The Great American Gig Shift: More Money. Fewer Hours. Better Life?

Most mornings, Dave DeNard rolls out of bed around 9:00 am. He makes his coffee, scrolls social media, and then heads outside for a walk with his two beagles, Ruby and Nova. By 10:00(ish), he’s at his desk, ready to start his 4-hour work day. By many definitions, he’s retired. And he’s only 31.

“Working a 9-to-5 isn’t going to buy me a house and two cars, and support a few kids,” he says. ”Those days are long gone, unfortunately. Past generations could buy a home with a minimum wage job. My generation can’t afford rent.”

So he decided to do things differently — by being his own boss.

According to our recent survey, DeNard isn’t alone. 43% of multi-job Americans say they’re working fewer hours and making more money than if they only had a single salaried job. If you look at Gen Z and millennials, that number is even higher, at 49%.

In DeNard’s case, he’s earning more income selling his crafts on Etsy and coaching other Etsy sellers than he ever hoped to earn as a traditional W-2 employee.

And while not everyone’s doing as well as DeNard, there’s a broader trend toward independent work that’s clearly on the upswing. According to a recent McKinsey survey, 36% of employed Americans now identify as independent workers. In 2016, that number was only 27%.

Could the gig economy be the next great land of opportunity?

When corporate salaries just aren’t enough

There’s no denying that economic pressure in the U.S. continues to rise. The median price of a single-family home in comparison to median household income is higher than at any point since the early 70’s. Health insurance premiums have increased 55% over the last decade. And let’s not get started on the price of groceries.

The result? According to a recent MarketWatch survey, 66% of Americans are living month to month, unable to save for the future or even for potential emergencies.

Our survey backs this up. 39% of Americans with more than one job say they weren’t making enough money to meet their needs with a single income stream. And when we asked people why they started their side gig, 40% said they simply started it to pay for holiday gifts and expenses.

As concerning as that is, by adding a second income stream, 72% of our survey respondents say they feel more financially secure and 67% feel less stressed financially.

Not only that, they seem to be happier, too. 72% of multi-job Americans say they enjoy working for themselves rather than a corporation. And 66% say they are happier having multiple jobs than focusing all their energy into just one.

Gen Z and millennials want to do more of what they love

What arose from necessity for many Americans seems to be driving new opportunities for Gen Z and millennials. For them, moving away from single-salaried jobs is often more about pursuing goals than paying bills.

In fact, while 49% of our Boomer respondents said they weren’t making enough money on a single income, that number was only 30% for Gen Z, who were also 15% more likely than Boomers to say they picked up a second job simply because they had extra time.

Other top reasons for getting a side hustle included more money for non-essential purchases, like travel or eating out, and a desire to pursue a passion project.

At 21, DeNard already knew he wasn’t cut out for corporate America. He had seen what his parents’ generation put into it and, by comparison, what his own generation was getting out of it. Instead, he chose to tour with a metal band that eventually got signed to a major label — one that had signed bands he listened to growing up.

But even being a member of a rising band wasn’t the right fit. “I didn’t like the demanding lifestyle of always being on the road, enriching other people’s pockets,” DeNard says. He and his wife decided it was time for a change.

They started selling crafts at every farmers market and music festival they could, paying upwards of $1,500 just for a spot and grinding all week to sell all weekend.

There had to be another way to make it work.

“I was a hippie back then,” DeNard remembers, “and being on Etsy was the cool thing to do. If you had a successful handmade Etsy shop, you were ultra cool.” So he turned his sights online.

A digital revolution?

The emergence of online marketplaces opened up a new business model — one that had never existed before. There was no need to pay for a spot at a fair, festival, or convention. Online business wasn’t limited to weekends. And platforms linked creators to customers across the country and even around the world without leaving home. Creators like DeNard only needed an Etsy page, a little marketing know-how, and a way to ship.

And the customers came to them… in droves.

For DeNard, what started as a side gig very quickly became a full-on hustle. Just three months after launching on Etsy, he had enough money saved to buy a house. “On the West Coast, mind you,” DeNard notes, “where prices are not friendly to a midwestern kid.”

