Budgeting Tips for Saving Money on Cell Phone Plans

While the cell phone industry will tell you that a typical monthly bill is about $47 as of 2012, many people are paying more than that — and depending on their needs, it may be too much. There are a few actions that you can take to save money on your cell phone plan today. Sometimes to save money in the long run, you have to consider all the angles, such as whether switching carriers is worth the money you’ll spend on a new phone.

New Versus Used: Budgeting Tips on Buying a Car

New Versus Used: Budgeting Tips on Buying a Car With used cars, it’s wise to budget for repairs. While it’s possible to walk into a dealership and walk out with a new car, especially if you have the credit, you might want to consider doing…

How to Reduce Spending, Expenses & Debt in Retirement

How to Reduce Spending, Expenses & Debt in Retirement When you have an extra 2,000 hours to fill because you’re not working, it’s easy to let your expenses run amok. What’s more, even people who have saved wisely often find that during retirement their incomes…

Filing Bankruptcy and Its Effects on Personal Finances

Filing Bankruptcy and Its Effects on Personal Finances Bankruptcy can create havoc with your finances, but you can recover. Filing bankruptcy has been called the “nuclear option” when it comes to personal finances, because it creates dramatic and far-reaching effects. However, while the word “bankruptcy”…

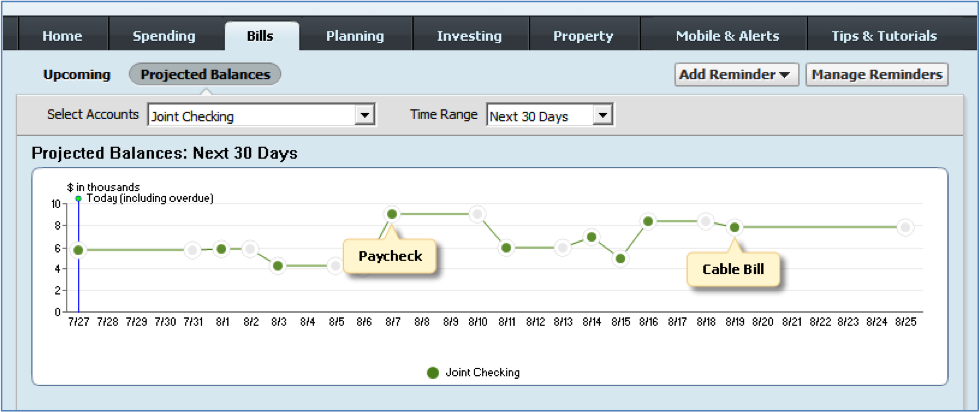

How to Project Balances and Cash Flow

Projected balances and cash flow Thank you for choosing Quicken! Do you have a have a general idea of where you stand financially? Accompanied by a sinking feeling you’re spending more than you’re taking in? Quicken can help! By understanding how much money comes in…

Tips for Homeowners

Thank you for choosing Quicken! Owning your own home is one of the great American dreams. Whether you’re just sticking your toes in the water, or you took the plunge long ago, Quicken has the tools you need to evaluate and track your investment. This…

3 Personal Finance Tips for College Grads

Walking across the stage to get your college diploma might be the proudest moment of your life, but it’s also just the beginning of your adult life. Tripping up financially might not be as initially embarrassing as stumbling on stage, but it can be more devastating long-term. Having a plan for how you’re going to manage your finances can turn your money into an ally.

How to Set Up Your Bills and Income

OK. So now you have one or two accounts set up in Quicken and you can download transactions and use categories to see where your money is going. What’s next? What more could there be? Beyond tracking your spending, Quicken actually makes it easier to…

How to Categorize Your Transactions

Categorizing your transactions lets you see where you’re spending your money. The good news is that Quicken does most of this work automatically for you! Quicken assigns categories to your transactions when it downloads them from your bank. For example, if you used your…

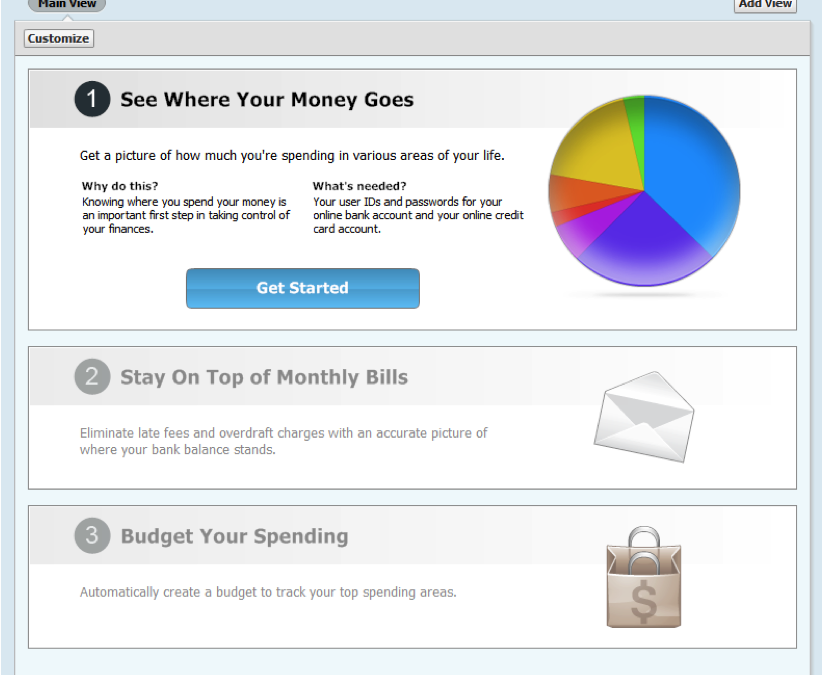

How to Set Up Your First Account

Follow these simple instructions and you’ll be up-and-running with Quicken in less than 10 minutes. Seriously! 1. Click the Home tab at the top of the Quicken window. 2. Click Get Started in the See Where Your Money Goes section. 3. Enter or choose the name of your bank….