Intuit Releases Redesigned Quicken 2015 for Mac

Newest Version Includes Free Mobile Companion App MOUNTAIN VIEW, Calif. – Aug. 21, 2014 – Intuit Inc. (Nasdaq: INTU) today announced the availability of Quicken 2015 for Mac, featuring a new, clean and simple interface designed specifically for Mac and new investment capabilities. The…

Intuit Announces Quicken for Windows 2015

Offers Clear View of Credit, Portfolio Performance MOUNTAIN VIEW, Calif. – Oct. 1, 2014 – Quicken for Windows 2015 from Intuit Inc. (Nasdaq: INTU) simplifies money management for those who want greater control over managing their finances or investments. The newest version provides a…

Improvement List for Quicken 2015 for Mac

You Asked. We Listened. We truly value your feedback, which has helped us prioritize new features and improvements to Quicken Mac for 2015. Thanks for sharing your ideas. We hope you enjoy these enhancements below. We’ll continue to update this list as we add new…

Quicken 2016 for Windows Improvements

You Asked. We Listened. Your feedback helped us deliver many new improvements to Quicken 2016 for Windows in addition to exciting new features such as Bill Presentment. Thanks for sharing your ideas. We hope you enjoy the enhancements below. See, track, and pay your bills…

Make More Benjamins Without Quitting Your Job

I’m all for silver linings, but the latest survey issued by the National Association of Colleges and Employers on starting salaries for recent college grads – despite its upbeat spin – fails to excite.

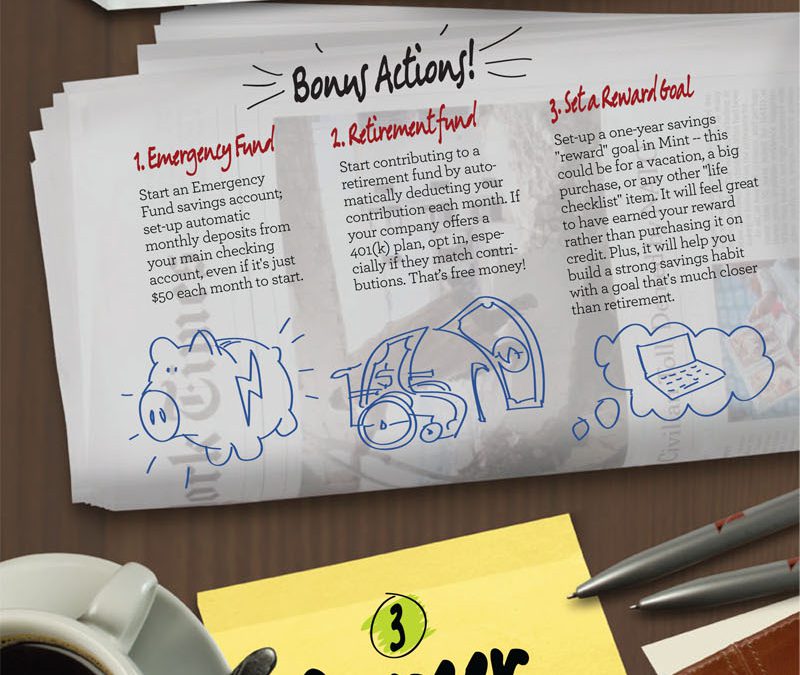

Life After College Roadmap

College can be the best years of your life. But what happens after graduation? With the tough economy, increased costs of living, and outsourcing of jobs, what’s a recent graduate to do? We partnered with prominent blogger and author of Life After College, Jenny Blake,…

Last-Minute Costume Ideas For Under $5

Want to be scared this Halloween? Take a look with your software at what you’re paying to celebrate the year’s spookiest holiday. Renting a basic pirate’s outfit from Boston Costume will run you $65. Add candy, snacks, and drinks and you’ll soon be over $100.

Is Staying Single Better for Your Finances?

You know you’re in love and you know you want to spend your life with your partner — but does getting married help your finances, or leave them worse off? Before you walk down the aisle and commit to each other “for richer or for…

How To Save Smarter Without Working Harder

While it would be nice, we don’t all have trust funds, a professional golf swing or the stage presence of Bruce Springsteen to bank our retirements on. It’s not that the rich, talented and famous don’t work, it’s just that they don’t have to work to retire. Most people must work to save, whether for retirement or another goal. Even if you don’t want to work harder at your current job or take on another one, you can become a better saver without breaking a sweat. You will, however, need to learn wisely and make some sacrifices.

How To Quit Your Job, Travel the World, And Not Go Broke

Have you ever had a quarter-life crisis? Olivia, a 28-year-old former marketing executive for a Portland, Ore. sporting goods e-commerce company did. She quit her job in Feb. of 2008, two months after earning her MBA from Portland State, and set off to travel the world. Four continents and one year later, she still has nine months of savings in the bank.