Simplifi Makes Bill Tracking Easy with Bill Connect

Have you ever paid a late fee, underestimated a credit card bill, or forgot to cancel a subscription before it renewed?

Quicken Simplifi’s Bill Connect makes it easier than ever to stay on top of your bills. By connecting directly to each biller, you’ll know the exact amount of each bill before you have to pay it, keeping your bills on track and your spending plan always up to date.

Track your bills automatically with Quicken Simplifi.

Learn more →

What is Bill Connect?

Bill Connect is a feature in Simplifi that lets you connect your regular bills and subscriptions to each biller electronically, so your actual bill amounts can be displayed directly in the app as soon as they’re available.

You can still pay your bills automatically, but with Bill Connect you’ll see the actual amounts in your upcoming transactions — before the money comes out of your account.

Use Bill Connect to prevent these 5 billing disasters

1. Paying bills automatically that should have flagged a major problem

Ignoring your bill notifications and paying them automatically is fine when there aren’t any surprises, but life isn’t always predictable.

If your house has a water leak, you could pay a water bill that’s 5 times higher than it should be without noticing either the bill or the leak. That leak might be a small split in your garden hose, or it could be a crack in your plumbing that’s silently destroying your kitchen wall.

Or if you just got a new car and you forgot to take the old one off your insurance, you could easily keep paying to insure them both.

There’s nothing wrong with paying your bills automatically. In fact, it’s a great way to make sure you don’t pay late fees! But paying them without even looking at them isn’t a great idea.

See your bills ahead of time with Quicken Simplifi.

Learn more →

2. Underestimating that credit card bill

If you know what to expect from your credit card bills each month, you’re ahead of the game. One of the first signs of credit card fraud can be a simple discrepancy between what you’re expecting to pay and the actual bill. Seeing that difference right away can help you catch problems early.

You might also share a credit card with a family member, or you might not realize how many times you used that card recently. Either way, the amount of the bill could take you by surprise, risking late fees, overdraft fees, or higher interest charges.

3. Starting or renewing subscriptions you didn’t want

Extreme sales are a popular reason to give a new subscription a try. Maybe you signed up for a new streaming service at half price, or maybe you’re trying a new subscription box at a deep discount.

After a few months, that service is going to jump to the regular price. It’s easy to forget to cancel it before that happens, especially if you started out liking it and then forgot about it.

Since most subscriptions require a credit card to sign up, you could easily end up paying those bills without realizing it. If you do, you can’t get your money back.

4. Hidden charges, variable charges & late fees

Monthly billing amounts can also take you by surprise, especially for things like power bills that can change a lot from one season to the next.

And if you’re not paying those bills automatically, missing them can lead to late fees. That’s just wasted money.

Hidden charges, charges you forgot about, and other similar billing problems can all lead to last-minute surprises if you’re not reviewing your bill notifications ahead of time.

5. Losing things that have serious consequences

Finally, missing some bills can have serious consequences, especially if you miss that final notification.

A life insurance policy, for example, could get canceled. Or you could lose that web domain you were using for your side business, only to find out someone else bought it.

These are extreme examples, and, fortunately, they don’t happen often. But they do happen.

That’s why it’s important to review your bills — and why Simplifi comes with Bill Connect, to make that easy to do.

See how Quicken makes it easy to view your bills.

