12 Must-Have Features of Budgeting Software

A debt problem at its core is a budgeting problem. This is one of the most important lessons in personal finance: you can’t save your money if you don’t know where it’s going. In other words, you need a budget.

In fact, 74% of Americans now track their expenses with a budget. But just realizing the importance of a budget isn’t the same as properly executing one. Between retirement accounts, investments, mortgages, and varying monthly expenses, budgeting for yourself can feel like a course in accounting, which can be overwhelming.

This is why we stress the importance of utilizing good budgeting software. Allowing a computer to crunch the numbers for you can dramatically reduce your time and stress levels as well as provide a more robust and clear look into your personal finances. In fact, we’ve found that 93% of heavy users work with their budgeting software at least once a week.

However, no two budgeting software programs are alike, so it’s important to choose one that’s right for you. To better identify the features that are most useful, we surveyed 112 long-time users to ascertain the favorite aspects of their most-trusted budgeting software tools. We’ve summarized the twelve must-have features below.

1. Importing Data from Multiple Financial Institutions

Before you can budget your money, you have to know where it is—all of it. For most Americans, this means pulling and importing financial data from multiple financial institutions into one program. Many survey respondents described having “several brokerage accounts” in addition to 401(k)s, mutual funds, and certificates of deposit, and being able to seamlessly import these multiple accounts into one program was considered a top benefit by 46.43% of users.

2. Creating Custom Reports

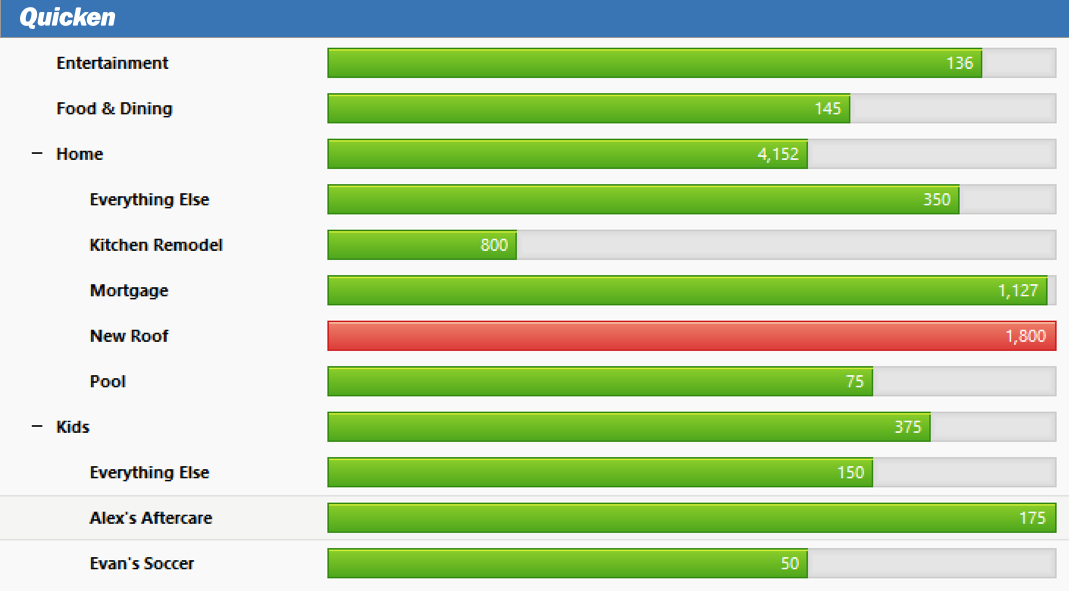

25.89% of respondents identified “creating custom reports” as their favorite budgeting software feature. Customizable reports allow you to do everything from checking your investments and net worth to comparing your cash flow and spending over time. You can even go one step deeper and subdivide your spending into categories like “groceries” or “bills and utilities”—and sort by time, payee, or account. If importing all your financial data is the “bread” of personal budgeting, then creating customizable reports is the “butter.”

3. Real-Time Expense Tracking

While it’s important to have a robust report with a full breakdown of the details, it’s equally important to be able to quickly check your expenses in real-time. This was an extremely popular feature among users, with 18.75% of respondents listing “automatic updates to your financial information” as their favorite benefit of the personal finance software. One user shared their software “Gives me [an] overall picture in one place and flags any illegitimate activity quickly without waiting until [the] monthly statement.”

4. Creating a Budget for You

While it’s valuable to have a complete view of all your finances in one place, the primary reason people utilize budgeting software is to help them manage and maintain a personal budget. Effective budgeting software should be able to generate an automated budget plan based on your income and expenses, differentiate special investments from income, and factor in contributions to retirement accounts. Many surveyed users combine the automated budget tool with custom reports, with one user emphasizing, “Budgeting along with a report to see all of my account balances helps me to manage my finances effectively.”

5. Exporting Data to Microsoft Excel

You may be asking, “Why would someone need to export data to Excel when you can instead produce a custom report?” The answer is personal preference. As the default software for virtually every financial institution of the last two decades, some individuals just think natively in Excel, and can filter, sort, and pivot data intuitively. A good budgeting software should allow you to view and export the data in whatever format you want.

6. Web and Mobile Access

We live in a mobile world, which means you should be able to access your financial data anywhere—including on your phone. In fact, 63% of smartphone users report having at least one mobile financial app. Having software that can integrate on your local computer, an online browser, and your mobile device is a must-have for today’s users.

7. Setting Customizable Alerts

Having your budget available at all times is useful, but it can also be draining if you have to constantly check it yourself. Customizable alerts (particularly for mobile) help to ensure you’re not overspending or missing payments, and can notify you when you’ve hit certain established benchmarks.

8. Bill Pay

Up to this point, we’ve talked mostly about the input side of personal budgeting software. However, it’s also important to consider what outgoing functions your software has—notably the ability to pay bills to all accounts. When structured properly, this is one of the most compelling features of budgeting software, as you can pay bills from multiple bank accounts via one central location. We’d recommend software with both scheduled and one-time payment functionality.

9. Investing Features

In our survey, “investing features” was ranked the second most popular budgeting software feature. Just like you want one centralized location to track all of your spending regardless of account, it’s useful to be able to monitor your different investments from multiple brokerages in one location. One user explained, “I like to have one place to track all investments and monitor the performance of the entire portfolio.”

10. Net Worth Tracking

A typical budget software user might have a mortgage, 401(k), IRA, savings account, investment account, mutual fund, and revolving debt and expenses. As we’ve seen above, that’s a lot to keep track of, and sometimes it gives peace of mind to know simply, “How much is it all worth?” Having your net worth easily calculated as one figure saves you hours of having to manually do it yourself, and also helps you quickly keep track how you’re doing.

11. Projecting Balances and Cash Flow

Once individuals get comfortable with creating and using a budget, many want to take it a step further: projecting future balances and cash flows. Your budgeting software should be able to look at your monthly income and expenses, and not only create a budget, but help forecast how much you’ll have saved and by what date—so you can time and hit your financial goals.

12. Simplicity and Usability

Last and most important: your software should be easy to use. Several respondents stated that “reliable” and “simple to understand and use” were the most essential features of a budgeting software. All the tools, such as syncing, categorizing, and exporting, count for nothing if you don’t understand how to use your personal budgeting software. So we recommend a powerful tool—as long as it’s simple to use and understand.

Together, all of the best budgeting software features listed above will enable you to fully harness your financial data in order to make the best decisions for your future. To get started with a personal budget we recommend you check out our personal budgeting center.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.