Since then, he’s turned that success to helping others.

In 2018, he launched his YouTube channel, AddToCart, where he started showing others how to make a living selling on Etsy, too. (One recent video is titled “I helped This Etsy Seller Get $1,000,000 Sales Her First Year.”) Not only does he find it extremely fulfilling to help others, but he’s been able to build a second income stream on his own terms. Now, he says he makes much more than people his own age and even more than many older than him.

Saying goodbye to corporate America

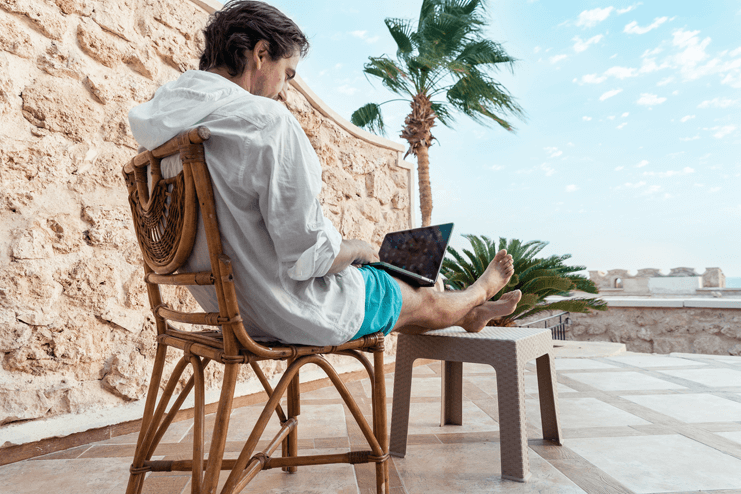

What DeNard and thousands of people like him have discovered as they built those multiple income streams is that once they reached a certain level, they could make more money and work less — the holy grail.

They no longer needed to depend on some larger entity for a salary — with increases doled out slowly in the form of incremental raises, promotions, or leaving one position for another. Increases that may barely keep up with inflation.

Plus, according to our survey, the people who have found this kind of success with more than one income stream are more likely to have built an emergency fund that can last them 4 months or more. Given the number of Americans eking out a living from one paycheck to the next, that’s a huge statement.

For independent workers who are truly thriving, retirement isn’t a goal anymore. It’s a reality. Working or not, they’re living their retirement dreams right now. Even workers as young as DeNard.

He and his wife have backpacked Columbia, Ecuador, Peru, and Argentina on their own dime and time. They just got back from a dream trip to the Greek island of Santorini. At one point, they even bought a massive class-A RV, drove it from Michigan to Nevada and back again, all over the course of three months — something he says they would never have been able to do with traditional 9-to-5 careers.

None of this, though, is to say that it all came easily.

“There are times when you must hustle, yes,” DeNard says. “I’ve created something that works for me, and maintaining that is easy. But if you want to force growth, you do have to work hard. The only difference is that I am the boss.”

In pursuit of a better life

More money. Fewer hours. If 49% of Gen Z and millennial Americans with more than one job can claim this over a single-salaried job, that still means 51% aren’t there yet — but maybe they’re on the way. There seems to be a generational shift in that direction, with the end goal of finding happiness through financial independence.

So what defines the independent workers who make it? Is there a formula for success? “Develop a talent first,” DeNard says. “Develop it, and believe in it. That’s the thing with a lot of people. They don’t have faith or confidence in themselves. You have to make a decision that you will succeed.”

Is it really that simple? If the key to success is good old American grit, maybe things like inflation and housing prices aren’t as insurmountable as they seem. Maybe we’re still living in a land of opportunity, where a new way to make money pops up every other week.

Maybe all we need is the courage to go after it.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.

About the Author

Lee Decker

Lee helps people overcome money struggles so they can live their best lives.

His love of traveling the world left him buried in $70,000 of credit card debt at the age of 35. By applying smart financial principles and laying out a budget, he managed to turn that ship around. Today, he’s debt free and back to his globe-hopping habits, taking in all the wonders of the world without the financial stress.