Streamline. Optimize. Grow.

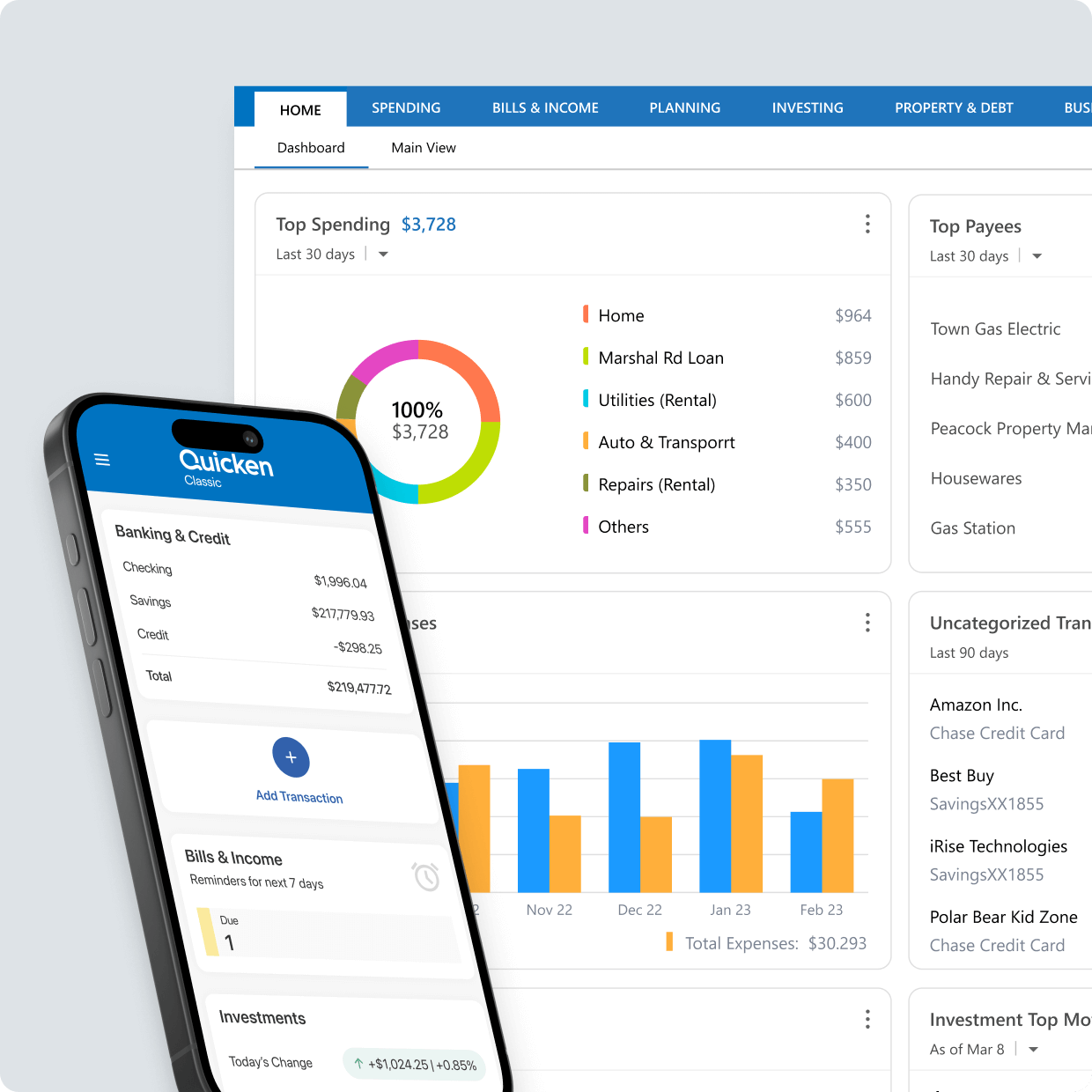

Get everything you need to take control of your business, rental & personal finances.

