Is Quicken Home & Business right for you?

See both your personal & business finances

Manage your finances together with perfect separation

Generate reports you need for taxes

Get Schedule C & E tax reports, profit & loss, cash flow, balance sheets & more

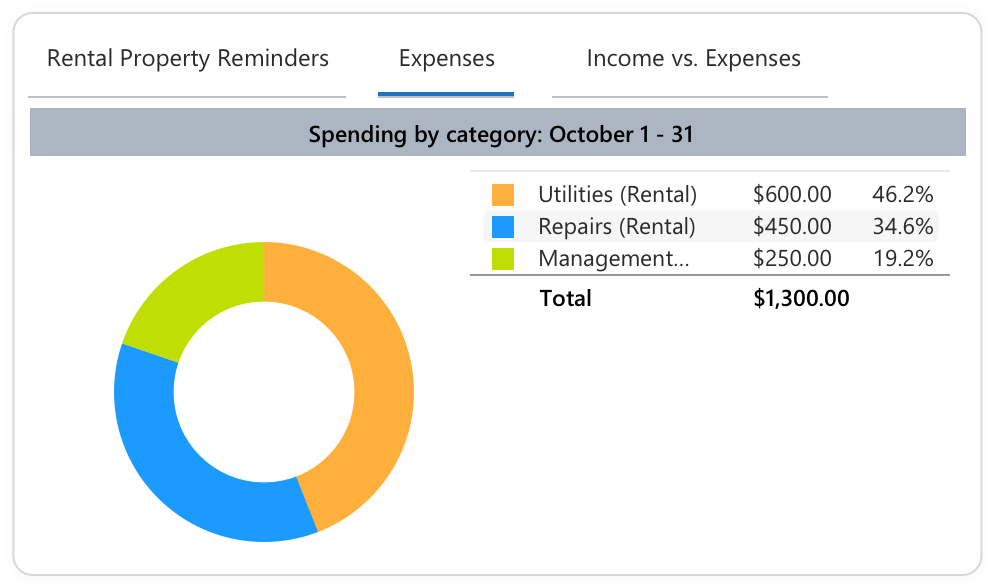

Get custom features for rental properties

Manage tenants, payments, expenses, lease terms, rates, deposits & more

Keep your documents organized

Store business & rental property documents and receipts where you need them

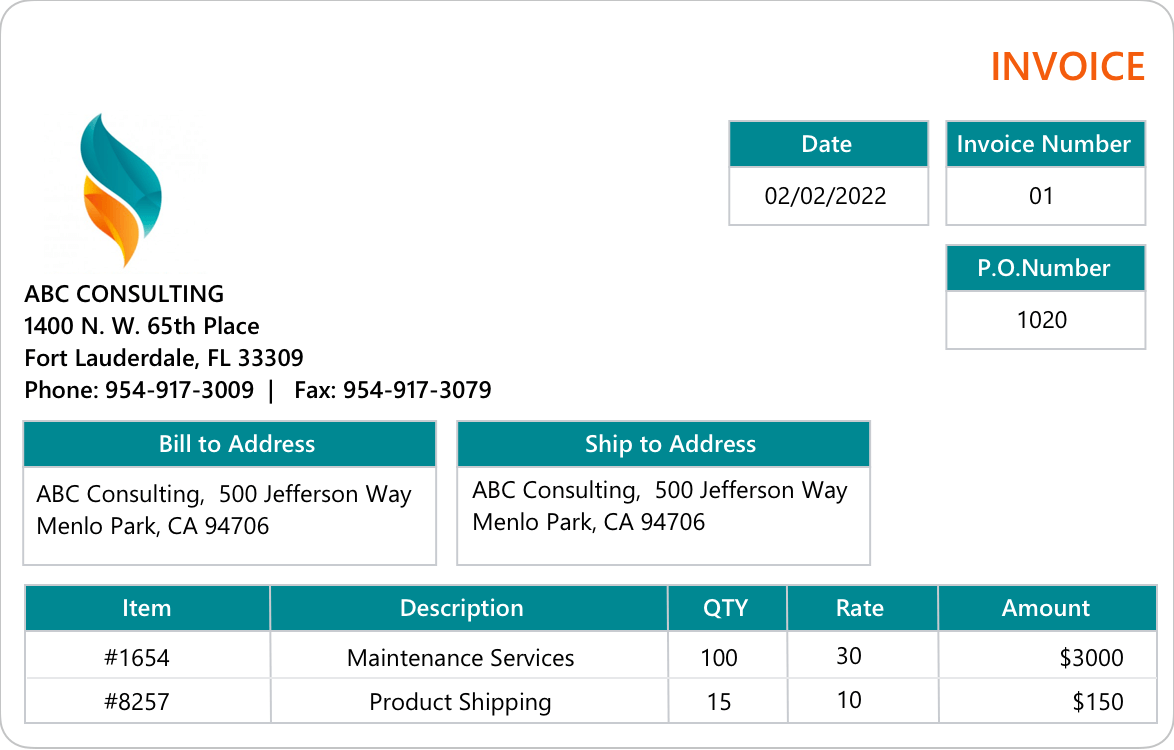

Custom features for your business

Grow your business

Separate personal & business income and expenses, even from the same account. Store images, documents & receipts with their transactions. Customize invoices with your brand & email or print them right from Quicken—include PayPal or your website link for timely payment.

Generate the reports you need for taxes

- Schedule C & E Tax Reports

- Accounts Payable

- Accounts Receivable

- Cash Flow

- Mileage Tracker

- Payroll

- Profit & Loss

- Project & Job List

- Sales Tax Account

- Vendor & Customer Details

- And much more

Manage your rental properties

Manage your rental properties

Track properties, expenses, tenants, lease terms, rental rates, deposits & rent payments in your dedicated Rent Center. Automate rent reminders & generate receipts. Store rental property, tenant documents and receipts right where you need them.

