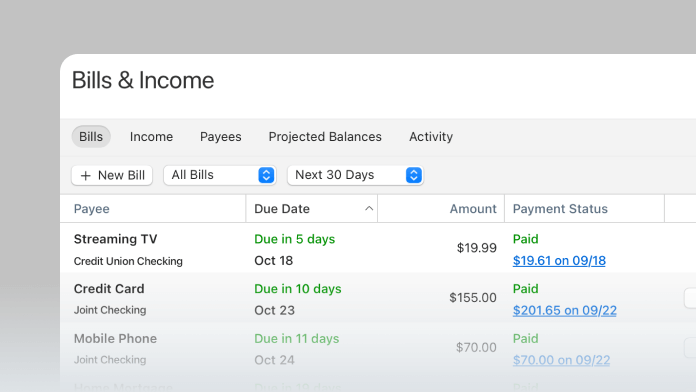

Pay your bills in Quicken

Make your payments online, or let Quicken print and mail checks for you — to any address in the US.*

*Enjoy 12 electronic payments & 5 check payments each month.

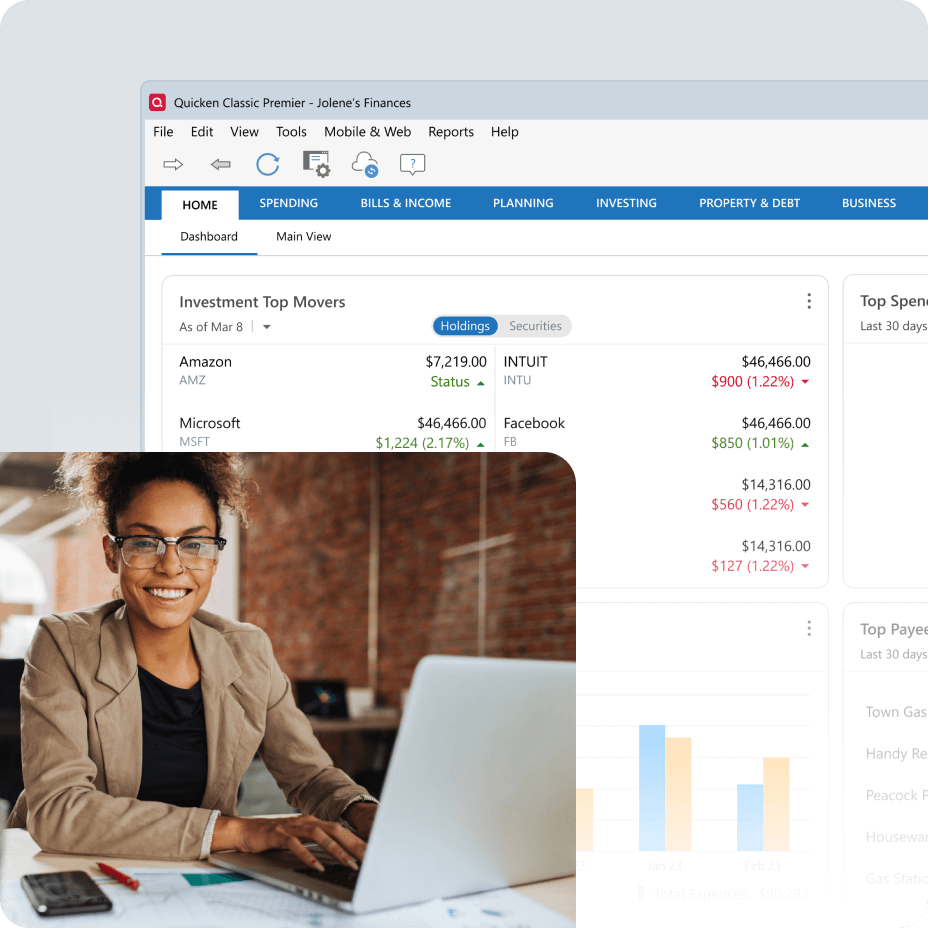

Built for hands-on, data-driven decision-makers, Classic Premier helps you plan every move.

Upgrade to Premier and enjoy everything in Classic Deluxe for Mac, plus.

Make your payments online, or let Quicken print and mail checks for you — to any address in the US.*

*Enjoy 12 electronic payments & 5 check payments each month.

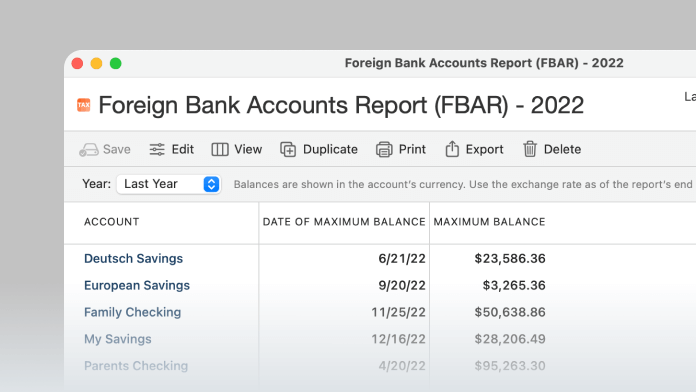

Get your Foreign Bank and Financial Accounts report every year with a click.

Want help by phone from a live agent? Jump to the front of the line with Classic Premier for Mac.