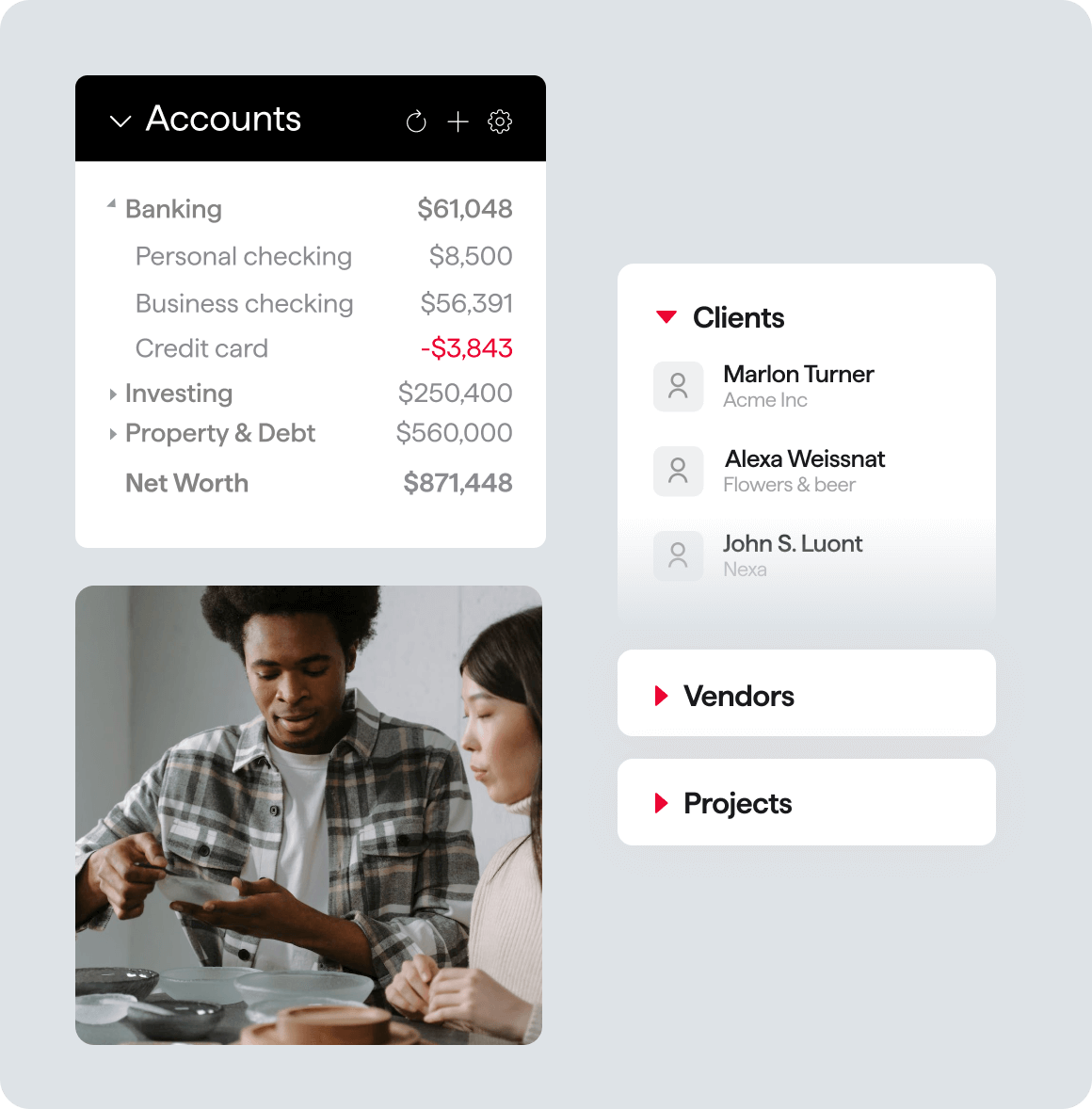

Connected when you want it, separate when you need it. Crystal clear money management for your business and personal finances.

