Easy Ways to Start Investing with Little Money

The sooner you start investing, the sooner your money can begin working for you. With the proliferation of employer-sponsored plans and discount brokerages, you don’t need tens of thousands of dollars to get in the investing game. A variety of opportunities exist if you’re able to set aside even $50 a month.

Why Love May Hinge on Your Credit Score

Credit scores were originally developed to help lenders gauge how likely a person is to pay back a loan. In a first-of-its-kind study by the Federal Reserve Board, researchers found evidence that your has predictive value when it comes to relationships forming and potentially separating as well.

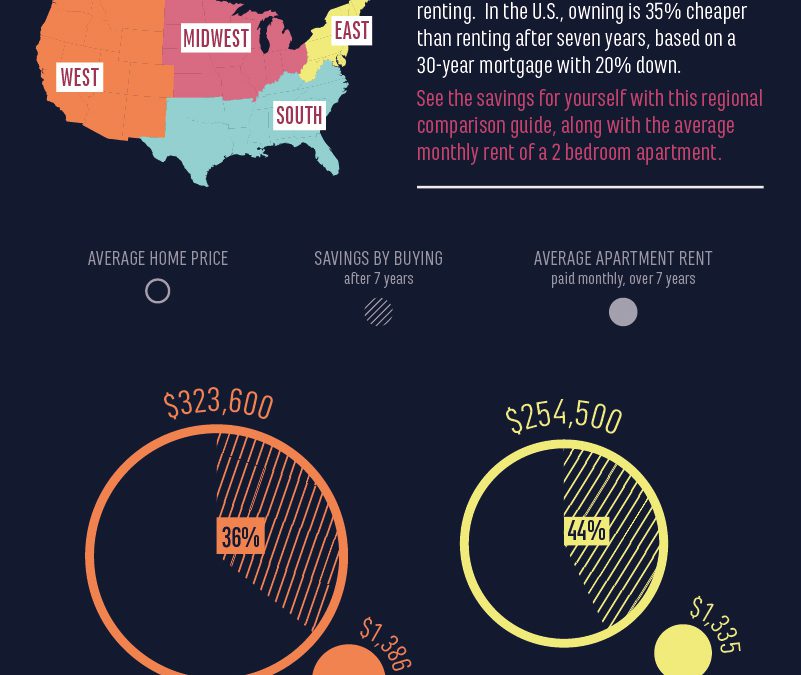

Renting vs Buying: A Regional Guide [Infographic]

Buying a house is almost always cheaper than renting. In the U.S., owning is 35% cheaper than renting after seven years, based on a 30-year mortgage with 20% down.

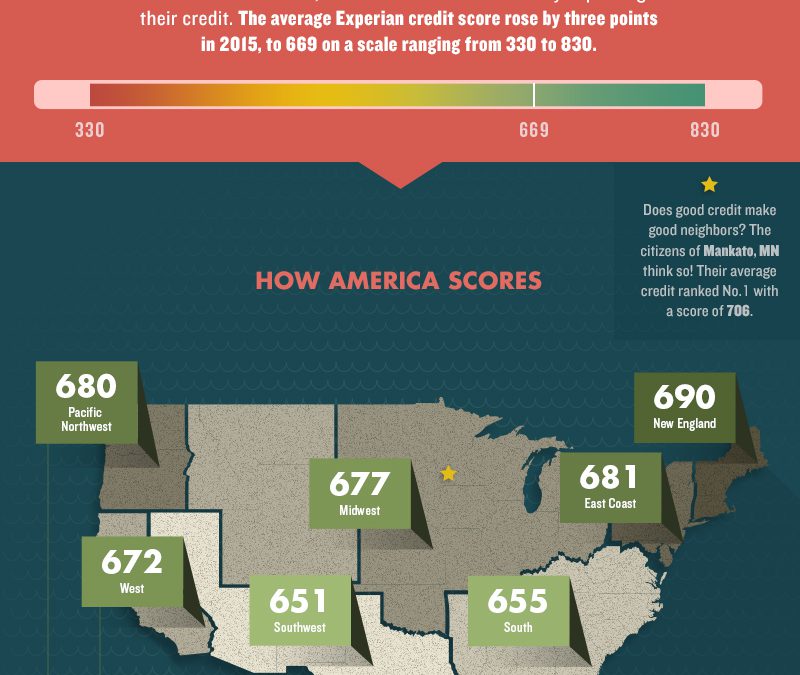

Credit Scores Across the Country [Infographic]

From coast-to-coast, Americans have been steadily improving their credit. The average Experian credit score rose by three points in 2015, to 699 on a scale ranging from 330 to 830.

A Financial Cheat Sheet for Newlyweds [Infographic]

A financial cheat sheet for newlyweds: nobody likes to talk about it amid the excitements of marriage, but the :money talk” is one of the most important discussions you can have.

