How Much Should I Contribute to My 401(k)?

How much should you contribute to your 401(k)? First, take advantage of your employer’s matching plan and claim that free money. Then, follow these guidelines.

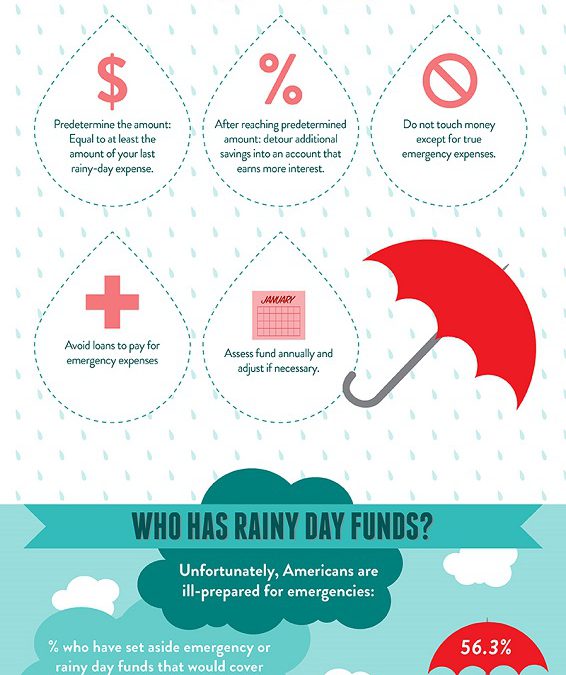

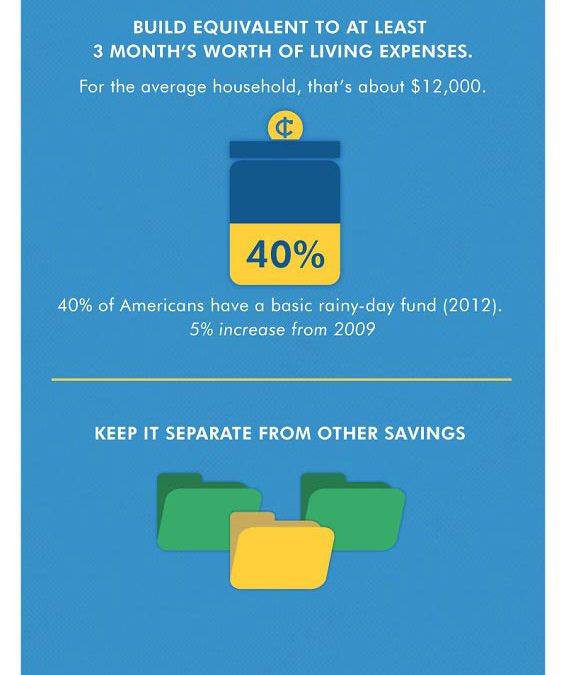

What are Rainy Day Funds? [Infographic]

Saving for a Rainy Day Fund. You can budget for everyday expenses, but what happens when life throws you an unexpected expense? Auto repair, major appliance, sick dog? A rainy day fund can cushion the blow.

6 Surprising Things That Hurt Your Credit Score

Your credit score might only be three digits, but it can have a substantial impact on your financial life because lenders use it to decide whether you get a loan and how much interest you pay. Nobody wants to lower their credit score, but if you don’t know what to avoid, you could unintentionally shoot your financial self in the foot and lower your credit score. “If you’re close to a hard cutoff range for a loan or credit options, then it can mean thousands of dollars in interest,” warns Anika Hedstrom, MBA and senior financial analyst in Medford, Oregon.