Quicken Starter

Best for organizing your simple personal finances

$4.49

/mon$Billed annually

Organize your basic finances

Connect your checking, savings, and credit cards in one place

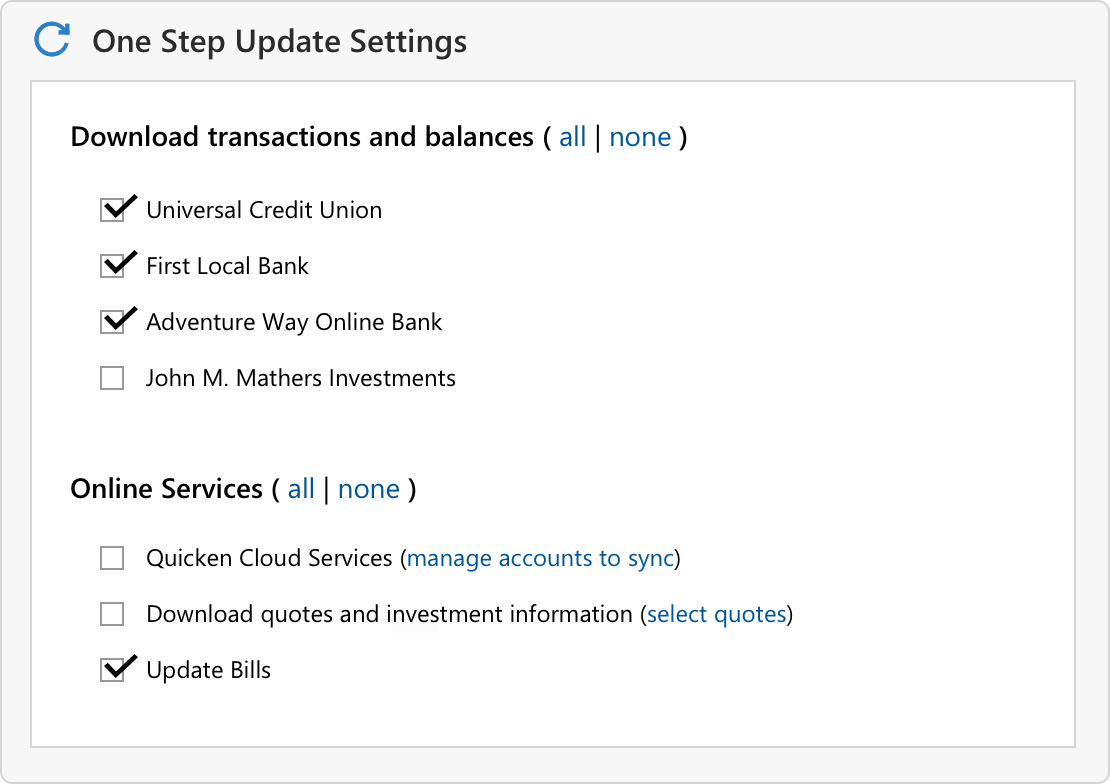

Stay up to date

Quicken downloads and categorizes your transactions automatically

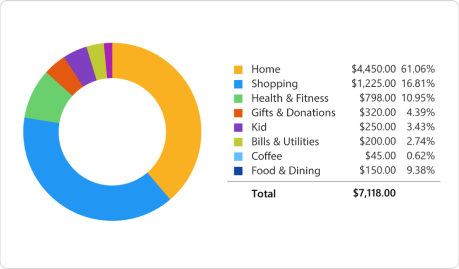

Easily track your spending

Create a simple monthly budget and see where your money is going

Grow your savings

Make sure you’re saving what you want to

Quicken Starter helps you organize your essential banking information. See all your income and spending in one convenient dashboard.

Quicken downloads your latest financial transactions with just one click and automatically categorizes your spending, so you can see where your money is going.

See your spending trends so you can make smart adjustments. Track all your bills in one place — stop wasting money on late fees. Create a simple monthly budget based on your income & expenses.

Include what you want to save in your budget and watch your savings grow over time.

Want to see your finances your way? Create fully customizable views & reports and even add your own tags to track anything you want to, across all your categories and accounts.

If you want to track loans or investments, including your RRSP, and create a budget that spans the whole year, Quicken Deluxe lets you add these and more.

Web & mobile apps

Sync with the Quicken web & mobile apps to manage your money on the go.

Free phone and chat support

Get help if you need it from our dedicated support team.

Trusted for 40 years

#1 best-selling with 20+ million customers over four decades.

30-day money-back guarantee

Get a full refund if you cancel for any reason in the first 30 days.*

Safety & security

Quicken protects your data with robust 256-bit encryption.

Just about anything. Quicken Deluxe and Quicken Home & Business offer the best tools on the market for managing investments and transactions. Use it to monitor all your investments: brokerage, SSRP, RESP, and even private holdings.

Yes! Track the value of all your tangible assets: your home, property, vehicles, collectibles, and more.

Definitely. You can use Quicken to manage & pay down debt from your mortgage and car loans to your student loans and other personal liabilities.