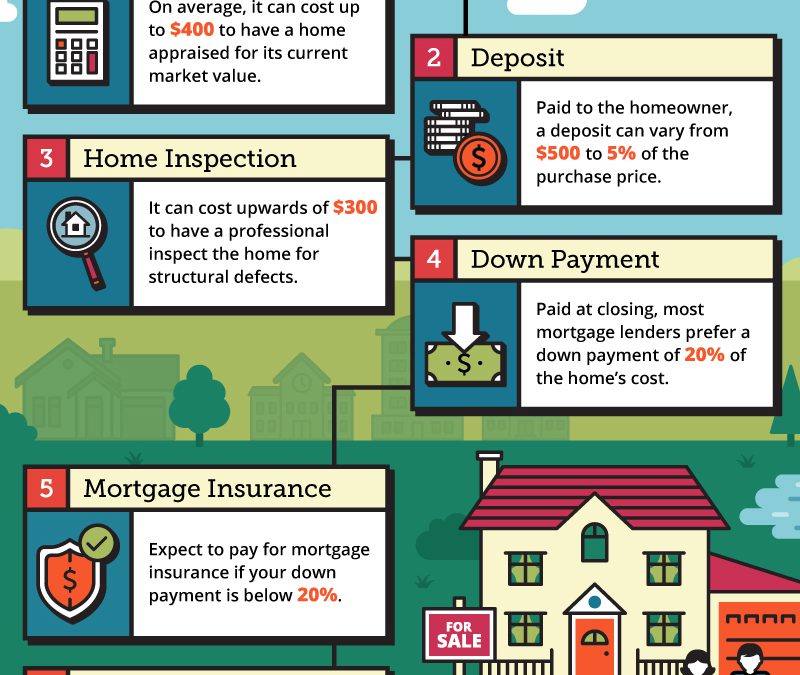

The Real Cost of Buying a Home in America [Infographic]

Expereinced homeowners know that the cost of buying a house goes far beyond the list price. Before applying for a mortggage, take a look at the hidden costs we’ve identified.

Knowing the Right Tipping Etiquette

Understanding the proper amount to tip can be confusing because the answer is often quite different from situation to situation. As a general rule, any time you receive service you might expect to leave a tip. However, this is an extremely broad rule because some service situations don’t require any tip at all. If you travel overseas, tipping etiquette can vary from country to country, and even from town to town.

Pros and Cons of Joint Accounts for Married Couples

Marriage joins two people at the hip financially – both have a right to a share of all marital assets. This can make the question of whether to open a joint account with your spouse somewhat moot, at least if the marriage breaks up, because both spouses are entitled to a portion of the money regardless of whose name is on the account. But some practical considerations apply to maintaining a joint account as long as your is healthy.

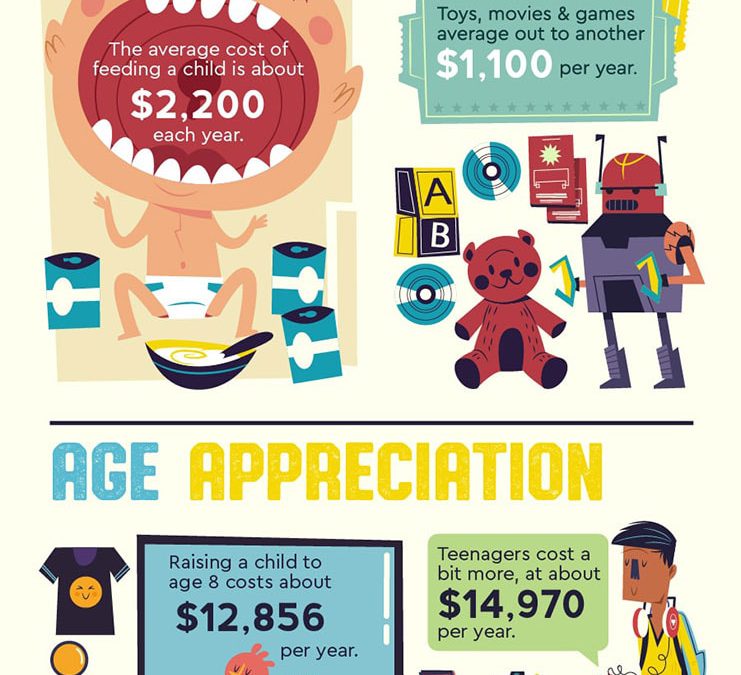

Tips for Adjusting Your Budget After Having a Baby

More and more moms are electing to stay home with their children, according to Pew Research Center. But a new baby can bump up your monthly expenses by $2,000 a month or so, and when combined with the loss of one parent’s income, the resulting budget gap may seem impossible to straddle. However, it’s may be doable with a little and advance planning.