Is Quicken Home & Business right for you?

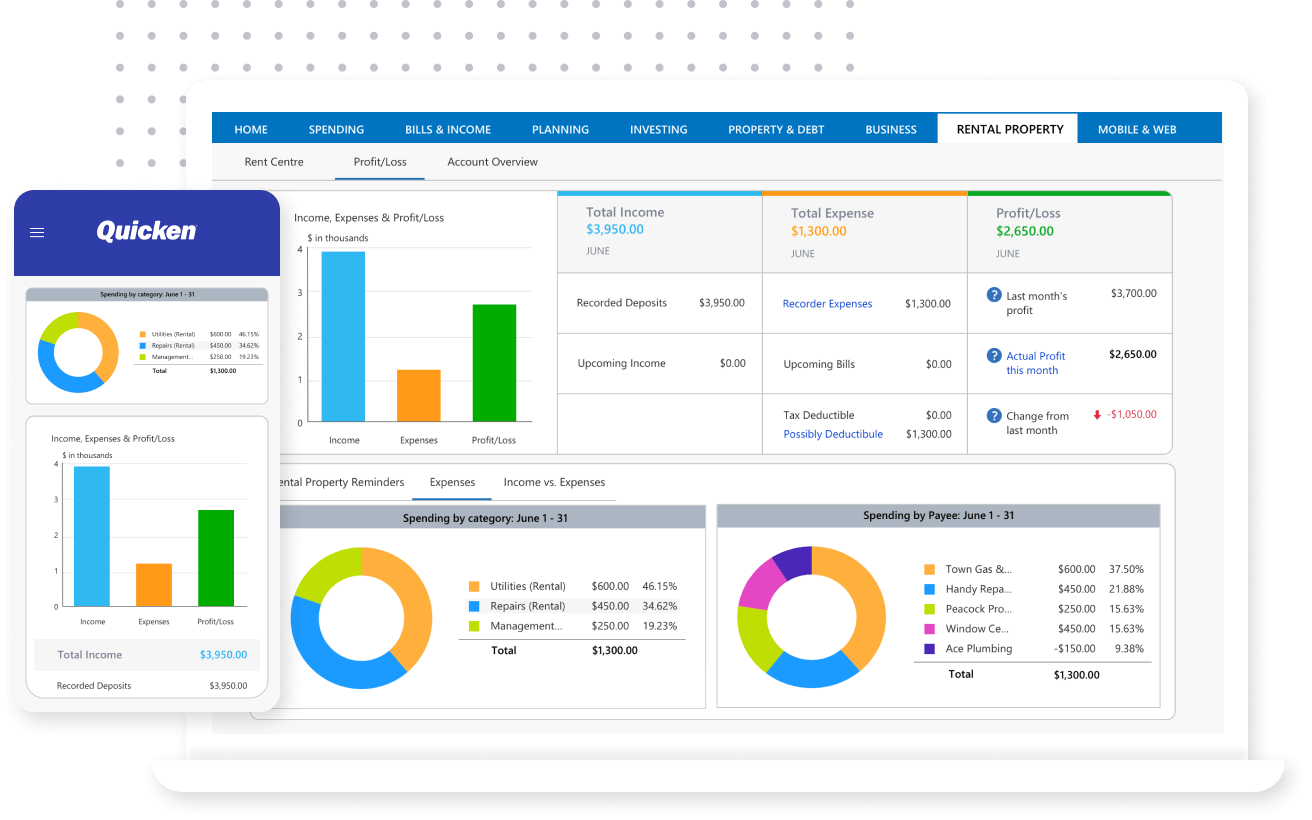

See both your personal & business finances

Manage your finances together with perfect separation

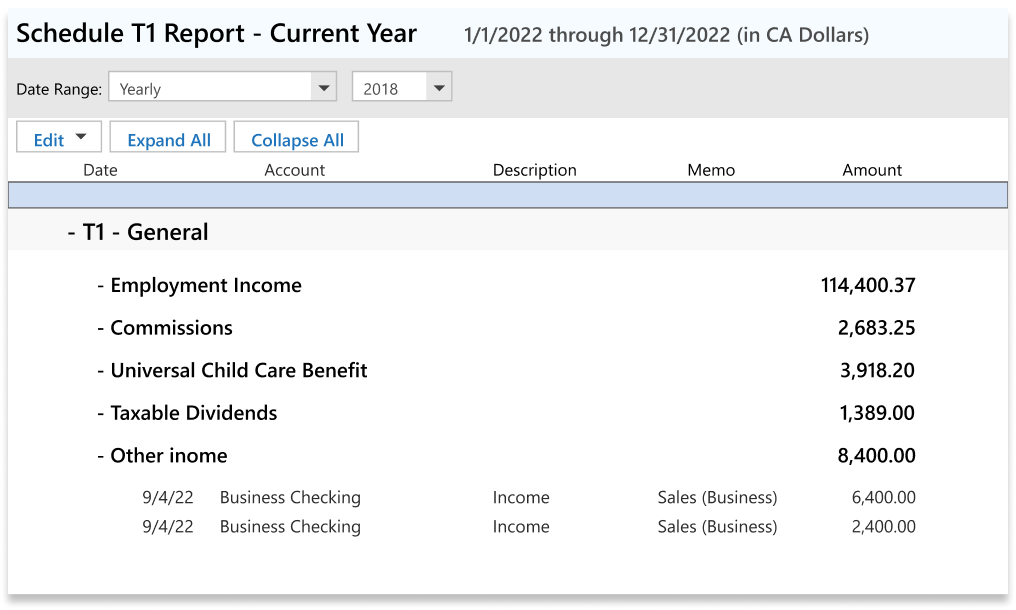

Generate reports you need for taxes

Get T1 tax reports, profit & loss, cash flow, balance sheets & more

Keep your documents organized

Store business & personal documents and receipts where you need them

