What’s New in Quicken for Mac 2016

Made for Mac. Easier for You.

The new Quicken 2016 for Mac makes managing your money easier than ever. See your accounts, pay your bills, and spending all in one place. And on the go.

Direct Connect Bill Pay

Quicken Direct Connect Bill Pay is service included with Quicken that allows you to pay your bills and send money from your checking/saving accounts. For many financial institutions, you can use this service to transfer funds within the same financial institution. Over 400 financial institutions in the United States support this service.

With this service, you can:

- Create payment transactions before the pay date, so that you do not miss the due date.

- Pay your bills from any Bill Pay enabled account in Quicken.

- Pay merchants, small businesses, friends or any individual at any time.

- Transfer funds to and from your accounts within the same financial institution.

Learn more about getting started with Direct Connect Bill Pay

Free Mobile App

The Quicken mobile app syncs data from your computer to your iPhone, iPad or Android device. Check your personal finances and budget on the go. Take a picture of your receipts to track key purchases.

If you didn’t already opt-in to mobile sync during setup, just go to Quicken > Preferences…, click on the Mobile & Alerts tab and switch the big button to ON. Your checking, savings, credit card and cash accounts will be synced and available for viewing on the Quicken mobile app.

Visit the Apple App Store on your iOS device or Google Play Store on your Android device to download the Quicken app. Just sign in with the Intuit ID you used to setup this data file.

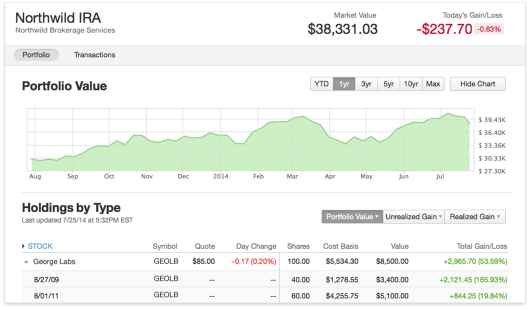

Robust Investing

Quicken 2016 allows you to track your investing transactions. Connect and download transactions or enter them manually to see how your investments are performing. We continuously update quotes to keep your portfolio value current. We support lot-level cost basis tracking, report on realized and unrealized gains, capital gains, and more.

Learn more about Quicken’s investing features.

Easy to use Registers

You’ll discover that the registers are flexible and easy to use.

- Add or remove the columns see the information you want.

- Drag columns left and right and position them where they work best for you.

- Drag and Drop to reorder transactions on the same day.

- IMproved matching of transactions you entered manually with ones you downloaded from your bank or credit card is easy: Just drag and drop one over the other. Quicken 2016 bundles them together.

- Extensive undo capabilities so you can easily correct mistakes.

Learn more about using the registers

Sidebar and Multi-account Registers

The sidebar and global registers make it easy to get a comprehensive view of your finances. The multi-account registers let you review and work with transactions across all your accounts at once. Or drill down to work with accounts of a specific type (all Credit Card accounts, all Brokerage accounts, etc.

Take a tour of the sidebar and register changes

More financial institutions

Using new technology, Quicken 2016 lets you download transactions from over 13,000 different financial institutions, up from about 4,000 in previous versions of Quicken. You can now pay bills using Direct Connect Bill Pay from over 400 financial institutions.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.