Quicken Product Highlights January 2022

Managing your Home, Business, and Rental Properties with Quicken

Quicken is a great tool for managing your home, business, and rental properties as well as your personal finances. While you can accomplish a lot with any version of Quicken, Quicken Home & Business is designed to help you do all the financial work needed to keep your home and business thriving while keeping your business finances separate from your personal finances.

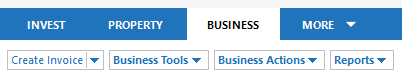

Invoices

With Quicken Home & Business you can easily send out invoices to customers after you have set up an accounts receivable customer invoices account. You can list up to 30 items per invoice. You can set up customers for repeat billing and include a message to your customer. Adding sales tax is also quick and easy. Sending out estimates works in much the same way, making it easy to convert an estimate into an invoice. To access the Invoice features in Quicken Home & Business go to the Business tab and use the Create Invoice button.

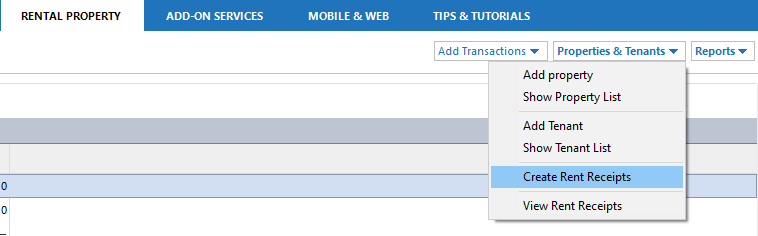

Rent Center

Quicken is the perfect software for managing all your properties and their tenants. You can easily manage cash flow, payments, budgeting, and much more all in one central location. Quicken is able to keep track of your upcoming, paid, and overdue rent payments with the Rent Center feature. Rent tracking is easy. The Rent Center sorts properties, units, and tenants so you can pick whichever you need to enter a rent payment.

If you are running a property rental business, one of the great things about using Quicken Home & Business is your ability to print and send receipts to your renters. The receipts list the owner and the tenant’s information, as well as the rent amount and the mode of payment. You can include a message, add a signature, and include a due date and the date the rent is received. To access the Receipt features in Quicken Home & Business go to the Rent Center under the Rental Property tab and select Properties & Tenants → Create Rent Receipts.

If you are running a property rental business, one of the great things about using Quicken Home & Business is your ability to print and send receipts to your renters. The receipts list the owner and the tenant’s information, as well as the rent amount and the mode of payment. You can include a message, add a signature, and include a due date and the date the rent is received. To access the Receipt features in Quicken Home & Business go to the Rent Center under the Rental Property tab and select Properties & Tenants → Create Rent Receipts.