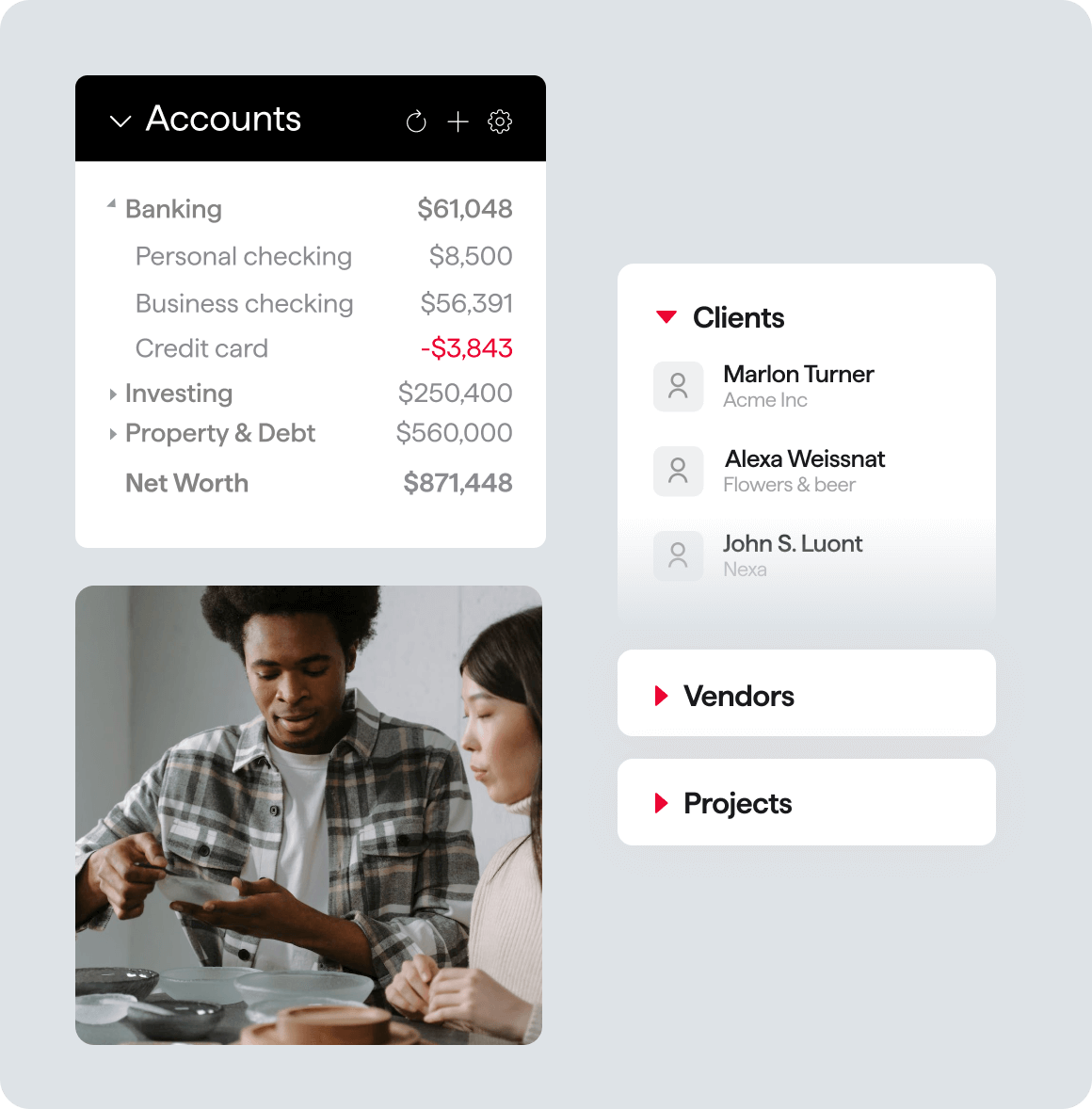

See all your budgets and cash flows. Track payables, receivables, vendors, customers, and more* — and see your complete net worth in one place.

