Are Love and Money Related?

Love and money seem like different pursuits on the surface, but the money and love relationship correlation is clear if you dig deeper. As one of the most trusted names in finance, we help support your financial health and reduce the stress you and your partner face when dealing with money.

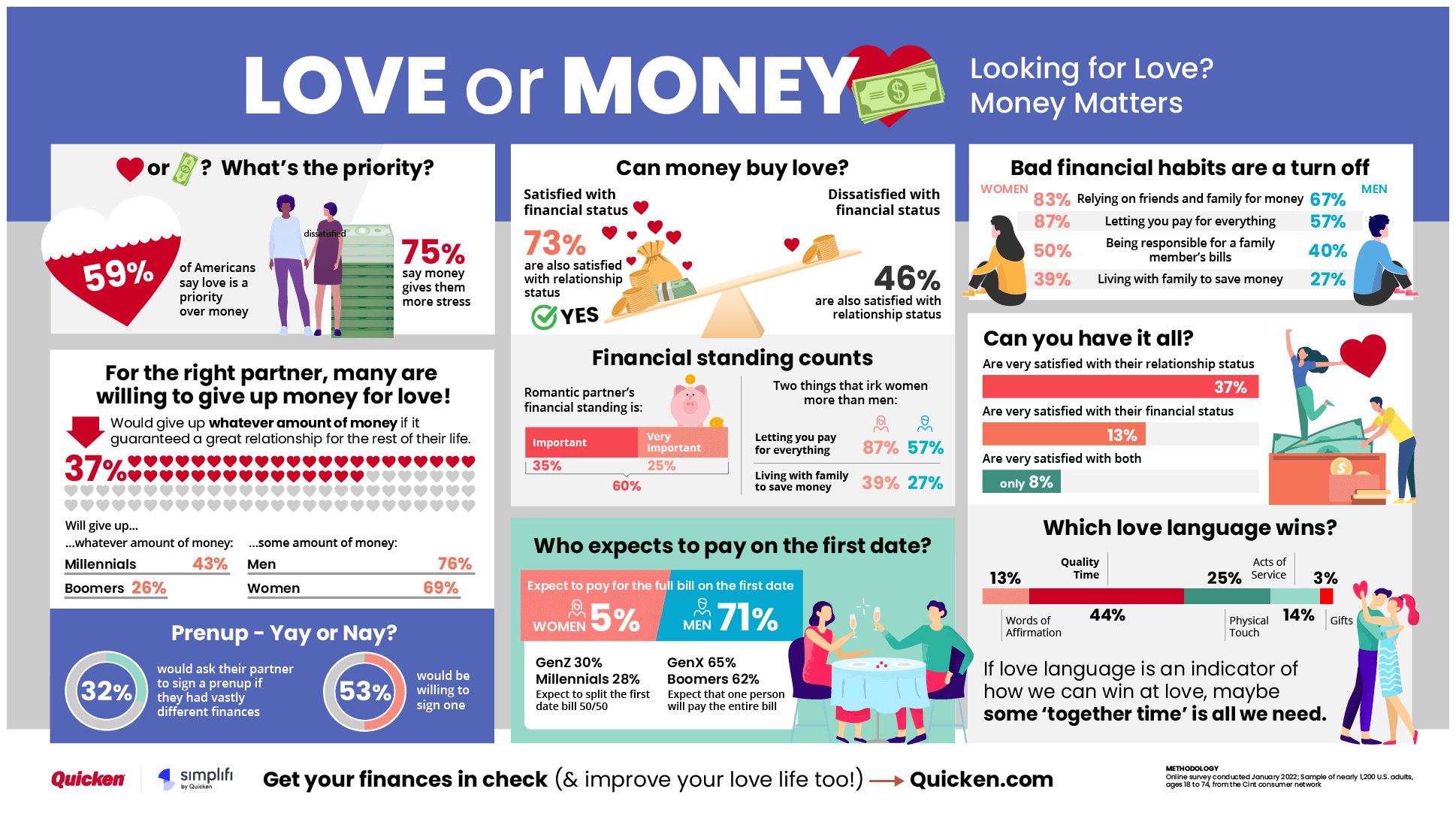

What’s a bigger priority for you, love or money? For 59% of Americans, it’s relationships of the heart, not the wallet that drive them. On the other hand, which is a bigger source of stress in your life? This time, 75% of people said money was more challenging to deal with than love.

