How to Set Up Your Bills and Income

OK. So now you have one or two accounts set up in Quicken and you can download transactions and use categories to see where your money is going. What’s next? What more could there be? Beyond tracking your spending, Quicken actually makes it easier to spend your money. And we mean that in a good way!

If you’re like most people, you have pretty much the same bills every month and you get paid on a regular schedule. If you tell Quicken what your bills are, and when you expect income, it can remind you when your bills are due, and project your account balances into the future. This will help you avoid late fees and overdraft charges, and perhaps put some of that “extra money” you might have into your savings account. Imagine that! Here’s how:

1. Click the Home tab.

2. Click Get Started in the Stay on Top of Monthly Bills section.

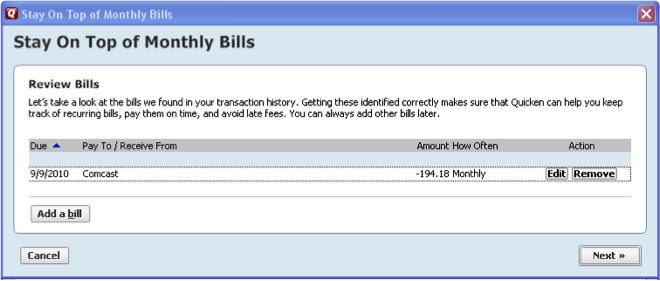

3. Click Add a bill to tell Quicken about any bills it doesn’t know about yet.

Click Edit to change the details of a bill, such as when it’s due, the amount, etc. Click Next and tell Quicken about your paycheck and other income you may have.

4. When you’ve finished, the Stay on Top of Monthly Bills section on the Home tab lists your upcoming bills and any income for the selected date range. Tip: Click Options to change the time period displayed.

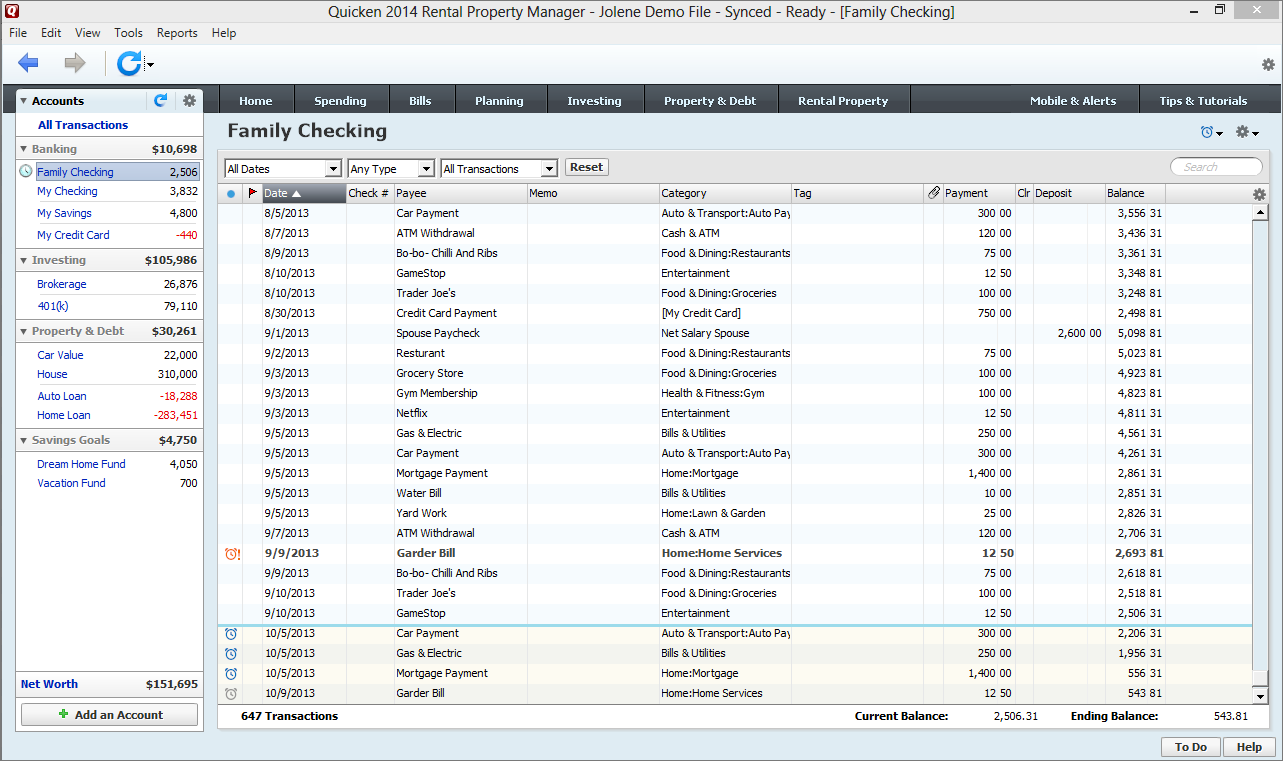

5. New! Bill Reminders in your Register

After you set up your bill (or income) reminders, you can choose to show them in your Register, so you can see what impact your planned spending will have on your account balance. Click the reminder icon in the first column to act on the reminders: update the amount when you get a bill, enter the reminder when you’re ready to pay, or skip reminders that you’ve already taken care of.

Tip: You can change the time period for the reminders to display (next 7 days, next 30 days, etc.). You can also toggle reminders on-and-off as you need them.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.