How to Manage Your Investments and Grow Your Net Worth

Whether you’re a brand new investor or a seasoned veteran, there’s always something new to learn, especially when it comes to using Quicken to manage your investments. These investment tips and tricks, from beginner to expert, can help you track and plan your portfolio.

Basic investing principles and tips

1. Start early

The sooner you start investing, the more money you can make by the time you’re ready to retire. That might sound simple (and, in some ways, it is), but because of the way investing works, even a few extra years can add a lot more to your retirement.

When you invest money in your future, you’re not just saving it—you’re putting it to work. Over time, the businesses you invest in continue to grow, and your investment grows with them.

For example, if you invested just $5,000 at the age of 35, and your investments grew about 7.5% every year, that $5,000 would turn into $43,775 by the time you were 65. But if you took that same $5,000 and invested it 10 years sooner, when you were only 25, it would be worth $90,221 by the time you were 65—more than twice as much. Those ten extra years make a huge difference!

If you want to try plugging in different numbers to see what happens, try this Compound Interest Calculator.

2. Invest automatically

That was a simple example: investing $5,000 and leaving it there. But if you add to your investments with every paycheck, your retirement fund can go a lot further.

Let’s say you’re 35. If you start with that same $5,000 and add another $200 every month, you’d have $291,933 by the time you retired. And, as you make more money over time, you’ll be able to contribute even more. (If you maxed out your 401(k) contributions that whole time, currently $19,500 per year, you’d end up with just over $2 million.)

There are different tax implications of various retirement funds, but the important thing as a beginning investor is to add to your retirement fund automatically, whether it comes straight out of your paycheck or gets transferred from your bank account every month.

3. Take advantage of employer contributions

When you work for a company that offers a retirement plan, you can decide how much to contribute to that plan out of each paycheck, and your employer will usually match some part of it. For example, the company might contribute half of whatever you put in, up to $3,000 per year.

Whatever their maximum annual contribution is, try to contribute enough yourself to get that full amount. If your employer is matching half of whatever you put in, you’d need to contribute $500 each month, or $6,000 each year, to get the full $3,000 from the company.

If you can’t contribute that much yet, that’s okay, but try not to leave more money on the table than you absolutely have to. Look at other ways to cut back on your expenses in order to take maximum advantage of those employer benefits.

4. Invest for the long term

One of the most important keys to investing for your retirement, in any form, is not to take that money out before you’re ready. Some retirement plans hit you with penalties if you withdraw them early, but even beyond that, investments tend to rise and fall on a day-to-day basis.

Stocks go up or down depending on a lot of factors, and sometimes, as we all saw during the early months of 2020, they take a huge hit and then take a while to recover. You don’t want to be forced to sell your investments at a bad time.

Let’s say you invest $5,000 and the market hits a recession. Suddenly, that $5,000 is only worth $2,500, but if you can afford to keep your investments where they are, they’ll build back up again, eventually becoming worth more than they were before.

The stock market is a gamble that has historically paid off over the long-term, but not always in the short-term. So it’s important to build up an emergency fund in a simple savings account to cover any unexpected expenses. That way, when life takes you by surprise, you won’t have to sell your investments at a bad time or cash out your retirement plan early.

How Quicken can help you—from beginner to advanced

1. Set your sights on growing your net worth

One of the most important things you can do at any stage in your investing journey is to set your sights on growing your net worth: the total value of everything you own, minus your debts.

Adding up all your assets (cash, investments, home value, etc.) and subtracting your debts (mortgage, car & student loans, credit card balances) provides a key insight into your financial position—a more complete picture than just looking at your bank balance. That’s why Quicken calculates it for you, letting you track your net worth over time.

For many people, your net worth will be negative, especially if you’re still paying off student loans. That’s okay. Over time, as you add to your investments and pay down your debt, your net worth will turn positive and continue to grow.

2. Sync with our companion apps for mobile and web

When you sync Quicken with our companion web and mobile apps, you can monitor your investments anywhere you go. Refresh the app as often as you like to download the latest stock prices and keep all your publicly traded holdings up to date.

