Personal Finance Strategies: Applying for an Auto Loan

When it comes to buying a new or used vehicle, there are more financing options available today than ever before, due mainly to the power of the Internet. Not only can you compare the prices of vehicles online, you can also use the Internet to research financing. Invest a bit of time to ensure you get the best value for your hard-earned dollars without rushing into a decision.

Start With Your Budget

Before heading out to a car lot, take a look at your budget to decide how much you can comfortably afford for a vehicle. A good rule of thumb is that your monthly car payment, insurance and fuel costs should not exceed 20 percent of your disposable income. Use personal finance software like Quicken Starter Edition to examine your current spending habits and plan for auto costs that suit your budget.

Once you know how much you can spend each month, use Quicken Starter to calculate what price you can afford. Simply enter the monthly amount available for car expenses, and the software shows you the price range you should be looking at based on different loan terms. An ideal car loan should not last for more than five years, so look at 36-, 48- and 60-month terms. Loan terms longer than five years will reduce your monthly cost, but you’ll end up paying a lot more in interest before the loan is fully paid off.

Separate the Purchase From the Loan

Most dealers offer both loan and lease options, which you can apply for while picking out your new vehicle. While this is certainly convenient, it gives the dealer an advantage when it comes to negotiating the sale price. Padding the price by several hundred dollars or adding expensive options won’t seem like that much more when spread out in monthly payments over the life of the loan.

Research Your Options

Regardless of where you plan to finance your vehicle purchase, it’s important to do your research and shop around, according to Dr. Sean Stein Smith, CPA and Assistant Professor of Accounting at Rutgers University in New Jersey.

“Go online,” he says. “Research what types of financing options and deals are out there, and which manufacturers are offering the most appealing rates. Even different dealerships can have different options, so be sure to do your homework. The dealerships aren’t going anywhere, so don’t rush into a decision.”

Once you have a few options in front of you, Smith recommends comparing the monthly payments to your budget. “Seeing those numbers and adding them to your current monthly expenses is always a good exercise,” he says. “Not to mention letting you know whether you can actually afford it.”

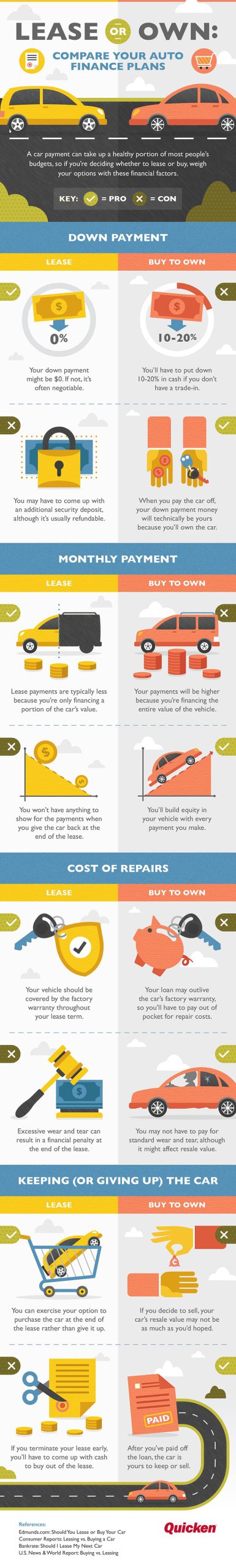

Approach Leasing With Caution

Manufacturers and car dealers can make leasing a new vehicle an extremely attractive option, particularly if you have your heart set on a brand-new car. But leasing can bring a lot of headaches if you don’t understand all of the contract terms.

“Whether you’re buying or leasing, read the fine print,” says Smith. “This decision will drive a lot of your future options, but keep in mind that while monthly payments might be lower on a lease payment, you have to watch out for any mileage caps or conditions you have to meet when you return the vehicle — those dings from parking can result in unplanned fees.”

Click image to see full infographic

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.