Classic Premier

#1 best-selling with 20+ million customers over 4 decades.

We protect your data with industry-standard 256-bit encryption.

Rest assured, we’ll never sell your personal data.

No hidden fees or annoying ads. What you see is what you get.

Premier includes everything that comes with Deluxe — and more. It’s best for serious investors who want to make the most of every investment dollar.

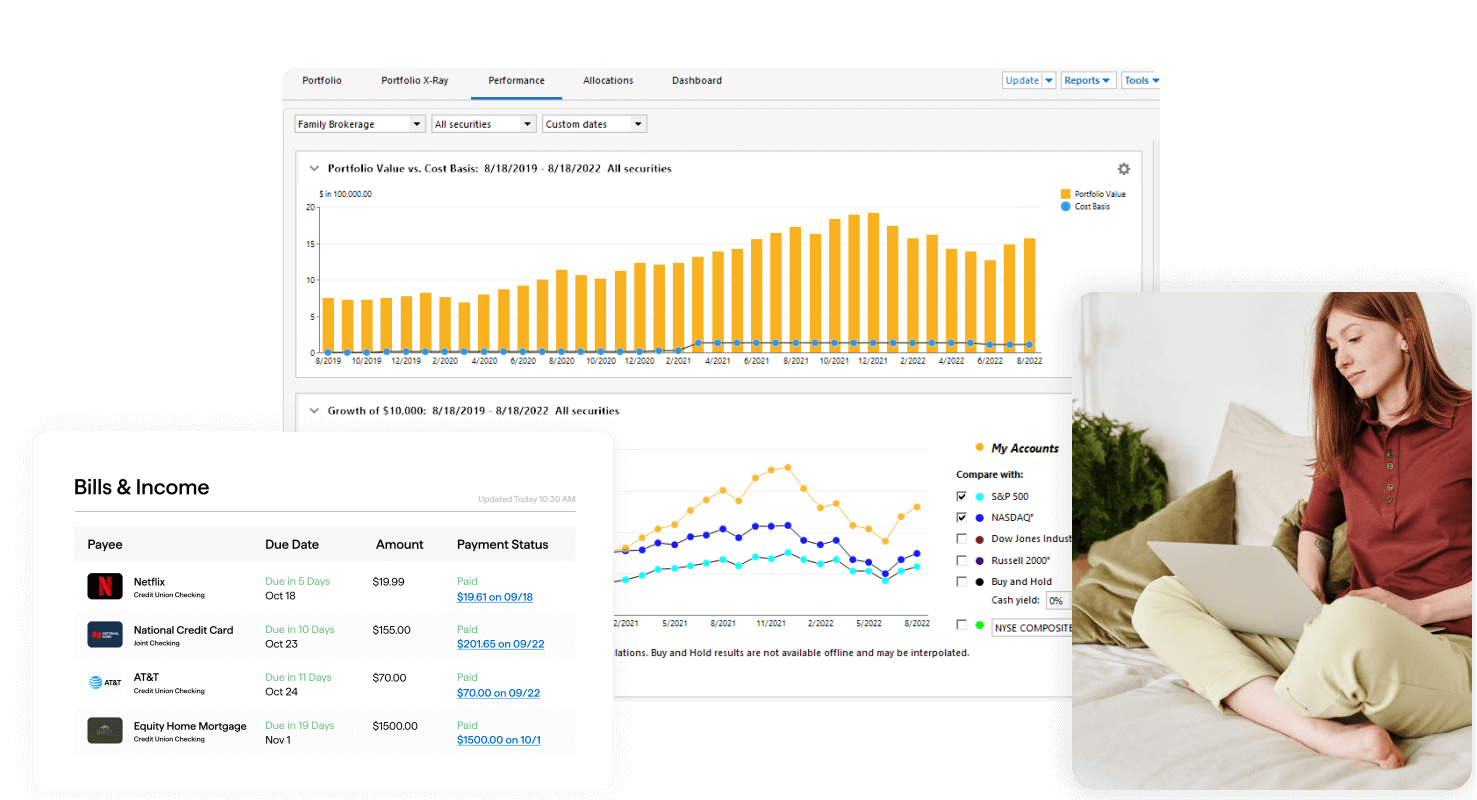

Get our most robust investment tools & optimize your portfolio

Make tax prep easy & maximize deductions with built-in reports

Pay your upcoming bills directly in Quicken

Premier focuses only on personal finances, not business or rental properties

Manage your debt in one place — credit cards, car loans, student loans, personal loans, mortgages, and more — and pay it all down with our debt reduction planner. “What-if” tools let you compare options and see your best plan, whether that’s paying off your smallest balances first or attacking your high-interest loans.

Use the Lifetime Planner to see how choices you make can impact your retirement — 401(k) and savings contributions, your retirement age, or even buying a new home. Plus, get a comprehensive view of your entire investment portfolio. Premier lets you evaluate individual holdings in ETFs and mutual funds with Morningstar's® Portfolio X-ray® tool; manage your allocations, even across multiple accounts and financial institutions; preview buy-sell tax implications; and much more.

Just like Deluxe, Premier scans your transactions to create a budget based on your actual income and expenses, then lets you tailor it to your lifestyle and priorities.

Premier includes automatic, built-in tax reports that you can pull up with just a few clicks. Or customize them for your unique needs. Then, export your data directly to TurboTax or email it to your accountant.