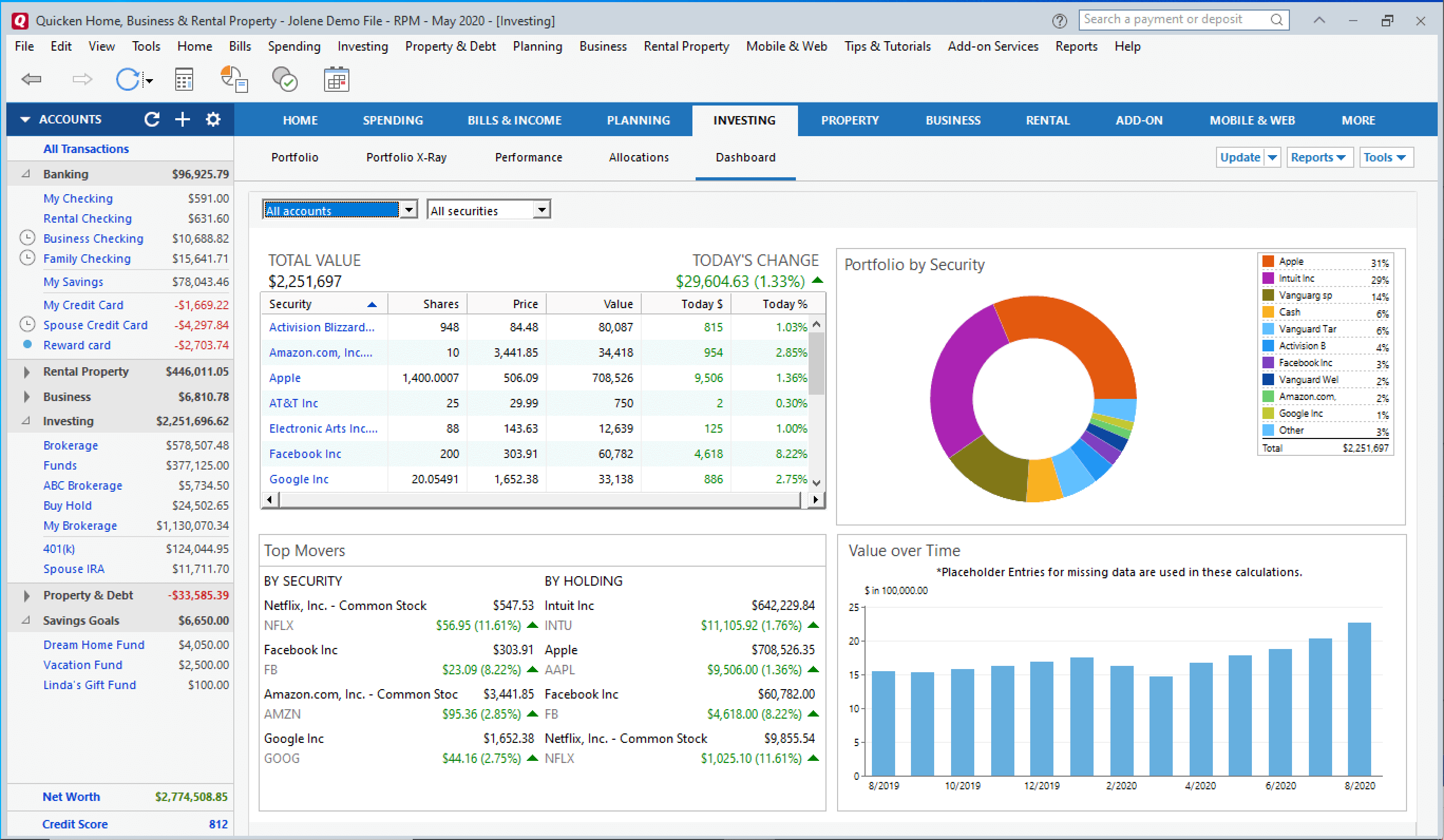

3. Use Quicken to monitor all your accounts at once

Monitor all your investment accounts, from all your brokerages and retirement plans, with the convenience of a single, combined view. Track both liquid and retirement holdings, including brokerage, 401(k)s, IRAs, options, bonds, ETFs, mutual funds, and more.

Quicken lets you combine all your investments in one place for a truly comprehensive view of your portfolio, making it FAR easier to see your true risk level, allocations, and performance.

4. Add those “manual” brokerage accounts

If you hold publicly traded securities in a brokerage account that doesn’t permit automatic connections, all you have to do is manually enter your buy/sell transactions. Quicken will update your position and continue to download those security prices every time you refresh the software or app, so you can see your portfolio’s current value even on those “manual” accounts.

