More than a Third of Millennials Are Likely to Flee Cities Within 12 Months

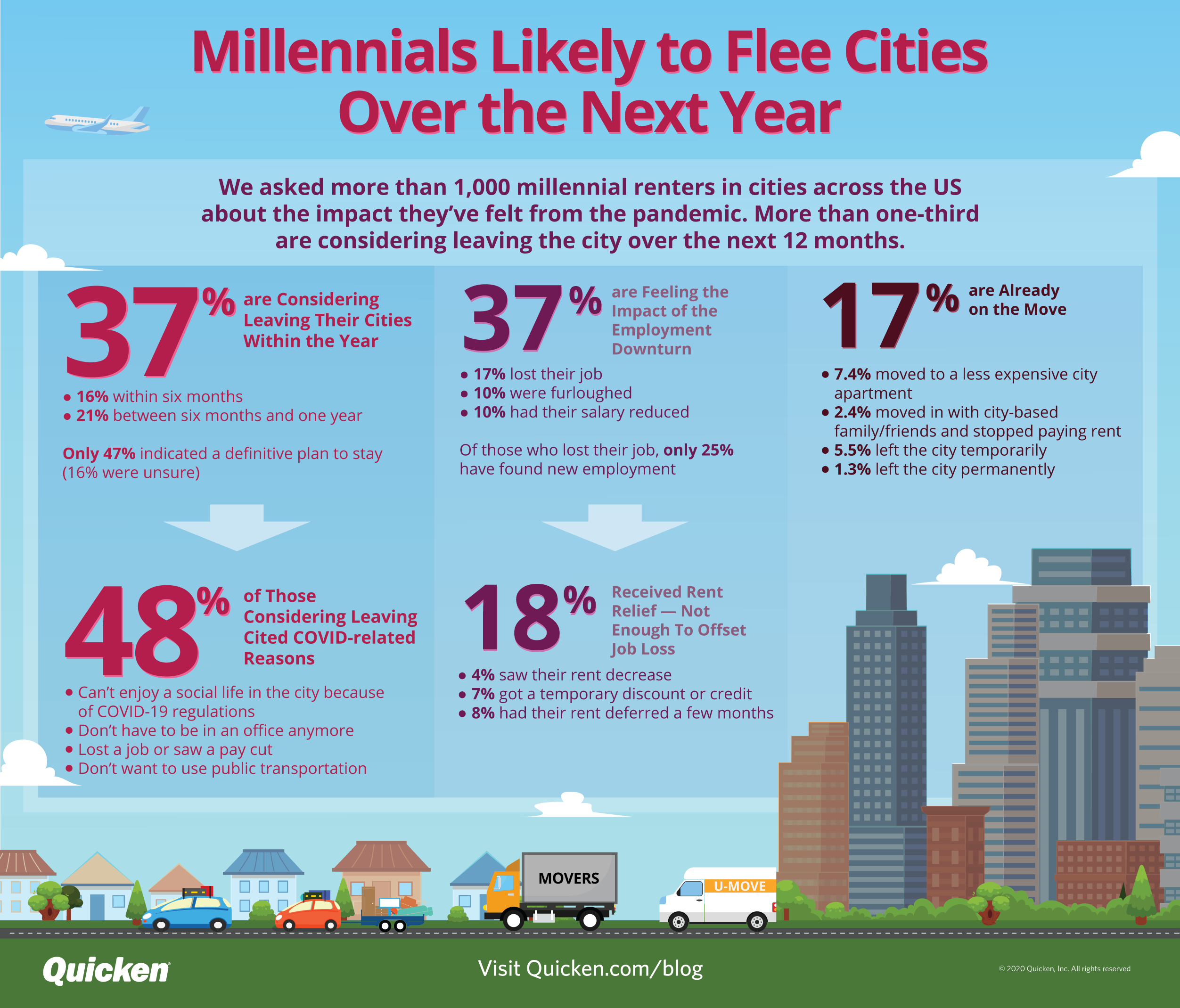

We asked more than 1,000 millennial renters in cities across the US about the impact they’ve felt from the pandemic—to their jobs, to their rent, and to their future plans.

The results? More than one-third are considering leaving the city over the next 12 months, most likely in waves as their leases come up.

With another 16% saying their plans are still uncertain, that leaves less than half of today’s renting millennials with a definitive plan to stay put.

