How to Set Up Savings Goals

Using Savings Goals Quicken’s Savings Goals feature helps you save money by “hiding” funds in an account. You set up a savings goal and make contributions to it using the Savings Goals window. Although the money never leaves the source bank account, it is deducted in the account register, thus reducing the account balance in Quicken. If you can’t see the money in your account, you’re less likely to spend it.

Budgeting for Your Peace of Mind

Are your finances keeping you up at night? You’re not alone. Almost three-quarters of adults say money has them feeling stressed, according to the American Psychological Association. That’s not surprising, especially in today’s economy with skyrocketing energy and food costs, tepid investment performance, and rising unemployment rates.

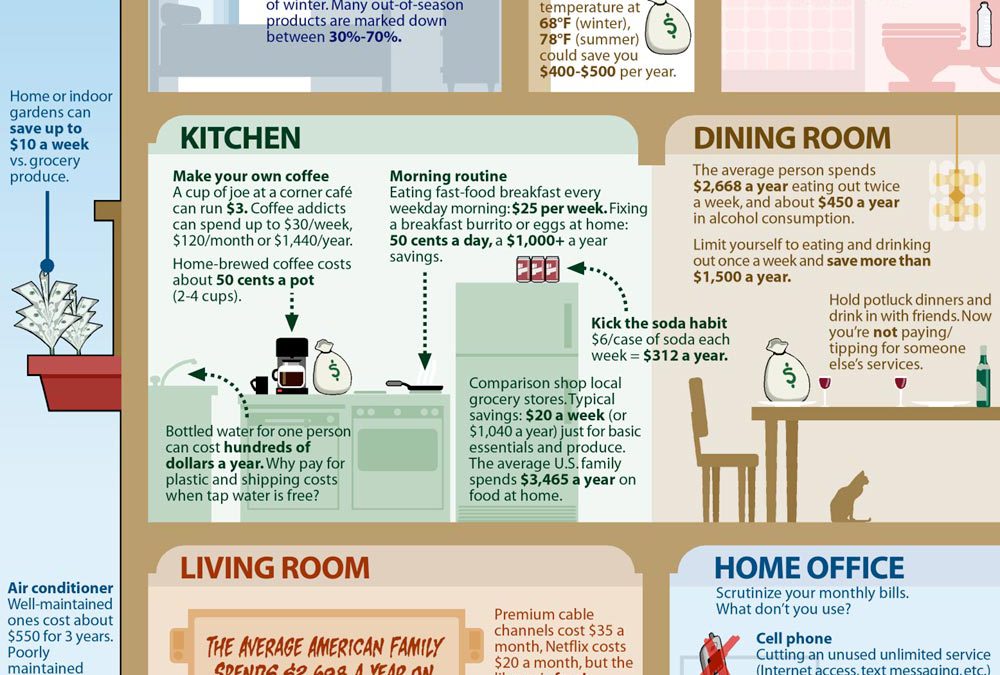

Budgeting: A Visual Guide to How Small Cutbacks Lead to Great Savings [Infographic]

Budgeting doesn’t have to be hard. You don’t even need to be tied down to the idea of “making a budget”. Saving money can be as simple as making a few small changes at home. The infographic above shows you easy, convenient ways to save up to $8,800 a year, without ever feeling the pinch of a restrictive budget.

4 Steps to Take to Avoid Stealth Fees

Stealth fees are the costs that aren’t included in the sticker price. Chances are, you have plenty of experience with them, even if you didn’t know their name. Take a standard $34.99 monthly cell phone plan, for example. That price conveniently omits about $10 worth of monthly surcharges, taxes and fees. (Also not included: the extra charges for each text message, the whopping per-minute cost if you exceed your monthly allowance and the per-megabyte charge for downloading data from the Internet.)

Credit Score Q&A

A good credit score can save you hundreds to thousands of dollars by helping you get a car loan, a mortgage, even an insurance policy. A bad credit score can cost you even more than higher interest rates – it can eliminate you as a candidate for a job!

5 Secrets to Smart Spending

Write down everything you spend money on for two months: what you bought, the amount, and the date. Don’t forget to include items you bought with a credit or a debit card, or paid for by check. Software like will automatically track and categorize your spending for you, though you’ll need to manually enter cash purchases.

5 Places to Stash Your Cash

With interest rates today at rock-bottom levels, it’s understandable if you feel that low-risk savings options are not much better than stuffing your money in a mattress. But our topic here is not maximizing your return over the long term, we’re looking at where to put money you may need to access quickly. The focus for these funds is safety and liquidity, not a great return. Here’s a look at the pros and cons of potential savings vehicles.

Understanding the New Credit Card Rules

A new federal law that became effective on February 22, 2010 is expected to save cardholders billions of dollars in fees and interest payments. But even with these friendlier rules, you still must pay close attention to your monthly statements. Here are the most important…

A Checklist of Financial Planning Staples

There are essential items you probably put on your grocery list every week—including bread, eggs and paper towels. There are also financial planning staples every family needs. Here’s a breadwinner’s checklist of seven financial essentials: 1. A will This is where you name a guardian…

Coverdell vs 529: Choosing a College Savings Account | Quicken

A Coverdell Savings Account and a state-sponsored 529 Savings Plan are both great ways to save for college. In both accounts, your earnings and withdrawals are tax-free when used to pay for eligible expenses. But they’re not identical. Here’s a rundown of the differences between them.