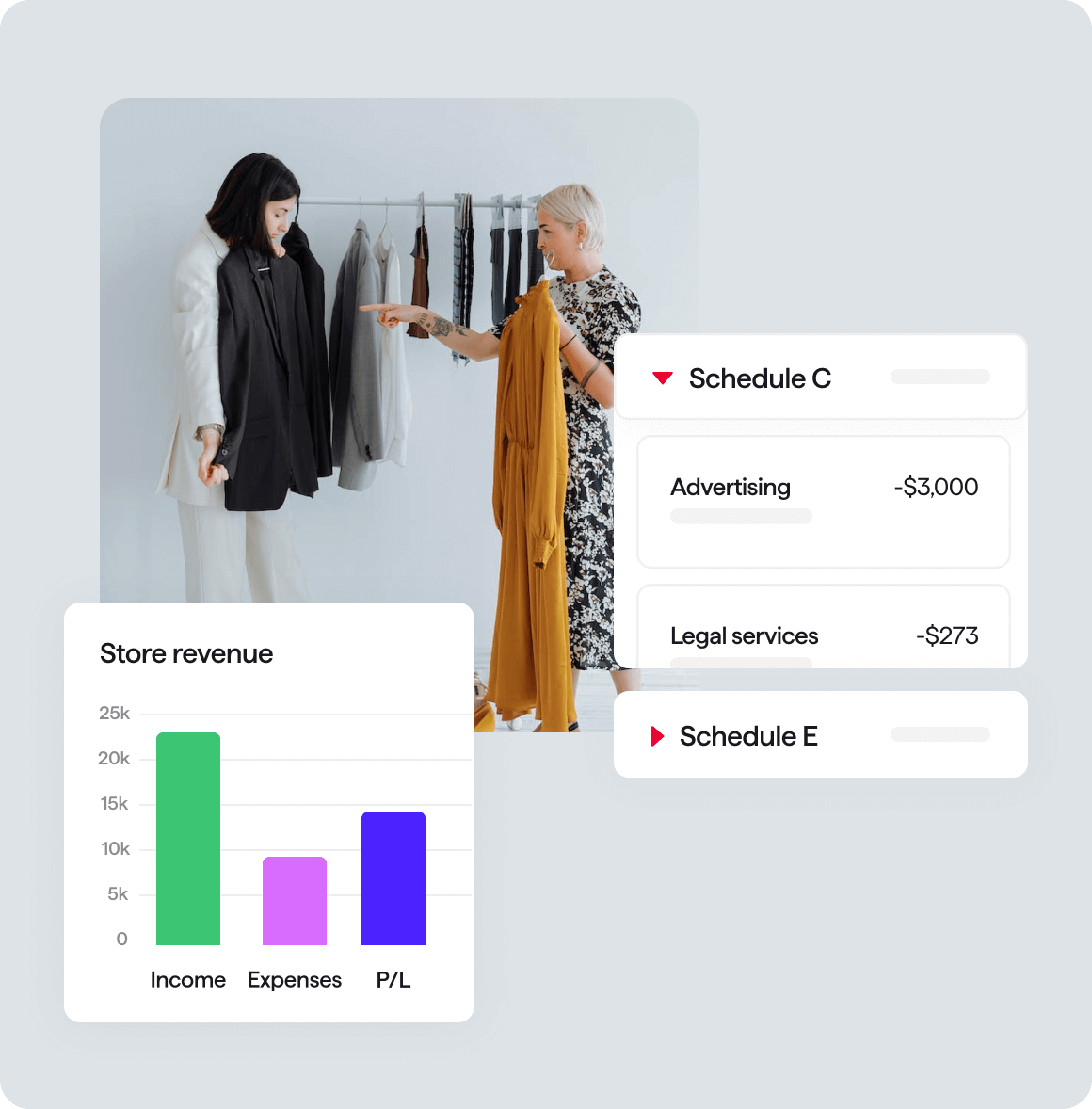

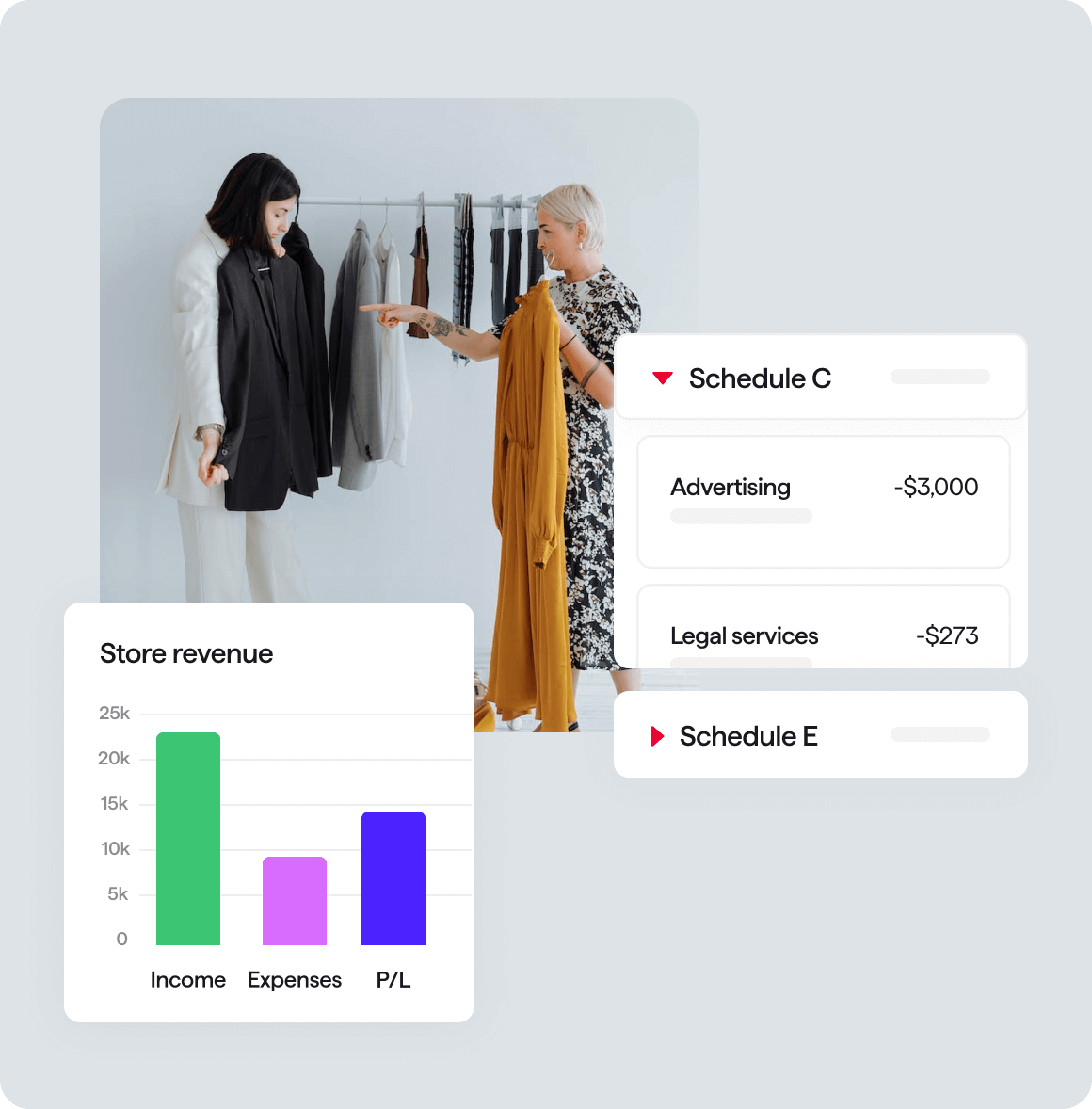

Maximize tax deductions across both business & personal finances. Save time with built-in reports for tax Schedules A through E, and export your data to TurboTax for tax season.