Custom features for your business

Grow your business

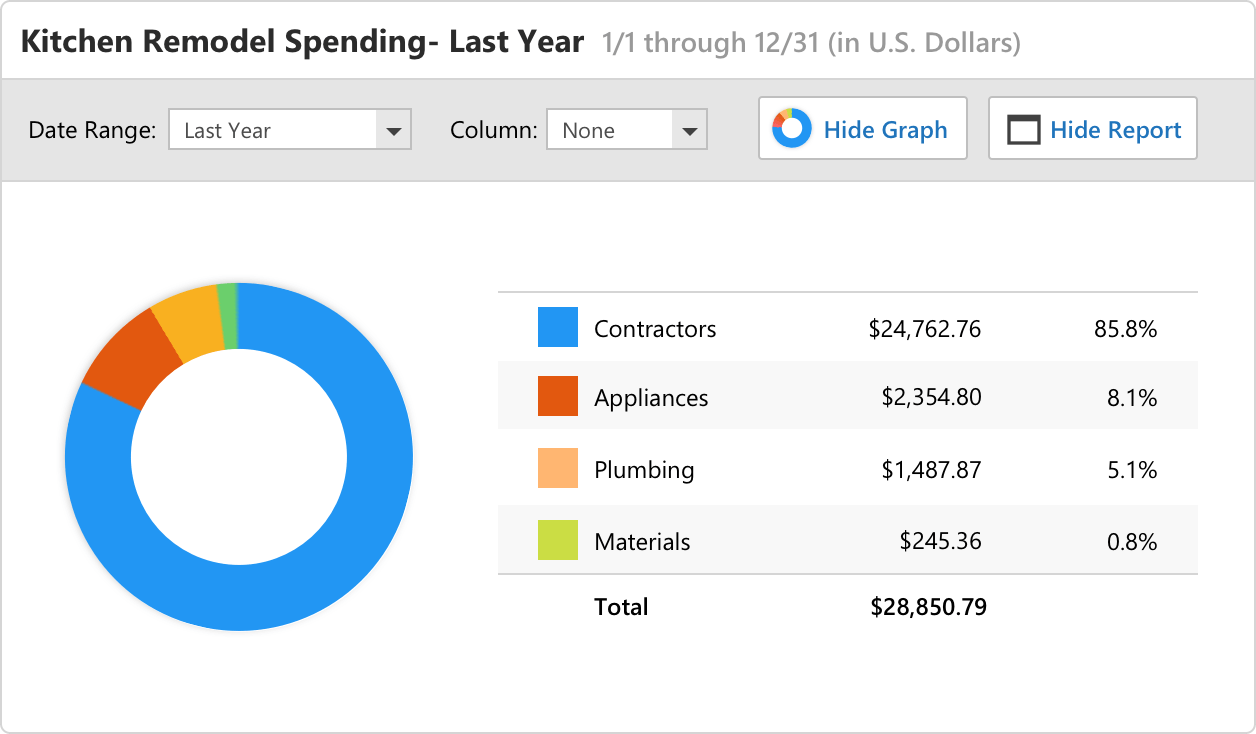

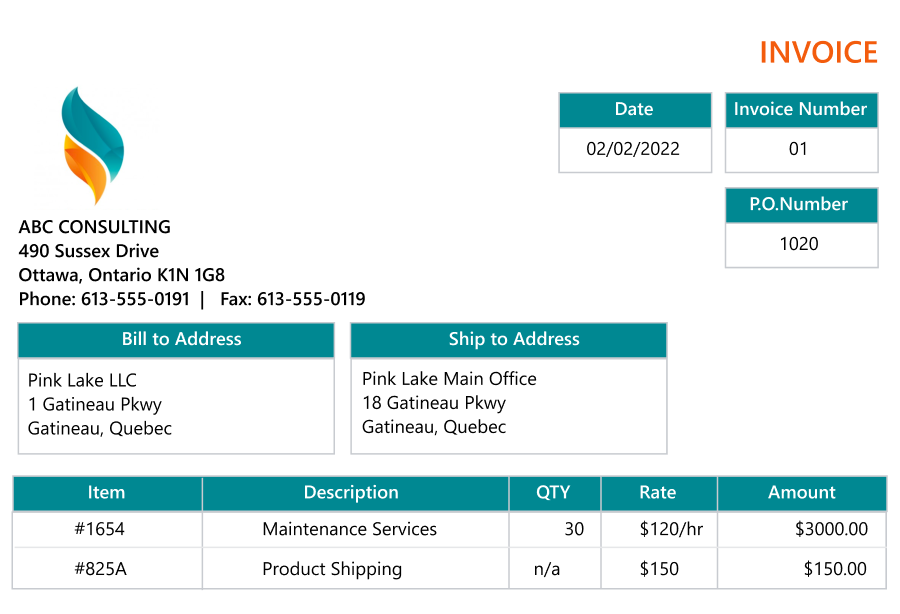

Separate personal & business income and expenses, even from the same account. Store images, documents & receipts with their transactions. Customize invoices with your brand & email or print them right from Quicken—include your website link for timely payment.