Learn more →

How Simplifi and Bill Connect make bill tracking easy

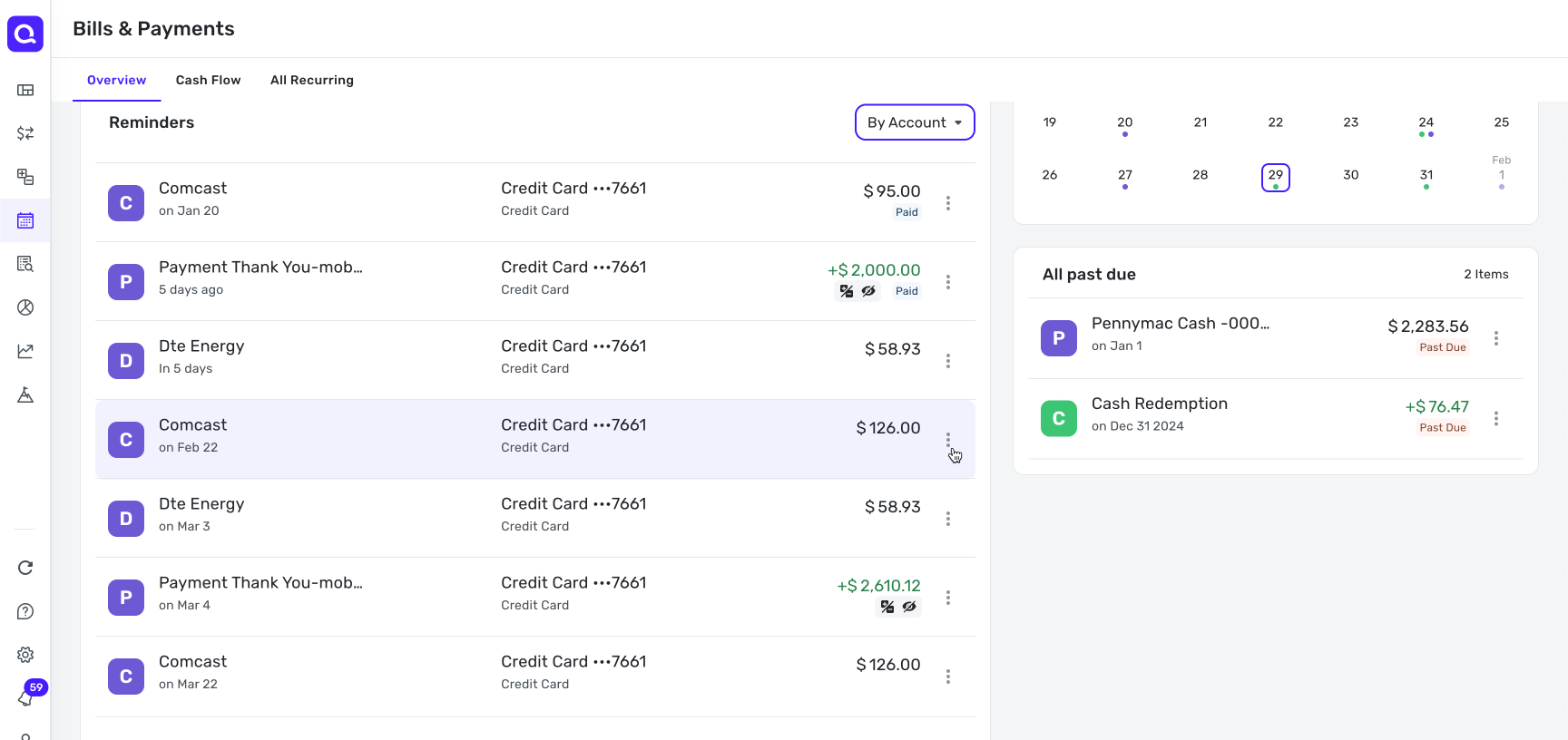

1. Track real bill amounts without the noise & clutter

With Simplifi’s Bill Connect, you can see all your bill amounts automatically in one convenient place.

Because your bills and subscriptions are connected electronically to actual billers, you don’t have to rely on estimates. Simplifi’s Bill Connect shows you your actual bill amounts as soon as each biller sends them.

2. Check all your bills on your phone in seconds

Just connect your bills and then check your upcoming transactions on your Simplifi dashboard — on your phone or in the web app.

Staying on top of your bills only takes a few moments a day, giving you plenty of time to recognize problems, plan for unusual amounts, and pay those bills on or before the due date, every time.

3. Include your real bill amounts in your monthly spending plan

Last, but certainly not least, when you connect your bills through Simplifi’s Bill Connect, your actual bill amounts will be included in your spending plan automatically.

Instead of having to estimate that power bill or gas bill every month, Simplifi will read your actual bill as soon as it comes in and adjust your spending plan to take it into account.

