Quicken Stories: Robert Hill, COO

Robert Hill started his career as an entry-level software engineer. Today, he’s the COO of a med-tech firm and a father of five. According to Robert, Quicken has been an integral part of helping him provide for his family. Read his Quicken story to learn how planning, tracking, and actively managing your finances can help you grow your net worth and support your life goals.

How to Protect Your Investments in an Economic Downturn

From assessing risk to safeguarding your 401(k), you’ve got a lot of questions about managing your investments now—and we’ve got answers.

What Is a 401(k) Retirement Plan?

Our free 401(k) retirement calculator estimates how much you’ll have saved when you retire. See how much a slight boost in your contributions could be worth.

Mortgage Relief Programs and Refinancing During COVID-19

The COVID-19 Pandemic is creating unique challenges for us all. While we can get through it together, for many of us, shelter-in-place orders have led to mass layoffs and serious financial struggles. If that applies to you, there are ways to get help. Both the federal government and private lenders are providing mortgage relief programs to get you through this trying time.

How to Calculate Return on Investment (ROI)

Knowing how to calculate return on investment (ROI) and annualized ROI can help you make better investment decisions. Here’s how to do it.

How to Build Good Financial Habits

Building good money habits takes time, but it is completely doable. Here’s 3 easy steps on how to make the changes you want to see in your life.

Preparing for a Recession: Embracing Your Personal Finances

COVID-19 has brought on a global recession, according to . With much of the world sheltering-in-place to stop the spread, economies have slowed to a crawl. Americans alone have filed more than .

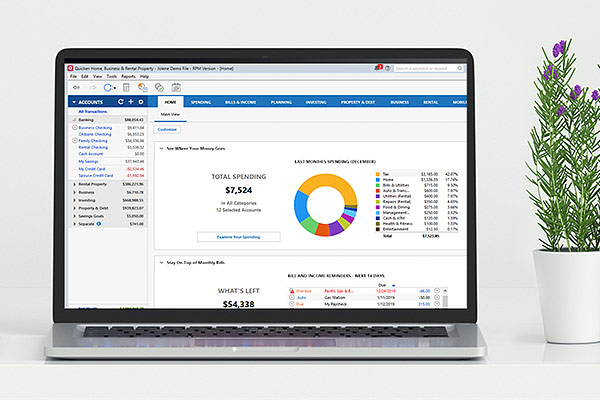

Ten Essentials to Getting a Great Start With Quicken

When you set up Quicken, you are going to want to have your financial information at your fingertips before you begin. This includes a list of your accounts:

Celebrating the Quicken Community

For 30 years, our Quicken customers have consistently impressed us with the depth and breadth of their collective knowledge, insight, and resilience. Your response to the has been everything we knew it would be and more, reaching out to each other and to your communities in this time of need.

What Does COVID-19 Mean For Our Personal Finances?

The COVID-19 pandemic has caused global disruption and brought an unprecedented level of uncertainty to daily life. Beyond health concerns, the short- and long-term impact on people’s personal finances is another major concern. With many businesses completely closed and others having to furlough or lay off employees, people across the country are finding themselves in difficult financial situations. To better understand the impact of the pandemic on Americans’ personal finances, Quicken Inc conducted a survey earlier this month of more than 1,300 adults in the U.S.