How Much Should You Spend on Rent?

You’ve probably heard the old rule:

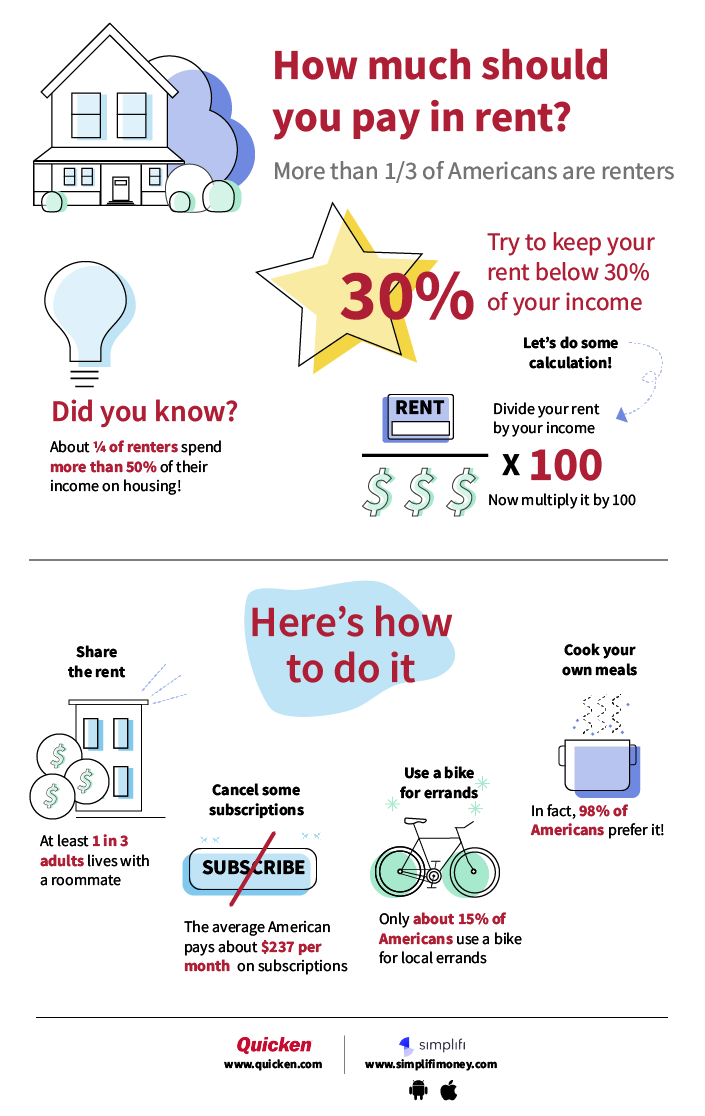

You shouldn’t spend more than 30% of your income on housing.

In today’s economy, that number can be hard to hit. But there are things you can do to make it easier. In trying to keep your rent below that threshold, here are some important numbers to keep in mind when working on your monthly budget.

Rent and Lower Income

The less money you earn, the bigger the bite your rent is likely to take out of your monthly budget. On average, high-income earners spend only 17% of their pre-tax income on housing, and middle-income earners average 25%. For low-income earners, housing often accounts for 40% or more of their pre-tax income. If you’re just starting out in your career, these tips can help get that percentage under control.

Rent and Location

If you live in a city, expect the cost of rent to be higher than if you lived in a rural area. In fact, the cost of housing accounts for 27% of the average monthly spending in rural areas, but 33% in urban areas. The good news? Other aspects of urban living can help make up the difference.

For example, if you can walk or bike to work, that saves a lot of money on gas and car maintenance. Many young urbanites forgo owning a car at all. You can “borrow” the money you would have spent on a car payment to pay more on rent while still maintaining your overall budget.

You also might be able to give up your parking space to save on rent, or sign an extended lease to bring your monthly rent down if you don’t intend to move any time soon. Look through your lease for other “extras,” like storage space, that you might not need, and talk to your landlord about your options.

Remember, budgeting isn’t about set rules. It’s about making choices that work for you. Keeping your rent below 30% of your income isn’t as important as keeping the total of your monthly bills low enough to squirrel away some savings every month.

Working With a High Rent Ratio

You can also share an apartment or a rented house with others to keep down your part of the rent. If the rent on a single-bedroom apartment in your area is $1,000, and a two-bedroom apartment is $1,400, you could share the second bedroom with a roommate and pay only half, or $700, saving yourself $300 every month. That’s a savings of $3,600 over the course of a year!

If you’re just starting out in an entry-level job and looking for your first apartment, you also might want to budget a higher percentage for rent and look for other ways to save. As your income grows, that rent-to-income ratio will start to shrink. Try to resist moving to a more expensive place unless you can keep that rent-to-income ratio below 30%.

Working on Your Budget

If your rent is more than 30% of your income, you’ll have less wiggle room in your monthly budget and might need to cut back in other areas. Having a planned budget is essential. That’s why financial experts like Kelley Long, Chicago-based CPA/PFS, recommend looking at your actual spending habits when drafting a budget.

When you create a spending plan with Simplifi or a budget with Quicken, your personalized plan is based on your actual spending from recent months. “Be realistic about discretionary expenses like food and entertainment,” Long advises. “Many people underestimate, so look at what you actually spent last month for guidance.”

Long also recommends using a well funded “Miscellaneous” category to cover irregular expenses, like personal care, pet expenses, gifts and events. “Finally, don’t forget to budget for savings, even just $25 per month to start a cash cushion that will help avoid debt down the road.”

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.