How Simplifi Bill Connect works

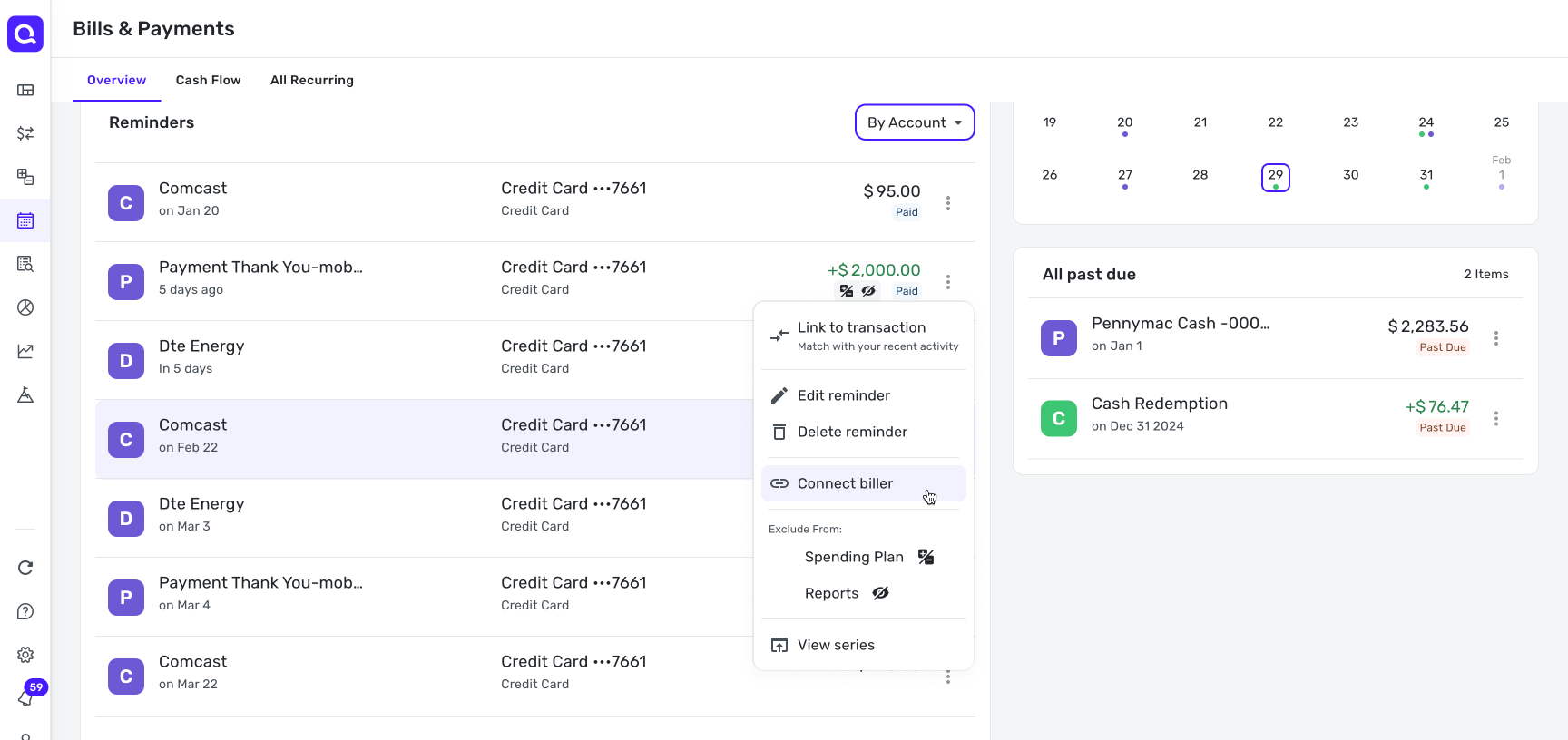

- Find any bill in the app, in any transaction list or in your settings.

