Manage Your Finances, Master Your Life: How to Maximize Your Employment Benefits

by Kathryn Bergeron

June 2, 2016

Your employment benefits can add as much as 30 percent to the value of your salary. And it does add...

Jobs & Career

Budgeting Conundrum: Is It Smarter to Rent or Buy a House?

by Kathryn Bergeron

June 2, 2016

Budgeting Conundrum: Is It Smarter to Rent or Buy a House? Home ownership is often touted as the American Dream,...

Adding It All Up: Determining Your Net Worth

by Kathryn Bergeron

June 2, 2016

Adding It All Up: Determining Your Net Worth Given recent economic history, it’s not surprising that people are paying close...

Need Money? Personal Finance Tips When Borrowing from a Retirement Account

by Kathryn Bergeron

June 2, 2016

When you're in a bind financially, it can be very tempting to turn to your nest egg for a quick...

What/How to Teach Your Kids About Money Management

by Kathryn Bergeron

June 2, 2016

What/How to Teach Your Kids About Money Management Money management is a fundamental life skill that is often overlooked in...

Changing Jobs? Finance Tips on What to Do With a 401K Retirement Plan

by Kathryn Bergeron

June 2, 2016

Congratulations on your new job! Before you are too far gone from your old position, you need to decide what...

Budgeting Tips for Saving Money on Cell Phone Plans

by Kathryn Bergeron

June 2, 2016

While the cell phone industry will tell you that a typical monthly bill is about $47 as of 2012, many...

New Versus Used: Budgeting Tips on Buying a Car

by Kathryn Bergeron

June 2, 2016

New Versus Used: Budgeting Tips on Buying a Car With used cars, it’s wise to budget for repairs. While it’s...

How to Reduce Spending, Expenses & Debt in Retirement

by Kathryn Bergeron

June 2, 2016

How to Reduce Spending, Expenses & Debt in Retirement When you have an extra 2,000 hours to fill because you’re...

Filing Bankruptcy and Its Effects on Personal Finances

by Kathryn Bergeron

June 2, 2016

Filing Bankruptcy and Its Effects on Personal Finances Bankruptcy can create havoc with your finances, but you can recover. Filing...

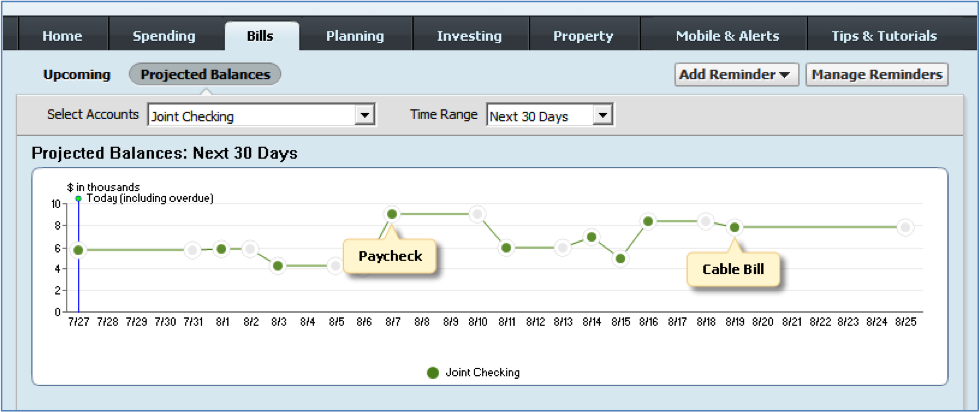

How to Project Balances and Cash Flow

by Kathryn Bergeron

June 2, 2016

Projected balances and cash flow Thank you for choosing Quicken! Do you have a have a general idea of where...

Tips for Homeowners

by Kathryn Bergeron

June 2, 2016

Thank you for choosing Quicken! Owning your own home is one of the great American dreams. Whether you’re just sticking...

3 Personal Finance Tips for College Grads

by Kathryn Bergeron

June 2, 2016

Walking across the stage to get your college diploma might be the proudest moment of your life, but it's also...

How to Set Up Your Bills and Income

by Kathryn Bergeron

June 2, 2016

OK. So now you have one or two accounts set up in Quicken and you can download transactions and use...

How to Categorize Your Transactions

by Kathryn Bergeron

June 2, 2016

Categorizing your transactions lets you see where you’re spending your money. The good news is that Quicken does most...

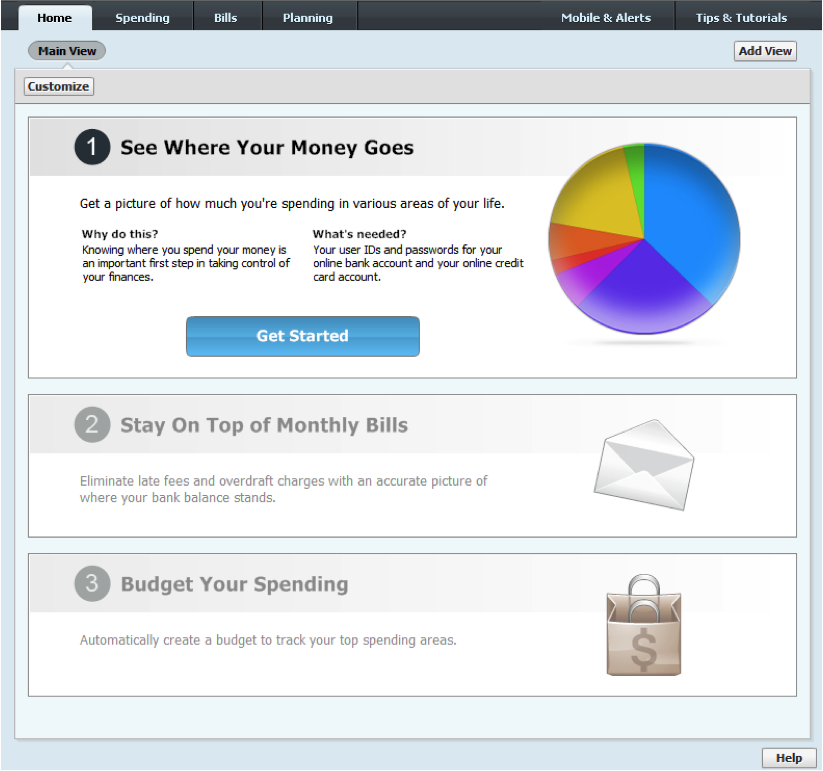

How to Set Up Your First Account

by Kathryn Bergeron

June 2, 2016

Follow these simple instructions and you’ll be up-and-running with Quicken in less than 10 minutes. Seriously! 1. Click the Home...

How to Set Up Savings Goals

by Kathryn Bergeron

June 2, 2016

Using Savings Goals Quicken’s Savings Goals feature helps you save money by “hiding” funds in an account. You set up...

Budgeting for Your Peace of Mind

by Kathryn Bergeron

June 2, 2016

Are your finances keeping you up at night? You’re not alone. Almost three-quarters of adults say money has them feeling...