5. Include private equities and partnerships

If you hold investments in partnerships and private equities that aren’t publicly traded, you can add those too. You’ll have to keep track of them manually, but Quicken gives you a way to add them yourself so you can still see everything at once, letting you see those “side” investments for what they are—a crucial part of your whole portfolio.

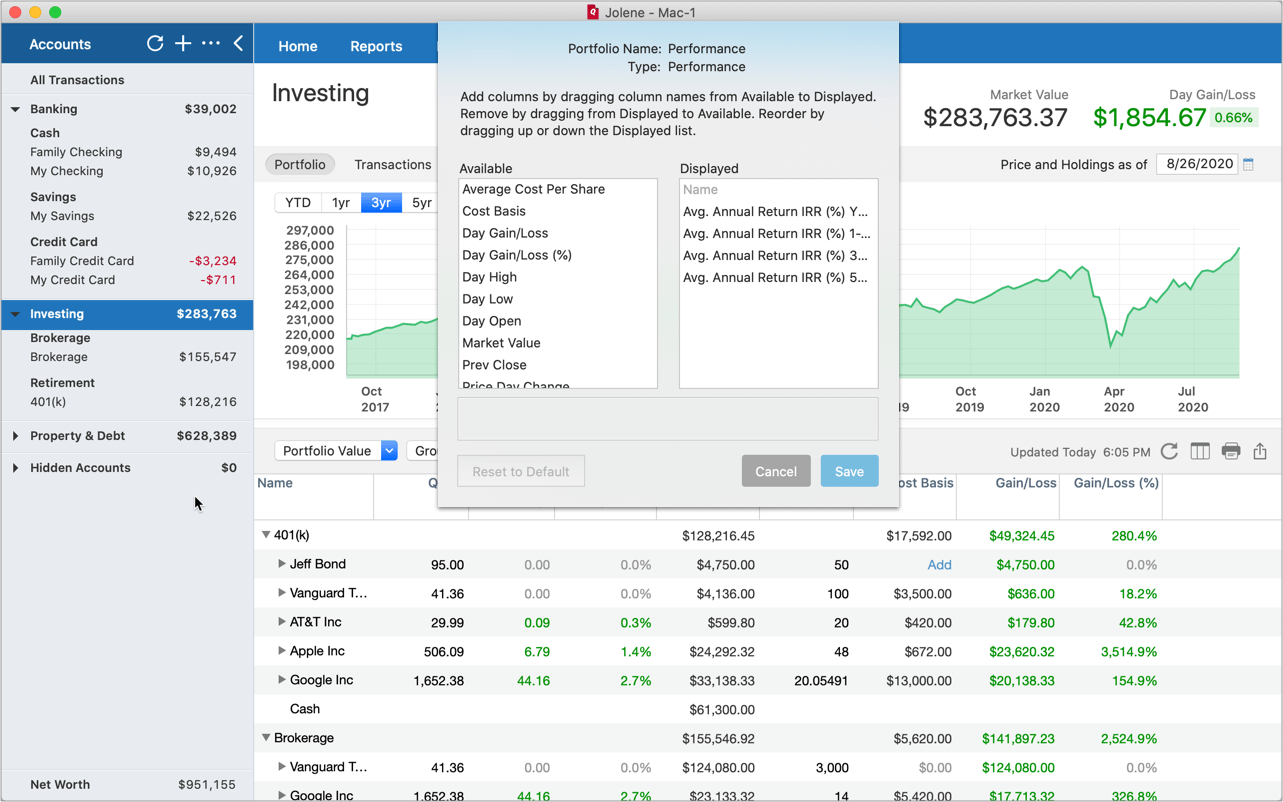

6. Customize your portfolio view

Group your portfolios however you like—by type, brokerage, or asset class (domestic bonds, large cap stock, and so on)—or create new “buckets” to group your holdings in your own, unique way.

Maybe you want to see how your blue-chip holdings are performing against your tech stocks or cryptocurrencies. Or maybe you want to see the stock you set aside for your kids separately from your own portfolio. Quicken is fully customizable, so you can track your investments in the way that makes the most sense for your own situation.

7. Understand your true market returns

Run IRR and ROI performance reports to see how your investments have done over time. Compare the performance of different funds, or run reports on all your investments together. Quicken can even track your investment fees, reporting your true market returns so you can make fair comparisons when you’re making decisions.