Understanding how people approach money and relationships is a powerful compass for navigating our lives. To learn more about how love and money intersect, we reached out to adult Americans across the country.

Happy in love or happy with your finances?

Happiness with finances seems harder to come by than a happy love life. Even though 37% of survey respondents said they were very satisfied with their relationship status, just 13% were very satisfied with their financial circumstances.

The findings on the other end of the love-money spectrum mirror this as well. Over 40% of respondents were somewhat or very dissatisfied with their finances, while 20% said they were somewhat or very dissatisfied with their relationship.

It’s probably not surprising that the biggest challenge is to have it all – just 8% said they were very satisfied with both their financial situation and their love lives.

Facing the hard truths about money and relationships

Musicians from The Beatles to Jason Derulo to Taylor Swift have insisted that money can’t buy love, but do the numbers bear that out? Among people who are satisfied with their financial situation, 73% were also happy with their relationship status. On the other hand, when people weren’t happy with their money, only 46% were part of a happy couple.

Meanwhile, money and relationships go together like chips and salsa, or cat memes and the internet. Around 60% of Americans think it’s important for their partner to have solid financial footing and be money smart. One in 4 elevated being wallet wise to “very important”

Is financial responsibility sexy?

There are no love poems about getting your finances in order, but not having it together can be a big turn off. The vast majority of respondents – 83% of women and 67% of men – don’t like it when their love interest relies on friends and family for money. Likewise, 87% of women are unhappy when they have to pay for everything. 57% of men agree.

Make sure your family pays their own bills, as well. 50% of women don’t want their special someone to cover everything for a family member. 40% of men agree.

What are you willing to sacrifice for love?

More millennials (43%) than boomers (26%) would willingly give up any amount of money necessary to guarantee a great romantic relationship for the rest of their lives. Overall, more than one in three people (37%) would sacrifice whatever money it takes to be part of a happy couple.

When the stakes weren’t quite as high, and people were asked to give up a more modest amount of money for love, men led the way. Over three-quarters (76%) of men would take the money-for-love guarantee. Women were more pragmatic, but only a little – 69% would hand over cash for love.

The intertwined future of a money and love relationship

Speaking of pragmatism, how are people feeling about prenuptial agreements? Romance seems to rule here, as well: only one-third of respondents (32%) would ask their sweetheart to sign a prenup if they had vastly different financial situations. People in the reverse circumstances seemed more willing to bite the bullet for love, though: a little more than half of respondents (53%) said they would sign a prenup if asked.

Ultimately, a prenup might be smart for even the happiest couple. Of all the many reasons people in a relationship might argue, couples managing money is the No.1 source of arguments (25%). Sex, incidentally, is way down the list at just 4%.

Couples managing money together begins with the first date

The start of a relationship has some wildly different expectations depending on gender, according to respondents. Nearly three-quarters of men (71%) expected to pay for the full bill on the first date, while just 5% of women expected to pick up the tab.

But attitudes may be changing with cultural shifts in upcoming generations. Plenty of GenZ (30%) and millennials (28%) expect to split the first date bill 50/50. It’s the dating GenX (65%) and boomers (62%) who are holding fast to the idea that one person will pay for the whole thing.

So what love language wins hearts?

Nearly half of respondents (45%) said their “love language” was seeking quality time together, followed by physical touch (25%) and acts of service (14%). Only 3% of respondents said that gifts is their love language. Above all, being together as a couple is more important than spending money on each other. And there’s no better bonding than planning for your financial future together!

The best budgeting app for couples

Who would have guessed the most attractive thing you can do to win love is be financially smart? Learning how to manage money as a couple will help minimize much of the financial stress that can eat away at happy relationships.

Normalize discussing money with your partner, from conversations about whether to combine finances to planning for long-term financial goals. It may not be the most romantic pillow talk, but couples budgeting together will strengthen your bonds in many ways.

Embrace the best personal budgeting tool to learn how to budget as a couple, and you will be on the right path toward happily ever after. Try Simplifi by Quicken and love is sure to follow.

About the study: Quicken conducted the online survey January 2022; Sample of nearly 1,200 U.S. adults, ages 18 to 74, from the Cint consumer network

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.