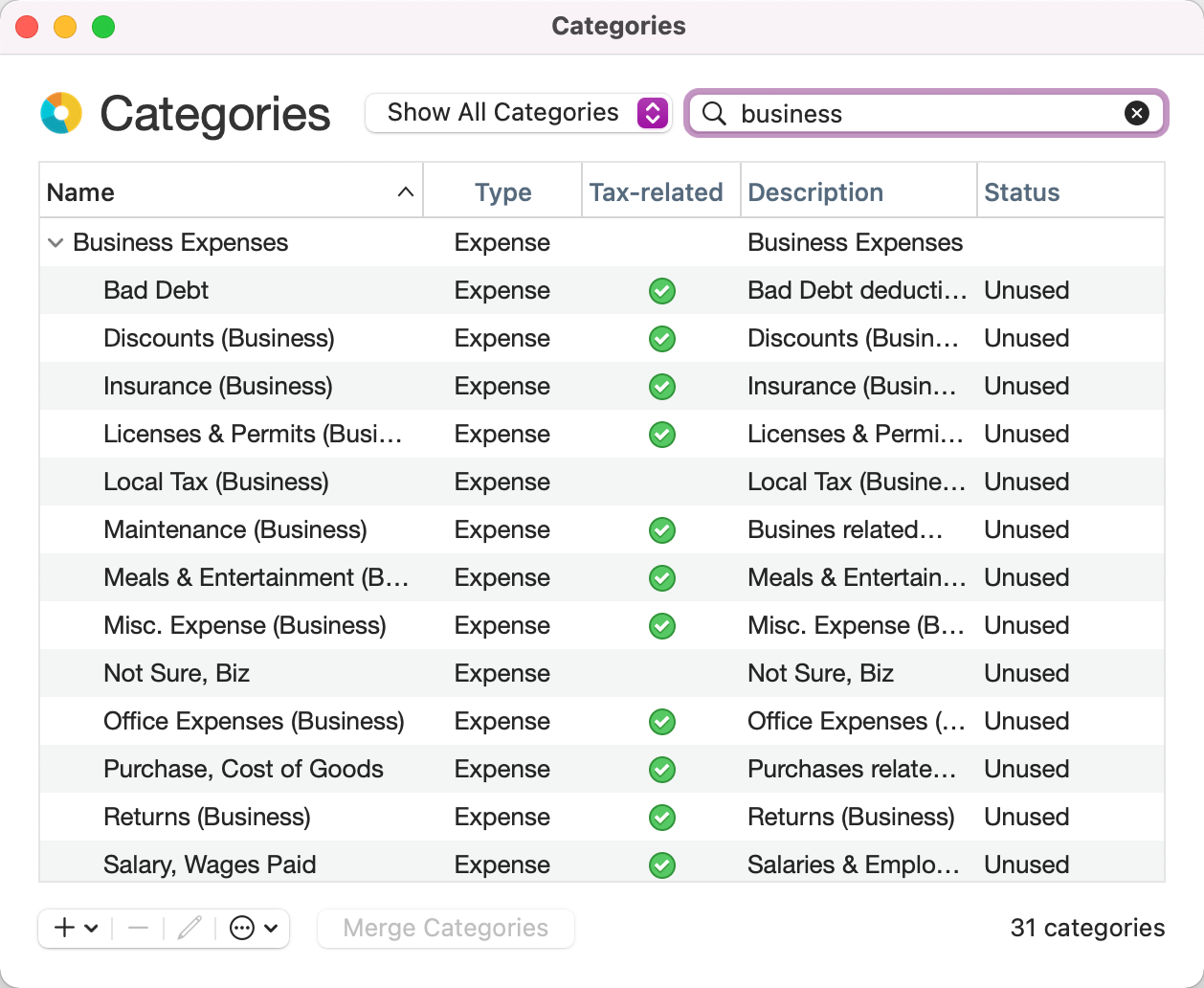

Keeping personal finances separate from business finances

One of the great advantages of Quicken over other tools is that it can easily manage both your personal and business finances. While it is best to keep a separate business account with your financial institution, Quicken can handle all your finances even if they use the same account. The key is to use Categories to specify business or personal transactions. Quicken has Categories for both, and can even be used to generate tax information based on your transactions.

Other key tools

There are many tools in Quicken Home & Business to help you run the financial side of your business and rentals. Some of the other ways Quicken Home & Business helps you include:

- A custom invoice tool to help you customize your forms to suit your needs and display the graphics and information for your business.

- Project tracking tools that will help you track multiple jobs even for a single customer.

- Profit and loss details.

- The ability to track your mileage.

- A variety of reports that help you track cash flow, payroll, profit & loss.

While there are many tools specifically created for Quicken Home & Business, remember that there are many general Quicken tools that will help you run the finances of your business. This includes:

- Tracking your spending and our variety of spending reports.

- Creating budgets for individual accounts.

- Running reports for banking, comparisons, net worth, spending, and taxes.

- Using our planning and tax tools.

Quicken is a great tool for running small businesses and staying on top of your finances as a whole. Take the time to explore Quicken in detail.

Managing your business account with Quicken for Mac

While it does not have a dedicated Home & Business version, you can still use Quicken for Mac to track your business accounts and take advantage of our many tools. To do so, you will need to set up your business account the same way you set up other financial accounts. You can connect the account online or create a manual account. Once you are tracking your business account through Quicken you can take advantage of our many tools.

Categories

Using categories for your transactions is the best way to work with your personal finances and your business finances independently. Quicken includes a full set of Business Income and Expense Categories pre-mapped to Schedule C Tax line items, so business tax reporting by exporting Schedule C transactions to TurboTax works out of the box. This helps to ensure that your business and personal finances can be kept completely separate. You can also set up custom categories for your business in addition to the many included categories and map them to any appropriate tax schedules.

Using categories for your transactions is the best way to work with your personal finances and your business finances independently. Quicken includes a full set of Business Income and Expense Categories pre-mapped to Schedule C Tax line items, so business tax reporting by exporting Schedule C transactions to TurboTax works out of the box. This helps to ensure that your business and personal finances can be kept completely separate. You can also set up custom categories for your business in addition to the many included categories and map them to any appropriate tax schedules.

Reports

Quicken provides many reports. Some of the most useful reports for small business owners are Cash Flow, Cash Flow Comparison, Tax Schedule, Transactions by Category, and Transactions by Payee. You can also export your tax reports and information to TurboTax for your tax preparation needs. This includes tax information for rental properties if you have been using the Rental Property tax categories (Schedule E).

Budgeting

You can set up a budget specifically for your business account so that you track separate categories and amounts than your personal accounts. Remember that you can always set up custom categories for your business in addition to the many included business categories.

Set reminders

For small businesses, it is common to have both incoming and outgoing cash flow transactions scheduled well in advance. With Quicken you can schedule upcoming transactions and use a calendar that lets you know when to expect payment. The calendar even helps you to project account balances.

Send Payments

You can take advantage of Quicken’s Bill Pay to make business-related payments using the online Quick Pay payments or by sending payments through the mail using Check Pay. This makes it easy to use Quicken as a single source for paying your business expenses.

Keep your accounts separate

It is a good idea, when possible, to keep your business accounts and personal accounts separate. You can do this in one of two ways. The first way is to create a separate file for business accounts that is completely separate from your personal file. That is the best method to prevent any confusion, and you can have as many Quicken files as you need.

If you want to keep both types of accounts in the same file, but you still want to keep the business accounts separate from personal accounts, the business accounts can be designated as Separate Accounts which can be accessed from the Accounts > Hide and Show Accounts screen. By doing this, business accounts are not included in your personal net worth or account group roll-ups but are instead grouped together underneath the Net Worth in a section called Separate Accounts.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.

About the Author

John Hewitt

John Hewitt is a Content Strategist for Quicken. He has many years of experience writing about personal finance and payment processing. In his spare time, he writes stories and poetry.