Click image to view larger

37% Are Planning to Leave Their Cities Within the Year

When asked about their future plans, more than half of those surveyed said they were either planning on leaving the city in the next year or were still uncertain. Only 46.8% said they had no plans to leave.

For the 37% planning to leave, here’s how the timing breaks down:

- Within 3 months: 6.4%

- Within 6 months: 10.0%

- Within 9 months: 5.4%

- Within 12 months: 15.1%

Another 16.2% of the respondents were still undecided.

37% of Millennials are Feeling the Impact of the Employment Downturn

In total, 37% of the urban millennials surveyed said they had suffered a negative job impact since the beginning of the pandemic: 16.5% lost their job outright, 10.0% were furloughed, and 10.4% saw their salary reduced. Of those who said they lost their job, 25% reported having found new employment.

Although some millennials have received minimal rent relief in one form or another since the start of the pandemic, these expense reductions haven’t been enough to offset the negative employment impact, especially since rent accounts for such a high percentage of income in urban areas.

Only 18% Saw Any Rent Relief—Not Enough to Offset Job Loss

A few millennials reported temporary rent discounts or deferments, but not many—7% said they had received a temporary discount or credit, and 7.9% said their rent had been deferred for a few months.

Only 3.6% of the millennials surveyed said their rent had actually been reduced. Of these, 38% said their rent was reduced by $250 per month or less—which accounts for only 1.3% of all those surveyed.

The other 62% of those who saw a rent break reported higher relief, but that still accounts for only about 2% of all millennials surveyed. Rent reductions of $251–$500; $501–$1,000; and over $1,000 all accounted for less than 1% each of the total population.

17% of Millennials Are Already on the Move

Of the 17% who said they had already changed their living situation, over half (59%) had stayed in the city, either moving to a less expensive apartment or moving in with city-based family and friends where they wouldn’t have to pay rent.

The other 41% left the city, either permanently or temporarily.

In terms of all the millennials surveyed, these numbers are still relatively small: 7.4% moved to a less expensive city apartment; 2.4% moved in with city-based family & friends; and 5.5% left the city temporarily, more than 85% of those moving in with family for the time being.

Of those who left the city temporarily, 69% continued to pay their full rent while they were away, more than half of them paying between $1,000 and $2,000 per month because they were either stuck with a lease obligation or just didn’t want to give up the apartment.

Only 1.3% of all those surveyed reported that they had already left the city permanently, but that’s just the leading edge of a significant migration: the urban flight of the millennials.

48% of Those Considering Leaving Cited COVID-related Reasons

Following the recession in 2008, suburban growth slowed while droves of millennials just graduating from college moved to big cities where jobs were concentrated. Many considered millennials the urban generation and questioned whether they’d ever settle into the suburbs.

However, the trend started to reverse in 2017 when some cities reported hitting “peak millennial.”1 And in 2018, census data2 for city population growth showed that suburban growth had outpaced city growth for the second straight year.

Now, as the pandemic has changed nearly every aspect of our daily lives, 48% of the millennials who are considering leaving the city cited COVID-related reasons for the move.

Top among these were:

- Can’t enjoy a social life in the city because of COVID-19 regulations — 24%

- Don’t have to be in an office anymore — 16%

- Lost a job or saw a pay cut — 15%

- Don’t want to use public transportation — 14%

Other top reasons people cited for considering a move included:

- Cost of living — 50%

- A desire for more living space — 46%

- Wanting to buy a house — 37%

- A concern about safety in their city — 24%

Despite All the Movement, 47% of Millennials are True City Diehards

For those not thinking about leaving the city, they have many reasons to stay, including:

- It’s where they want to live — 68%

- It’s where their friends and family are — 35%

- They feel they have nowhere else to go — 29%

- Their work requires them to be there — 27%

- They want to maintain a short commute — 21%

A small percentage (8%) of these folks cited that COVID-19 would be over soon, perhaps expecting that life in the cities would soon be back to what it once was.

What Does This Mean for Millennials (and Cities) in the Future?

With so many millennials experiencing negative job impacts from the pandemic, and with 34% of those surveyed reporting that they’re now working remotely, millennials are losing the financial ties that might have kept them in urban areas.

1 https://time.com/5054046/millennials-cities/

2 https://www.census.gov/newsroom/press-releases/2018/estimates-cities.html

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.

About the Author

Quicken

Our mission is to help our customers lead healthy financial lives.