What Does COVID-19 Mean For Our Personal Finances?

The COVID-19 pandemic has caused global disruption and brought an unprecedented level of uncertainty to daily life. Beyond health concerns, the short- and long-term impact on people’s personal finances is another major concern. With many businesses completely closed and others having to furlough or lay off employees, people across the country are finding themselves in difficult financial situations. To better understand the impact of the pandemic on Americans’ personal finances, Quicken Inc conducted a survey earlier this month of more than 1,300 adults in the U.S.

What we found is that people are being significantly impacted financially, even if they felt prepared pre-pandemic. Not only are people’s finances taking a hit, there is also a large part of the population pushing off major life milestones such as marriage, having a child or buying a house.

Personal finances are taking a hit

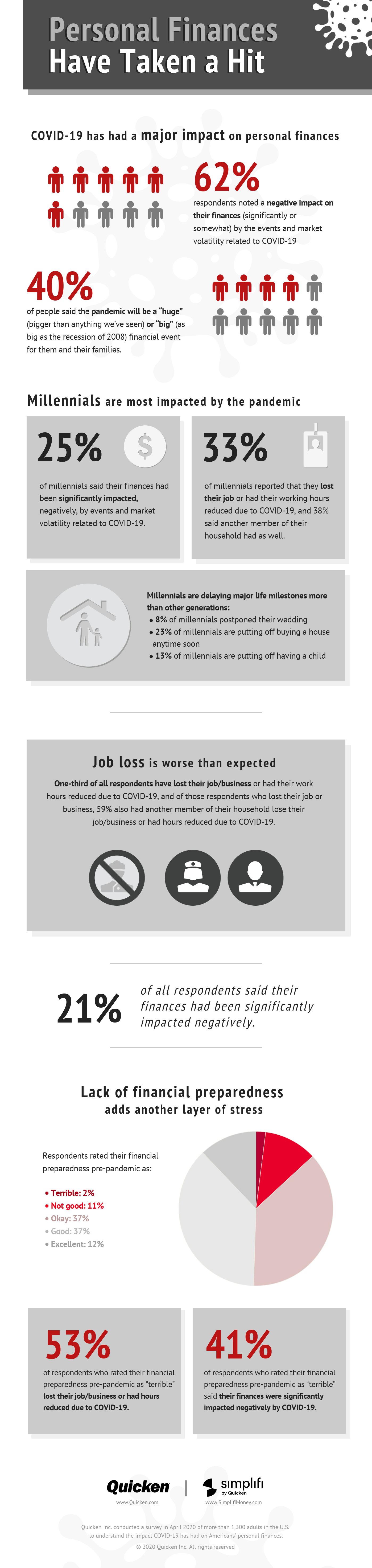

Sixty-two percent of the survey respondents noted a negative impact on their finances (significantly or somewhat) by the events and market volatility related to COVID-19. Of those who said their finances were significantly impacted negatively, most had been confident about their financial preparedness before:

- 31% rated their financial preparedness pre-pandemic as “good,”

- 35% rated it as “okay”

- 15% even rated it as “excellent”

Additionally, 40% of respondents said the pandemic will be a “huge” (bigger than anything we’ve seen before) or a “big” (similar to the recession of 2008) financial event for them and their families. Very few respondents (4%) said there would be no impact for them.

Millennials are most impacted by the pandemic — personal finances, job loss and delaying major life milestones

While the pandemic is affecting most Americans in a major way, millennials are reporting the biggest impact on their finances and delays in major life milestones. The millennial generation struggled ahead of the pandemic to save for retirement and far fewer owned a home than generations before them. The current economic conditions are likely to only exacerbate those trends.

One fourth (25%) of millennial respondents said their finances had been significantly impacted negatively by events and market volatility related to COVID-19, which was the highest percent by generation. And this may be because, after Gen Z, they are the generation experiencing the most job loss. One third (33%) of millennials reported that they lost their job or had their hours at work reduced due to COVID-19, and 38% said another member of their household had as well.

Millennials are also delaying major life milestones more than other generations because of COVID-19, including:

- 8% of millennials postponed their wedding

- 23% of millennials are putting off buying a house anytime soon

- 13% of millennials are putting off having a child

Lack of financial preparedness adds another layer of stress

We asked respondents to rate their financial preparedness pre-pandemic. Only 13% indicated they weren’t in a good position financially:

- Excellent: 12%

- Good: 37%

- Okay: 37%

- Not good: 11%

- Terrible: 2%

Twenty-one percent of all respondents said the negative impact on their finances from events and market volatility related to COVID-19 was significant. For those who noted their financial preparation was “terrible,” it was nearly double (41%). Additionally, more than half (53%) of respondents who rated their pre-pandemic financial preparedness as “terrible” lost their job/business or had hours at work reduced due to COVID-19.

The network effect of job loss

News headlines blast record unemployment numbers, but we discovered there’s also a high percentage of entire households that have been hit by job loss during this time. One third (33%) of all respondents have lost their job/business or had their hours at work reduced due to COVID-19. Further, of those respondents who lost their job or business, nearly 60% also had another member of their household lose their job/business or have hours reduced.

In the same vein, 13% of boomers are putting off retirement because of the pandemic.

And when it comes to the government stimulus package, respondents across the board said they feel it is not enough, but the percentage increased among those who had lost their job. Thirty percent of respondents who lost their job said the stimulus package is not enough and we need much more. Additionally, 30% said they need the government stimulus package but have not received anything or been able to register for benefits.

Jobs and income were recurring themes among respondents’ answers to the question “what advice would you give to yourself pre-pandemic?” Some people noted they would pick up a second job or look for something considered essential. Others noted they would find a better paying job sooner in order to help save money or pay off debts.

Everything has changed

The major change in our daily routine, from bustling work and social lives to quiet days at home, has caused ripple effects into every part of our lives. There has been a change in how we spend our time each day:

- 35% of respondents have shifted to working from home

- 21% are watching their non-adult children and helping with online schooling

- 10% of respondents are caring for elderly parents more than they would have had to otherwise

In addition to changes in routines, people are changing up their living situation during the pandemic:

- 11% of respondents moved back home with their parent

- 7% of respondents had adult child/children move in with them

In terms of spending behaviors during the pandemic, overall people are making a conscious effort to save more where they can. Half (50%) of respondents are making an effort to spend less and save more. Not surprisingly, people are saving the most across categories that no longer apply to their lives, such as daily transportation (26%), entertainment (23%) and food (17%). However, more than a fourth (28%) of respondents have spent a lot more than they typically would stocking up on supplies and food.

We heard from many respondents that “save more and spend less” is what they wish they could advise their pre-pandemic self, with some highlighting they wish they’d planned for an emergency and others noting that a small increase in past savings would make the difference during a time like this.

Methodology: This SurveyMonkey online poll was conducted in April 2020, with a sample of more than 1,300 people, age 18 to 73, in the U.S. Respondents for this survey were selected from the SurveyMonkey audience of 80M+ people.

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.