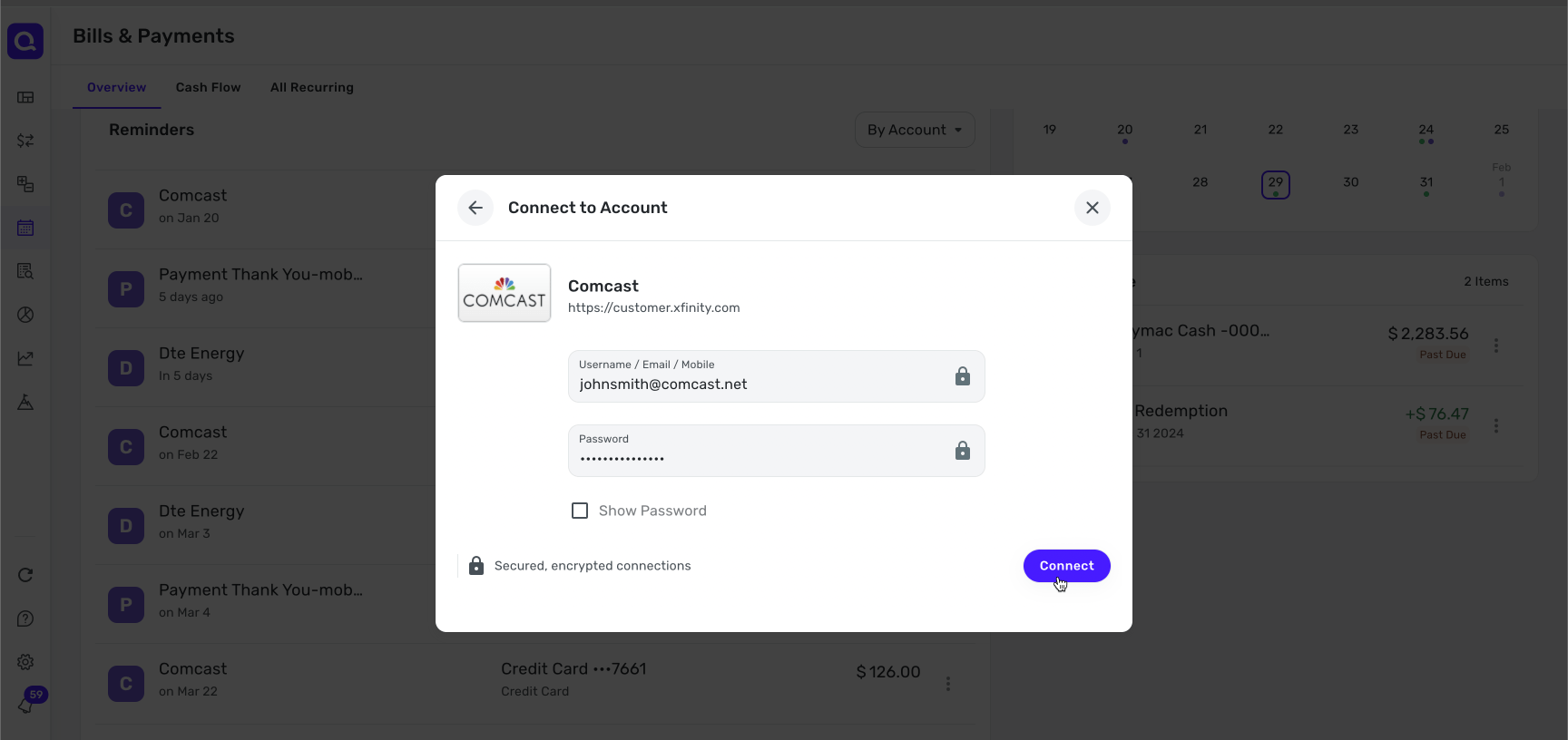

- Once you select the bill, select Connect, or go to the Options menu in the upper right and select Connect Biller.

- Enter your name and password for that biller to connect your account.

It’s that easy. From now on, Simplifi will reflect the actual amount of each connected bill.

Get started with Quicken Simplifi today.

Learn more →

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.