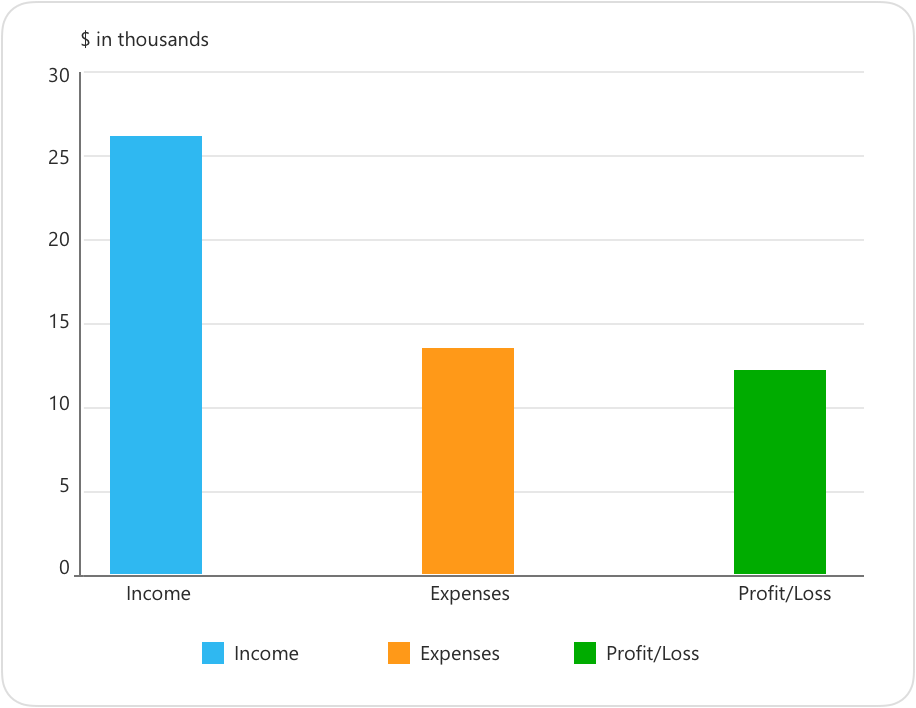

Get a comprehensive picture of your finances

Make better decisions & plan ahead

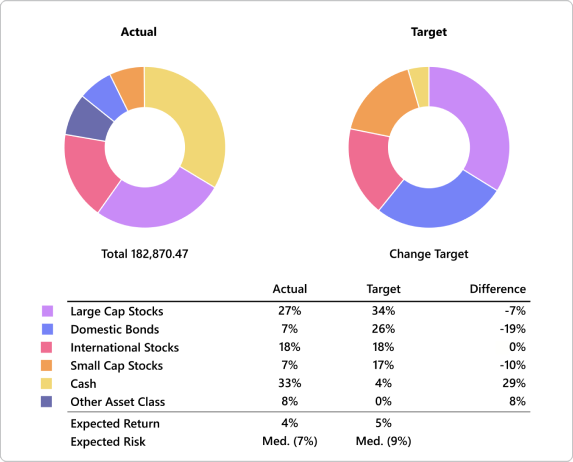

Maximize your investments with the most comprehensive analysis tools on the market

- Watchlists

- Benchmarks

- Target allocations

- Buy/Sell Preview

- Buy/Sell Optimizer

- Morningstar Portfolio X-Ray

- Performance View

- Investing activity reports

- And much more

Run scenarios & compare options

Apply “what-if” tools for both personal & business loans & investments. Pay loans down faster and save on interest. Use calculators to plan for college funds, refinancing, loans, and savings.

Plan for your retirement

Create a detailed roadmap for your retirement with Quicken’s Lifetime Planner. Project scenarios like buying new property, increasing or decreasing revenue streams, and more, to see how your plan changes.

Quicken Home & Business also comes with...

Web & mobile apps

Sync with the Quicken web & mobile apps to manage your money on the go.

Priority access to support

Get help quickly if you need it with free phone and chat support from our dedicated team.

Trusted for 40 years

#1 best-selling with 20+ million customers over four decades.

30-day money-back guarantee

Get a full refund if you cancel for any reason in the first 30 days.*

Safety & security

Quicken protects your data with robust 256-bit encryption.

See what our customers are saying

FAQs

What kinds of investment accounts can Quicken track?

Just about anything. Quicken Home & Business offers the best tools on the market for managing investments and transactions. Use it to monitor all your investments: brokerage, IRA, 401(k), 403(b), 529, and even private holdings.

Can Quicken also track physical assets?

Yes! Track the value of all your tangible assets: your home, property, vehicles, collectibles, and more.

Which tax-schedule reports does Quicken Home & Business support?

- Schedule A (itemized deductions)

- Schedule B (interest & dividends)

- Schedule C (profit & loss - small business)

- Schedule D (capital gains & losses)

- Schedule E (rental property income)

- Report of Foreign Bank and Financial Reports (FBAR)

Can Quicken help me pay down debt?

Definitely. You can use Quicken to manage & pay down debt from your mortgage and car loans to your student loans and other personal liabilities. Our “What-if Tools” let you compare options to pay loans down faster and save on interest.

”Worth its weight in gold — seriously,

worth so much more than I paid

for it. I don’t know what I would

do without Quicken.”

”Worth its weight in gold — seriously, worth so much more than I paid for it. I don’t know what I would do without Quicken.”

Stan

Quicken customer