5 Questions to Ask Before You Prepare a Budget

Sometimes, when people finally decide to take charge of their finances — to stop winging it and prepare a budget — they think of a budget as a restriction, depriving them of the nicer things in life. In reality, it can be liberating to chart a path to financial freedom. Before you start, you need to ask yourself at least five questions.

What Are My Goals?

How and what you budget depends on the short-term and long-term goals you set. Consider where you are in your life and where you want to go. If you have children, providing a college education is one goal. Another could be retiring from the nine-to-five work world before you’re 50 or perhaps buying a second vacation home. Todd Christensen, director of education for Debt Reduction Services Inc. suggests asking, “Why am I budgeting? If you can’t or don’t answer this question, your budget will become an exercise in futility. On the other hand, if you do answer it, you will have established a vision for what you’d like your financial future to be like.” He suggests using that vision as motivation to complete and adhere to your budget.

How Much Do I Need to Save?

Instead of subtracting your expenses from your income and saving whatever is left, take a different approach. Determine how much you need to save and lower your expenses until you reach your monthly savings goal. If that’s not possible, increase your income as well. How much you need to save depends on the size of your family, your lifestyle and future plans. For example, if you are saving for retirement, it’s a good idea to project the expected yield on bonds you own, your stock portfolio performance, any pensions you will receive and Social Security income. Subtract that monthly income from what you project your expenses will be in retirement. If your calculation shows a deficit — your total income does not at least equal your expenses — you will have to adjust your expense budget downward to fund the difference through additional savings.

What Are My Expenses?

To figure this out, look up your bank statements and see what you spend. The better question to ask yourself is how much you should be spending to meet your savings goal. One method is to devote 20 percent of your net income to debt repayment and savings. What’s left is what you have available for expenses. Another method is to review each expense and decide whether it’s necessary or can be reduced or eliminated. For example, your communication costs may include Internet, cell phone, home phone, cable TV including premium movie channels and mobile devices. All of these can be reduced by switching service providers or eliminating a device. For example, if you rarely use the Internet at home, you might cancel the service.

How Can I Include Unexpected Expenses?

Unexpected expenses don’t have to be unplanned expenses. You know that you’ll require auto maintenance, for example — you just don’t know when you’ll need it. Budget for it based on the age and make of your auto. Compare the age of your appliances to the average expected life span. If your refrigerator is six years old and the average life span is 10 years, start saving for a new refrigerator by putting away $25 a month for the next four years.

How Will I Stay on Track?

Setting up a budget is only the first step. Sticking to the budget is even more important. Motivate yourself by thinking about the vision you set for your financial future. When you’re tempted to splurge, resist the urge by imagining yourself on that vacation you’re saving for. Grant A. Webster, certified financial planner with AKT Wealth Advisors advises, “Always ask yourself how you will be able to best stay on track once your budget is prepared. You need to hold yourself accountable when you begin to veer off into bad spending habits. If you begin to start spending too much on discretionary items, for example, you need to balance out your mistake by spending less within another bucket of your budget. Think of your budget as a see-saw; once one side comes up, the other side must come down.”

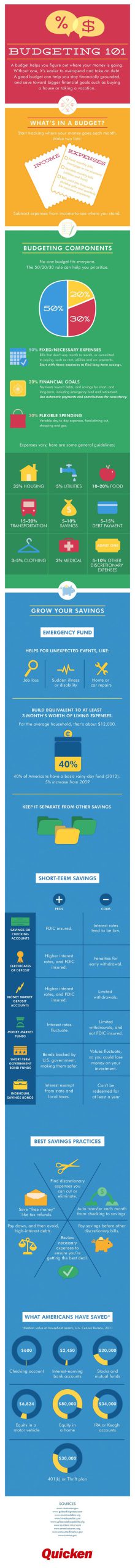

Click image to see full infographic

Quicken has made the material on this blog available for informational purposes only. Use of this website constitutes agreement to our Terms of Use and Privacy Policy. Quicken does not offer advisory or brokerage services, does not recommend the purchase or sale of any particular securities or other investments, and does not offer tax advice. For any such advice, please consult a professional.