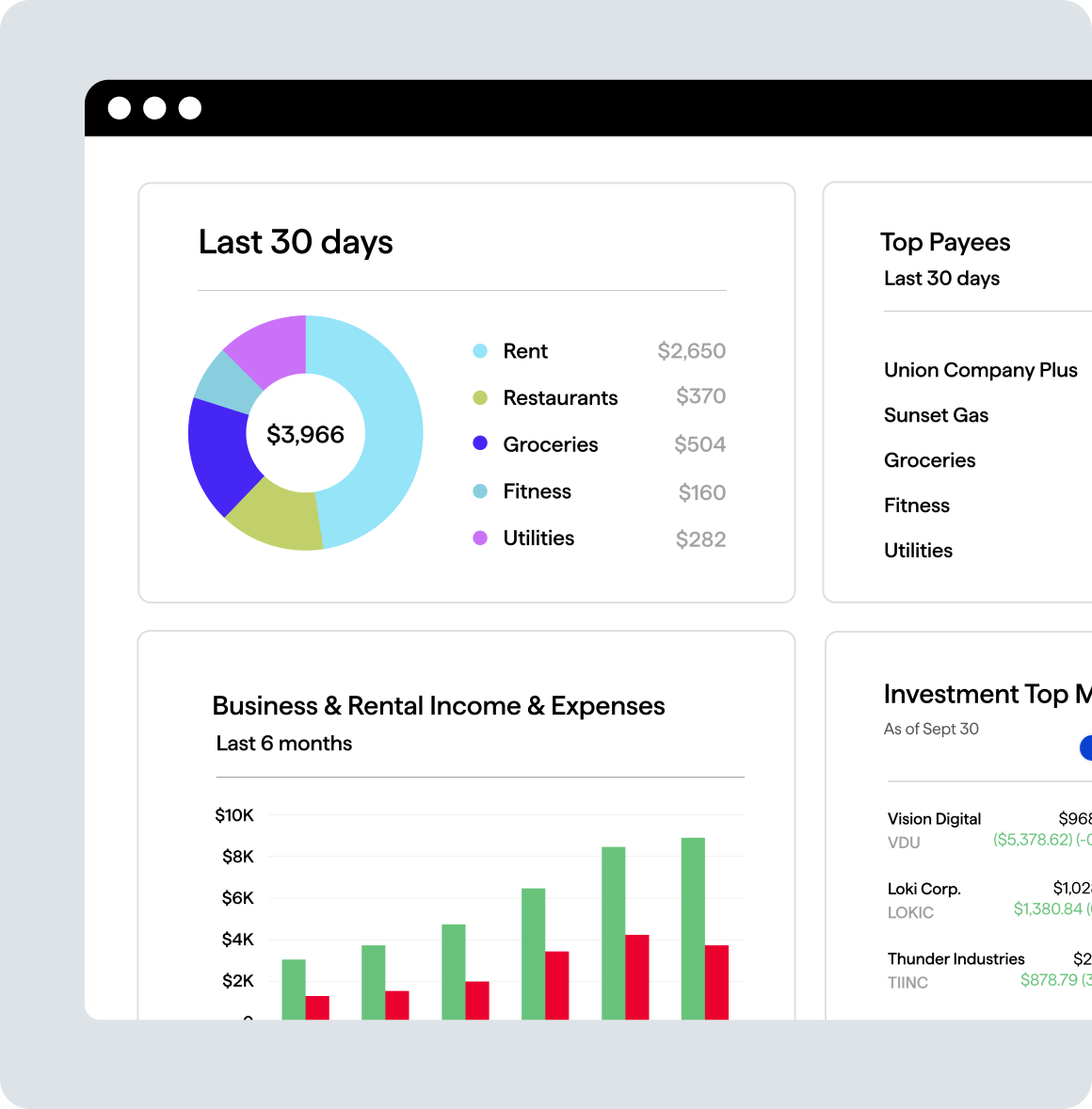

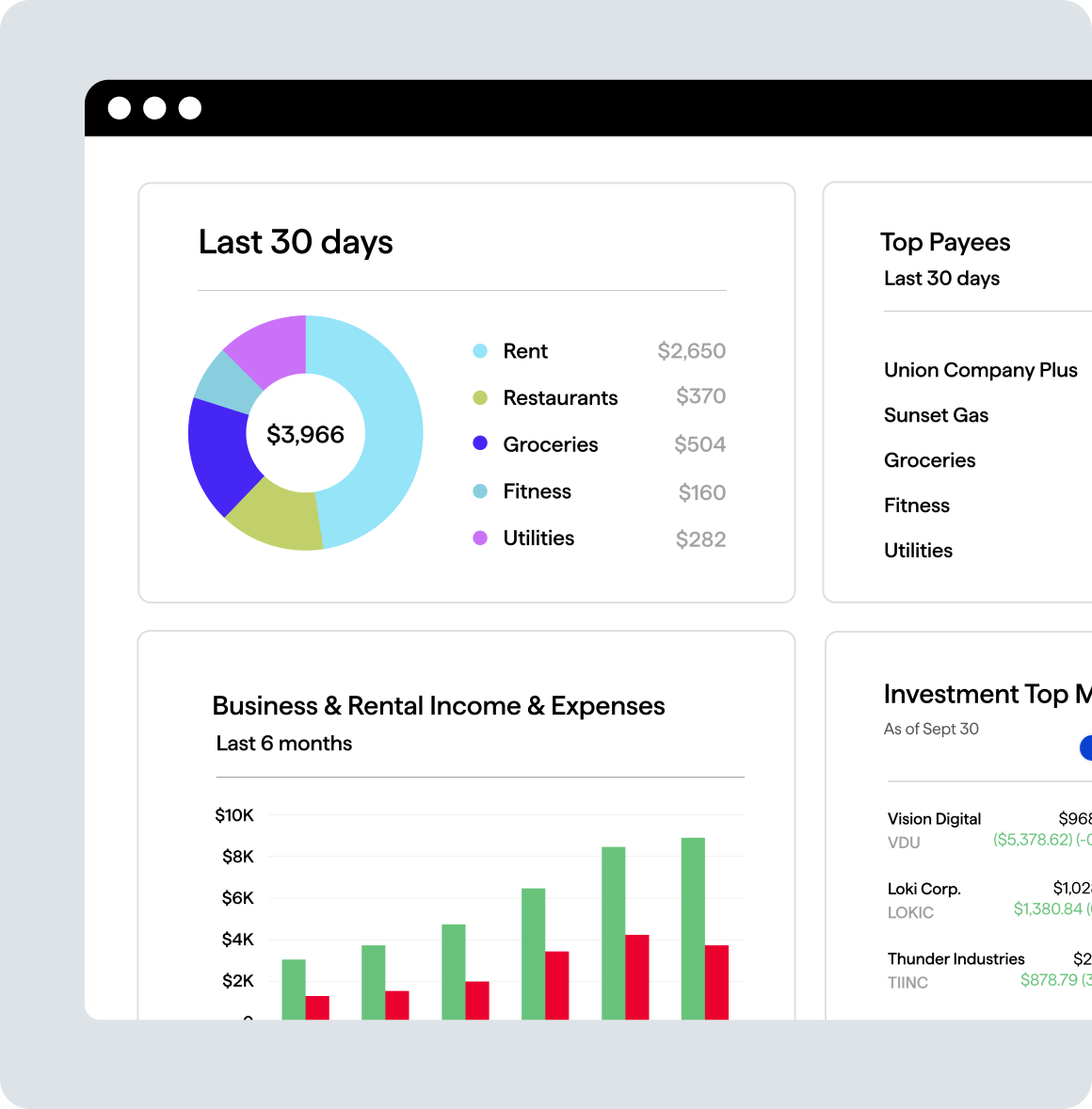

Customize any report to show you any combination of accounts you want to see. Deep dive into your cash flows, profit & loss, investments, debt, asset accounts, and more.

Create customized templates with your company’s logo, colors, and messaging, and send invoices with a click. Get paid faster with PayPal payment links — included automatically.*

Property management made easy. Streamline and organize rentals, tenants, documents, occupancy, and more. Get the tools you need to tackle it all.

