What Is Adjusted Gross Income?

What is adjusted gross income? You’ve heard the term, of course. Perhaps your accountant mentions it in passing whenever you get your taxes done, or you recognize it as a line item on your annual tax returns. But without context, it’s hard to understand just how important it is.

Adjusted gross income (AGI) is your gross income— i.e., the total amount of money you’re paid before taxes are taken out—minus certain deductions allowed by the IRS. Adjusted gross income is important because for many Americans it serves as the starting point for determining how much they’ll have to pay in taxes each year. Let’s take a closer look at adjusted gross income, how it’s determined, and how it can impact both your taxes and your financial life.

How Is Adjusted Gross Income Determined?

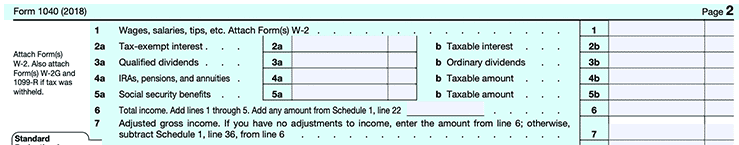

To calculate your adjusted gross income, you first need to determine your total gross income. Your gross income may include wages, dividends, alimony, capital gains, interest income, royalties, rental income, retirement distributions, and any other income that’s not reported elsewhere on your tax return.

Once you have this number, you can subtract any “Adjustments to Income”—also known as “above-the-line” deductions—that apply to your situation. “In order to claim an above-the-line deduction, you simply need to complete your tax return,” says banking and tax expert Amanda Dixon, in an article for SmartAsset. “Above-the-line deductions are easy to spot. You can find them above the line where you’re required to enter your adjusted gross income.”

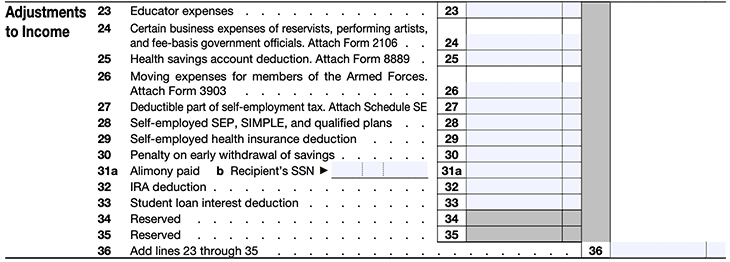

Here are the eligible above-the-line deductions for the 2018 tax year, found on Schedule 1 of the 1040 form (note that the 2019 1040 may be different):

As you can see above, some common adjustments include contributions to certain business expenses, classroom-related expenses, and any student loan interest you’ve paid.

After you add lines 23 through 35, you’ll enter your adjusted gross income on line 36. Back on your 1040 form, you’d then subtract the adjusted gross income you just arrived at on Schedule 1 from line 6 to get your new total for line 7.

How Does Adjusted Gross Income Impact My Taxes?

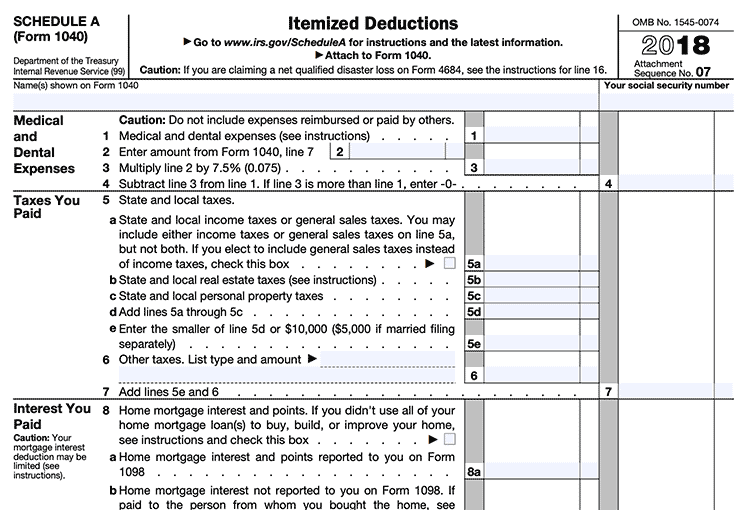

In the majority of states, adjusted gross income serves as the starting point for calculating taxable income. It also helps determine a taxpayer’s eligibility for certain “below-the-line” deductions and credits. Below-the-line deductions are deductions you subtract from your adjusted gross income. They can be either standard or itemized.

“There are two options for how you can deduct your expenses when you file your federal tax return,” explains Certified Educator in Personal Finance (CEPF®) Derek Silva, in an article for SmartAsset. “Taking the standard deduction is the simplest option. It allows you to deduct a set amount of money from your taxes. The other option is to itemize. Itemizing allows you to list your expenses and then deduct the total of everything you’ve listed. If your expenses throughout the year were more than the value of the standard deduction, itemizing is a useful strategy to maximize your tax benefits.”

Schedule A of the 1040 form shows all allowable itemized deductions for the 2018 tax year.

How can adjusted gross income impact my itemized deductions?

How your adjusted gross income will affect your eligibility for deductions depends entirely on your unique financial situation. For example, for the 2018 tax year, certain unreimbursed medical expenses you incur over the course of a year are tax-deductible, but only if they exceed 10 percent of your adjusted gross income (7.5 percent if you or your spouse are over 65).

Another example involves the 2019 Child Tax Credit. If you have children under 17, you can claim a tax credit of up to $2,000 per child. However, this credit is reduced or eliminated if your adjusted gross income exceeds a certain threshold. You can only take full advantage of the credit if your adjusted gross income is under $400,000 for married couples filing jointly, or under $200,000 for everyone else.

All in all, the lower your adjusted gross income, the greater the itemized deductions you’ll be able to take.

What Is Modified Adjusted Gross Income?

Your modified adjusted gross income is your adjusted gross income with certain deductions added back in. It is used to determine your eligibility for important tax benefits such as education tax benefits and certain income tax credits. Most notably, the IRS uses your modified adjusted gross income to determine how much of your retirement plan contributions—such as with a traditional or Roth IRA—are deductible.

To calculate your modified adjusted gross income, take your adjusted gross income and add back in any eligible items. These might include not only IRA contribution deductions, but also rental losses, excluded foreign income, and half of any self-employment tax, to name a few.

Keep in mind that many (if not most) taxpayers won’t have applicable deductions to add back into their adjusted gross income. If this applies to you, that means your modified adjusted gross income will be close to or the same as your adjusted gross income, and therefore won’t have much of an impact on your taxable income.

What Else Should I Know About Adjusted Gross Income?

Your adjusted gross income isn’t just a number on your yearly tax returns—it’s also considered a key indicator of the state of your finances. According to a tax expert for The Balance William Perez, “AGI even impacts your financial life outside of taxes: banks, mortgage lenders, and college financial aid programs all routinely ask for your adjusted gross income.”

For this reason, it’s important to have a well-rounded understanding of how adjusted gross income works and what it says about your financial health. When calculating your adjusted gross income, make sure to run the numbers carefully (hint: most online tax software programs will do the work for you). If you find anything confusing or unclear, it’s always a good idea to consult a trusted tax professional. A conversation with a professional now can help you avoid costly mistakes down the road.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.