Quicken Product Highlights September 2020

At Quicken, we’re always working to develop new tools and features to help you take control of your finances and manage your money with confidence. This month, we’re thrilled to highlight two new Quicken features: Simple Investing in Quicken for Windows (now in beta), and the ability to budget transfers in Quicken for Mac.

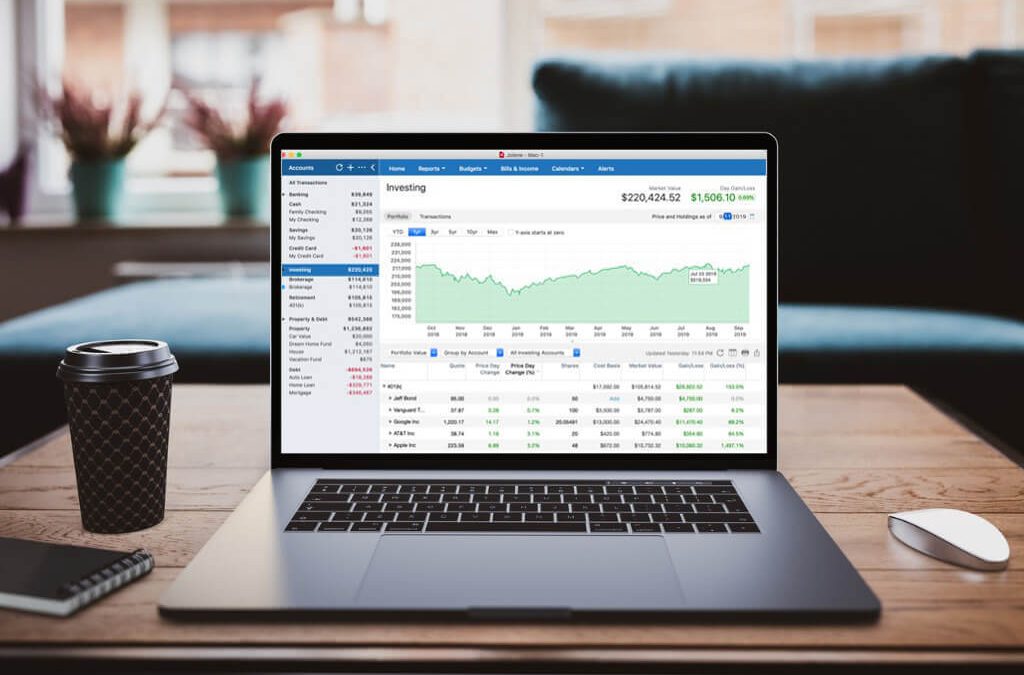

How to Manage Your Investments and Grow Your Net Worth

How to manage your investments and grow your net worth with Quicken, with tips and tricks for tracking and planning your portfolio, from beginner to expert.

How Much Should You Spend on Rent?

How much should you pay on rent? Keeping it below 30% of your income isn’t always easy. These tips can help you manage your rent—and your budget.

More than a Third of Millennials Are Likely to Flee Cities Within 12 Months

We asked more than 1,000 millennial renters in cities across the US about the impact they’ve felt from the pandemic—to their jobs, to their rent, and to their future plans.

How to get the most out of Quicken Reports

The ability to build any financial report you need is unique to Quicken. You won’t find that power and flexibility on any other app or website. Period.

How to Transfer Money From One Bank to Another

We live in an age of mobile-only bank accounts and . And yet, figuring out how to transfer money from one bank to another without paying a fee can be surprisingly difficult.

Quicken Stories: Paul Gipson

Paul Gipson came up through the aerospace industry, watching far too many airlines go under—sometimes right beneath his feet. After 9/11, the company he worked for cut salaries across the board and significantly reduced their 401(k) contributions.

How to Save Money on Groceries: 15 Tricks to Try

Eating at home more these days? Here’s 15 tricks to save money on groceries—even during a pandemic.

Should You Redeem Your Savings Bond? Use This Calculator

Purchasing U.S. savings bonds can be one of the safest ways to earn money on your savings, as a savings bond’s value is backed by the full faith and credit of the U.S. government. They can also offer tax advantages over similar products, such as a savings account or (CD).

Survey Shows COVID’s Drastic Impact on Spending Behavior

The pandemic changed nearly every aspect of our lives, including how we spend and manage our money. Get the data behind the story. Is this the new normal?