Duty Pay

If you’re called up for jury duty and continue to receive a paycheck, your company may ask for your jury duty fees—which are typically deducted from your paycheck.

You’ll also have to report your jury duty fees as taxable income, and they’ll show up on your W-2 as well. To avoid double-taxation, you can deduct the jury duty fees.

6. Startup Business Expenses

There’s often an initial capital-intensive phase to starting a new business. Thankfully, you may be able to deduct up to $5,000 in startup expenses (if your total expenses are less than $50,000) during your first year of business. You can amortize the remaining amount from tax-deductible items over the next 15 years.

7. The Business Use of Your Vehicle

Business owners—even those who have a side-gig or consult in addition to a full-time job—may be eligible to deduct some of the use of their personal vehicle.

You can either deduct the actual expenses related to the business use of your vehicle or use the IRS’s standard mileage rate and multiply that by the eligible business miles for the year. The standard mileage rate (58 cents in 2019 and 57.7 cents in 2020) takes gas, depreciation, maintenance, insurance, and other costs into account.

You can choose which method to use and take the larger tax deduction depending on the results. For example, if you have a new hybrid or electric vehicle that doesn’t use a lot of fuel or require much maintenance, the standard mileage rate may be much more beneficial. The opposite applies if you have an older truck. Keep in mind, you have to use the standard mileage rate method the first year if you want to be able to choose between the two methods in the future.

8. Rental Property Expenses

Landlords can deduct a variety of expenses including mortgage interest, property taxes, depreciation, repairs, and the cost for materials and labor to keep the property in good condition.

You may even be able to deduct the business use of your vehicle while driving to the hardware store or property. Also, look into other potential deductions, such as a deduction for the value of qualifying personal property like large appliances that you leave in the rental unit.

9. Tax-Free Rental Income

If you want to make a little extra spending money, but don’t want to become a full-time landlord, you may be able to earn tax-free rental income. To qualify, you need to rent out your home for 14 or fewer days in a year. And, you have to use the home for 14 or more days, (or at least 10% of the days you rented out the home.)

Technically this isn’t a deduction, and if you use the “14-day rule,” you won’t be able to claim related expenses. But it may be even better for your wallet.

10. Interest on Home Equity Loans and Lines of Credit

The Tax Cuts and Jobs Act of 2017 made changes to the tax deduction borrowers can receive when paying interest on home equity loans (HELs) and home equity lines of credit (HELOCs). However, it didn’t eliminate the deduction altogether.

If you take out a HEL or HELOC, you can still deduct your interest payments if you use the money to buy, build, or improve the home that you use as collateral. For example, the interest may be tax-deductible if you’re building an addition or renovating a room.

Watch Out For Expiring Tax Breaks

When put in place, tax breaks have a shelf-life. Every year, congress looks at expiring tax breaks (and even those that expired in the past) to decide whether or not to renew. For the current tax season, for example, the government decided to extend the mortgage insurance premium deduction, a boon for homeowners paying MIP.

Keeping an eye on what’s set to expire—and what renewed—can help you maximize your refund and take advantage of last-minute deductions. Check the IRS’ news desk to get up-to-date information on credits, breaks, and deductions.

While knowing about commonly overlooked tax deductions can keep you from paying more than needed when filing your tax return, tax planning is an all-year process. Planning ahead can keep more of your money in your pocket.

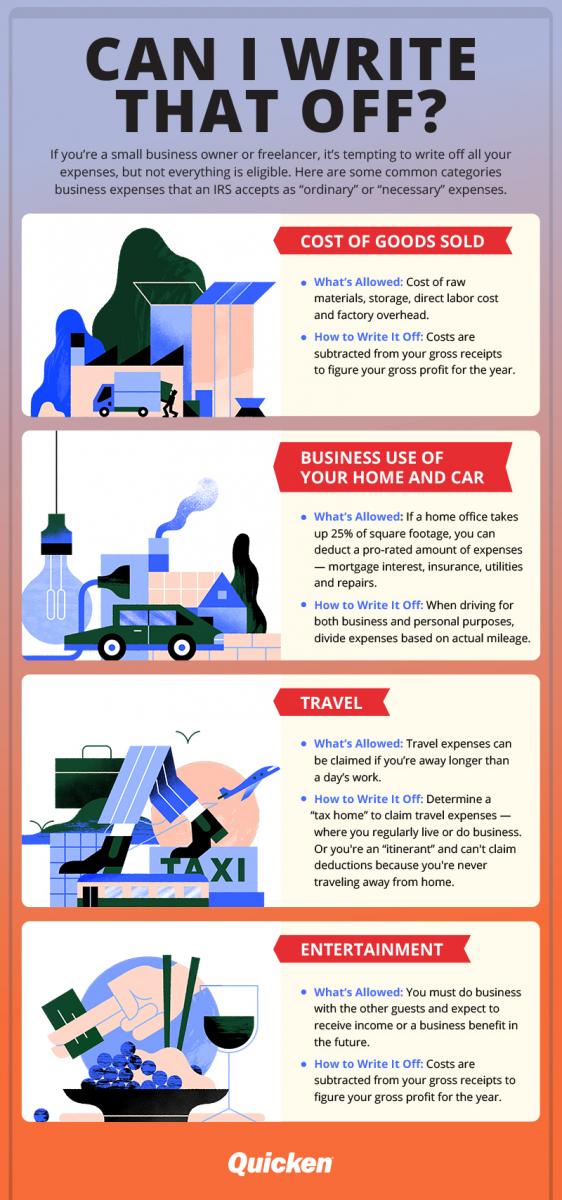

Click image to see full infographic

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.