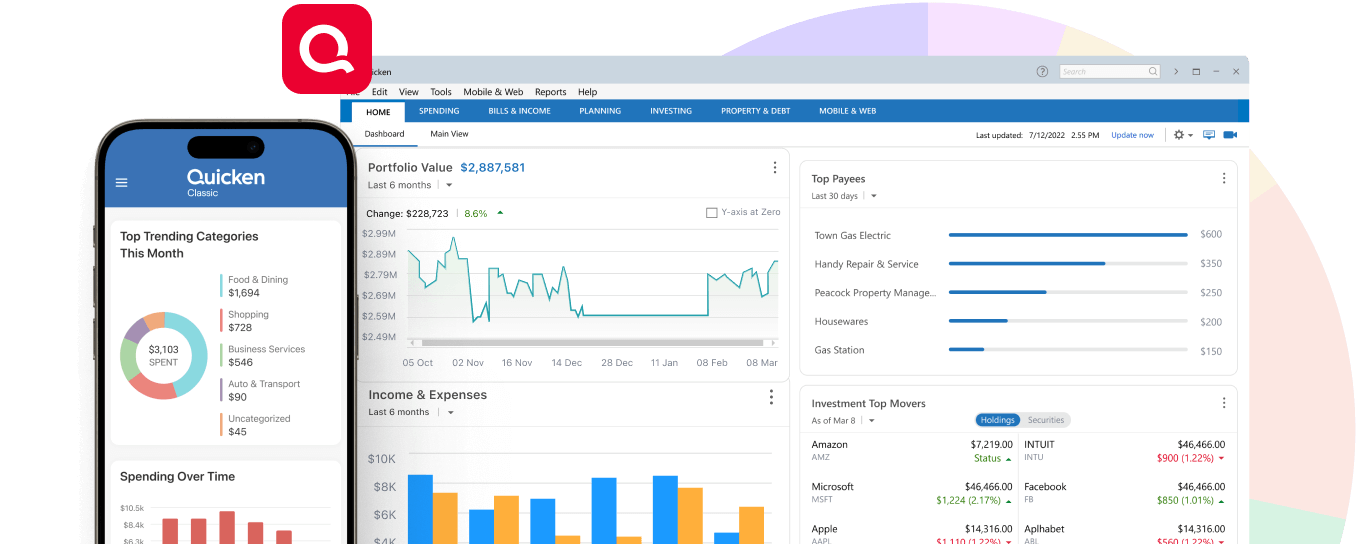

Classic Business & Personal

#1 best-selling with 20+ million customers over 4 decades.

We protect your data with industry-standard 256-bit encryption.

Rest assured, we’ll never sell your personal data.

No hidden fees or annoying ads. What you see is what you get.

Business & Personal includes every tool and feature from our entire Classic line, and more — adding features for small business & rentals:

Manage your business & personal finances together, with perfect separation

Get Schedule C & E tax reports, profit & loss, cash flow, balance sheets, and more

Manage tenants, payments, expenses, lease terms, rates, deposits, and more*

Store business & rental property documents and receipts where you need them*

Yes, even if income or expenses are from the same account, Business & Personal tracks them separately. But you can still see everything together when you want to.

Just like Premier, you can see all your debt in one place — from your personal mortgage to your business loans — and manage it all with our debt reduction planner. “What-if” tools let you compare options to see your best plan, whether that’s paying off small balances first or attacking high-interest loans.

Use the Lifetime Planner* to see how choices you make can impact your retirement — 401(k) and savings contributions, your retirement age, or even buying a new home. Plus, get a comprehensive view of your entire investment portfolio across all your business and personal accounts. Like Premier, Business & Personal lets you evaluate individual holdings in ETFs and mutual funds with Morningstar's® Portfolio X-ray® tool*; manage your allocations, even across multiple accounts and financial institutions; preview buy-sell tax implications; and much more. And, of course, you can use it to manage your rental properties, personal LLC or corporation, family trust, or any other business entity.

Like Premier, Business & Personal scans your transactions to create a budget based on your actual income and expenses, then lets you tailor it to your lifestyle and priorities. Manage your personal budgets, business budgets, rental budgets (even by property), and more.