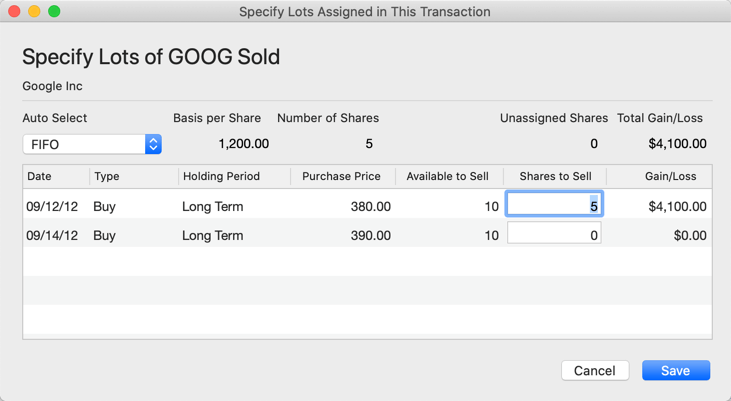

8. Plan for the tax implications

Not only does Quicken track your individual buy/sell transactions, it also lets you specify lots for those transactions, so you can track the cost basis of your positions and see your realized and unrealized gains. Tracking the cost basis of specified lots is something most personal finance management tools simply can’t do—one of the many things that makes Quicken stand apart from its competitors.

9. Easily export to tax preparation software like TurboTax

Investing is a smart move for the future, but an active portfolio can make filing your taxes more complicated. Quicken lets you easily export your tax-related data to tax preparation software, like TurboTax, or to tax schedule reports for your accountant.

Additional features in Quicken for Windows

1. ALL Quicken subscribers have access to Quicken for Windows

Some versions of Quicken for Windows come with advanced investing tools that aren’t available in Quicken for Mac, but every Quicken subscriber has access to both versions of the software. Mac users can sign into Quicken on a PC and download Quicken for Windows, or they can dedicate part of their Mac to run the Windows operating system using Apple’s Boot Camp.

2. Get a bird’s-eye view with Simple Investing

Whether you’re just starting out with investing or you’re a bit more hands-off in your approach, not everyone wants the full range of investment tracking tools that Quicken offers. If the idea of all this complexity feels a bit overwhelming, you might want to try our new Simple Investing beta, available now for Windows.

3. Keep and eye on possible investments with watchlists

If you want to watch certain securities for a while before you decide to invest, Quicken for Windows lets you set up stock watchlists to track any publicly traded securities you don’t own. Follow their performance over time without adding them to your portfolio, and Quicken will show you how they’re doing.

4. Monitor your benchmarks with custom investing goals

Designate any individual holding “bucket” and give it your own, custom investing goal. Quicken lets you tag your holdings however you want to—as green stocks or blue chips, experimental or designated for the kids—literally any way you can imagine to see your portfolio in your own way. For each tag, you can set up your own investing goal and Quicken will keep track of it for you, letting you know how those holdings are performing against that goal.

5. Design your ideal portfolio with target allocations

Quicken for Windows lets you set target allocations for your portfolio, helping you achieve the diversity you’re looking for. Not only can you see how your individual investment positions or brokerage accounts are shaping up, you can also combine all your accounts into a single, unified portfolio to see you see how all your holdings look, together, across all brokerages, no matter where or how you’re holding them.

6. Look inside your mutual funds

Quicken uses Morningstar’s X-ray feature to let you see inside your mutual fund holdings, so you’ll always know your true position in those individual securities. Understanding how much of a particular stock you happen to own through your mutual funds can help you decide whether to buy or divest that stock in your own separate holdings, keeping your overall portfolio balanced.

7. Estimate your capital gains

Although both Quicken for Mac and Quicken for Windows let you track your investments in specified lots, Quicken for Windows takes estimated capital gains planning a step further. If you’re thinking about selling stock, whether it’s to fund a private investment or to remodel your kitchen, Quicken provides a “what should I sell” tool that will look at your entire portfolio and calculate your best option.

8. Get a preview before you buy or sell

Finally, Quicken for Windows lets you run buy/sell previews for investments you might be considering. Enter a potential purchase—e.g. for a stock or mutual fund—and Quicken will tell you the total price as well as what percent the new holding would represent of all your investment assets. Enter a potential sale, and Quicken will show you the short-term and long-term capital gains implications of that transaction.

For more investing tips and articles from Quicken, visit the investing section of the Quicken blog.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.