Overview

You can create a number of reports to find out how your business is doing.

Instructions

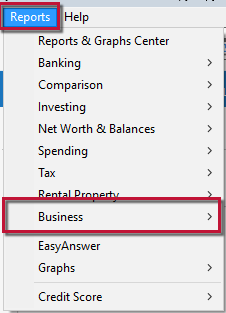

1. Go to the Reports dropdown in the top menu bar and select Business.

How can we help?

✖Still need help? Contact Us

2. Select a report from the Business reports list.

Report Types

Click the topic below for the report you want more information about.

Accounts Payable reports

These reports help you keep track of your bills. You can find out how much you owe a particular vendor, for example. You can also print the entire accounts payable register or selected portions of the register.

Accounts Receivable reports

These reports help you keep track of the money coming in. You can find out how much individual customers owe you or how much you've sold them in total. You can also see payment histories for your customers, and you can print the entire accounts receivable register or selected portions of the register.

Balance Sheet report

This report is a financial snapshot of your company on a specific date. It shows:

What you have

What people owe you

What your business owes to other people

The net worth of your business

The balance sheet is a fundamental business report. You generally need to provide one to your loan officer when requesting a loan.

Cash Flow and Cash Flow Comparison reports

These reports help your company keep track of the cash it receives from sources other than accounts receivable such as cash from loans, investments in the company, interest income, or repayment of loans to others.

A cash flow report tracks all sources of funds, both coming in and going out, by category.

A cash flow comparison report compares cash flow for two different time periods.

A current spending vs. average spending by category report or graph compares expenses from one period with the average expenses for another period.

Missing Checks report

This report prints a list of missing or duplicate checks and their transactions. You can use it to help you track down bookkeeping mistakes and problems without having to wade back through your paper registers.

Payroll report

This report summarizes income and expenses by category, with a separate column for each payee. It is limited to transactions with category or transfer information containing the word Payroll-that is, to transactions categorized with payroll categories and transfers to payroll liability accounts.

The TRANSFERS TO rows show decreases in your accrued payroll liabilities. For example, each time you record a FICA payment in your checking account, Quicken transfers the amount to the Payroll-FICA account, where it decreases the balance you owe.

The TRANSFERS FROM rows show increases in your accrued payroll liabilities. For example, each time you record a paycheck , Quicken transfers the FICA contribution amount from your checking account to the Payroll-FICA account, where it increases the balance you owe. In the same way, the report can track your liability for items like FUTA, SUI, and federal withholding.

Profit and Loss reports

A profit and loss statement, also called an income statement, is a fundamental business report. Along with the balance sheet, the profit and loss statement helps gauge the profitability of your business. The profit and loss statement shows your income, expenses, and net profit or loss. It summarizes the revenue and expenses of your business by category (first income, then expenses). You generally need to provide one to your loan officer when requesting a loan.

In Quicken, you can create two profit and loss reports, a profit and loss statement and a profit and loss comparison report; the latter compares profits and losses for two different time periods.

Quicken automatically sets to cash basis every business report that can be set to accrual or cash basis. To change this setting to accrual basis, click Customize. Then click the Advanced tab and select Accrual as the report basis. (If you run your business using accrual-basis bookkeeping, you want your income to show up when you issue invoices. This report option includes income for which you've invoiced, as well as income that you've received.)

Project/Job reports

If you take advantage of the project/job tracking capability in Quicken, these reports show your income and expenses for each class (job, client, department, property, and so on) or project.

In a project/job report, you can limit the report to only the transactions that have been assigned a specific class. Click Customize, and, on the Display tab, select Month. (If you want to add a column showing how much the individual income and expense amounts contribute to total income, select Amount as % under Show as well.) Then click the Classes tab, click Clear all, select the classes you want to include in the list, and click OK. Quicken displays all the transactions to which you assigned that class, even if they have different subclasses.

Schedule C report

This report shows Schedule C transactions subtotaled by tax line item. You should enter Schedule C information if you operated a business or practiced a profession as a sole proprietorship during the year, if you had more than one business, or if you and your spouse had separate businesses. In these cases, the IRS requires you to complete separate Schedule C forms for each business when you file your tax returns. You can export this report to tax preparation software.

Quicken automatically sets to cash basis every business report that can be set to accrual or cash basis. To verify that you are reporting on a cash basis, click Customize, click the Advanced tab, and, in the Report Basis area, select Cash.

Tax Schedule report

This report lists the exact figures you need to fill in on your 1040 tax form and most schedules (with the qualifications listed below). If you plan to export tax information to tax software, the tax schedule report is the report to use.

Be sure to:

Check the figures in the tax schedule report against any limits defined by the IRS, for example, the maximum deduction allowed for IRA contributions. The Quicken tax schedule report gives you your business totals, not the IRS limits.

Record all relevant transactions in Quicken.

Keep in mind that the tax schedule report does not include capital gains or business income and expenses. For that, you need to run a capital gains report for your Schedule D information, and a Schedule C report to get the figures you need for your business taxes.

For more information about reports,

Business Reports on Mac

While Quicken for Windows and Quicken for Mac have similar business reporting capabilities, there are some key differences in the types of reports that can be generated and the process for generating them.

For more information on Business Reports in Quicken for Mac,