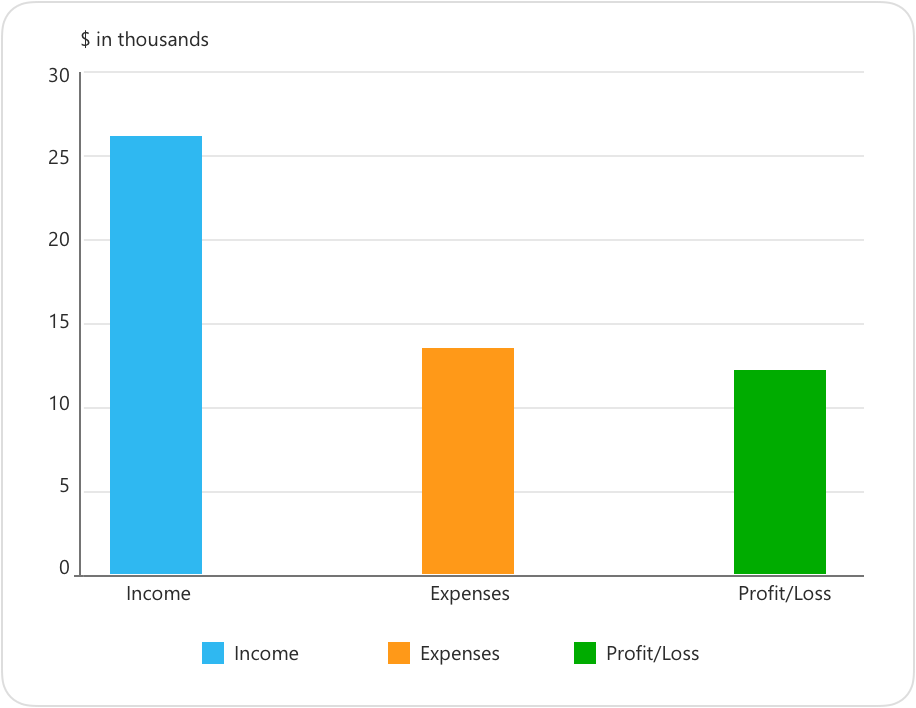

Generate the reports you need for taxes

- T1 Tax Reports

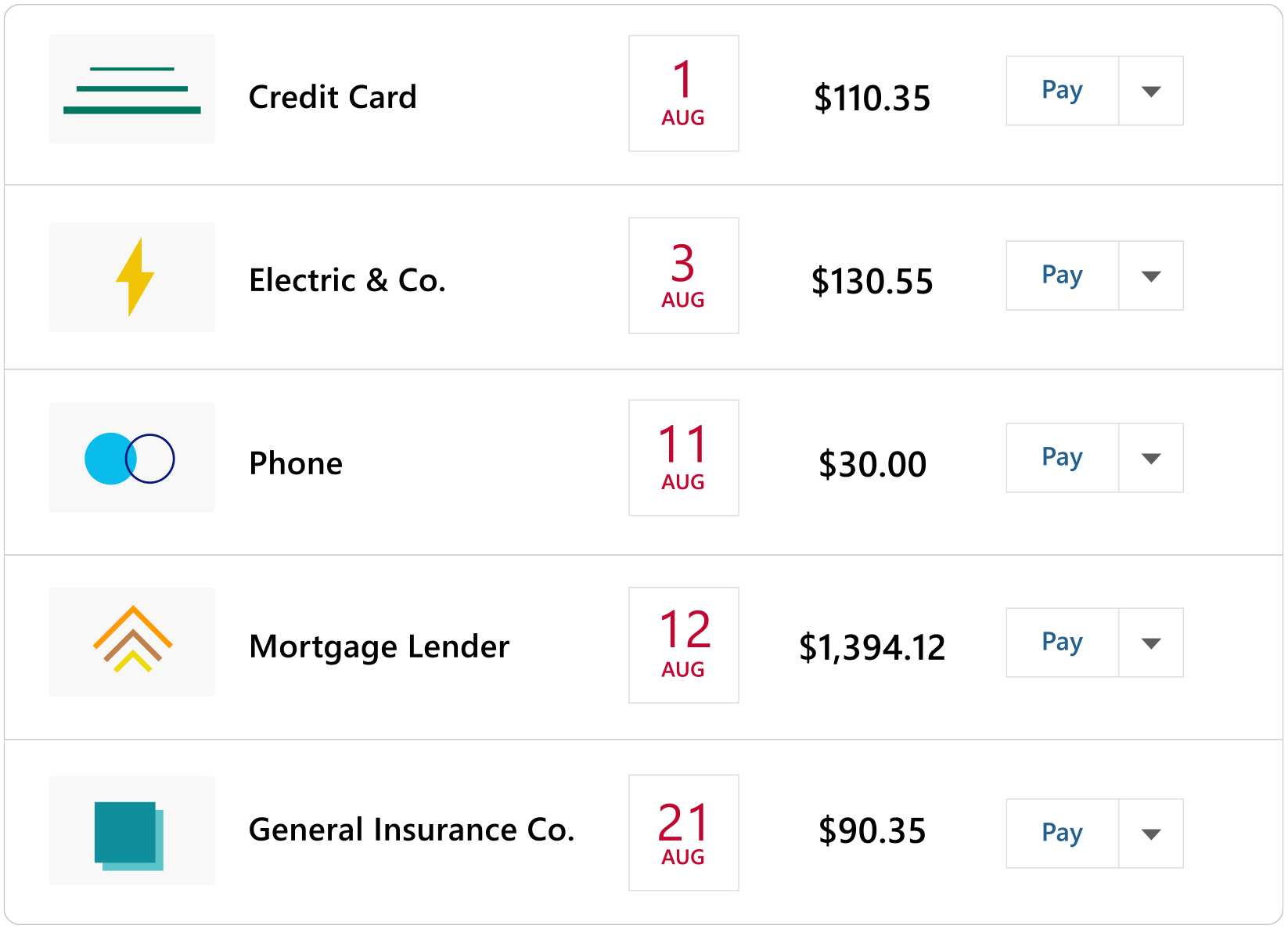

- Accounts Payable

- Accounts Receivable

- Cash Flow

- Mileage Tracker

- Payroll

- Profit & Loss

- Project & Job List

- Sales Tax Account

- Vendor & Customer Details

- And much more

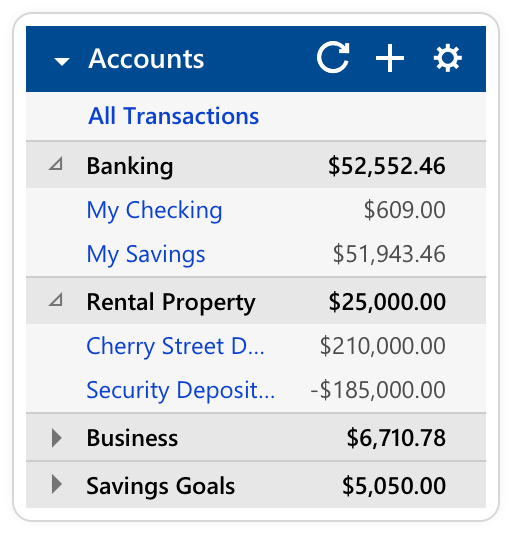

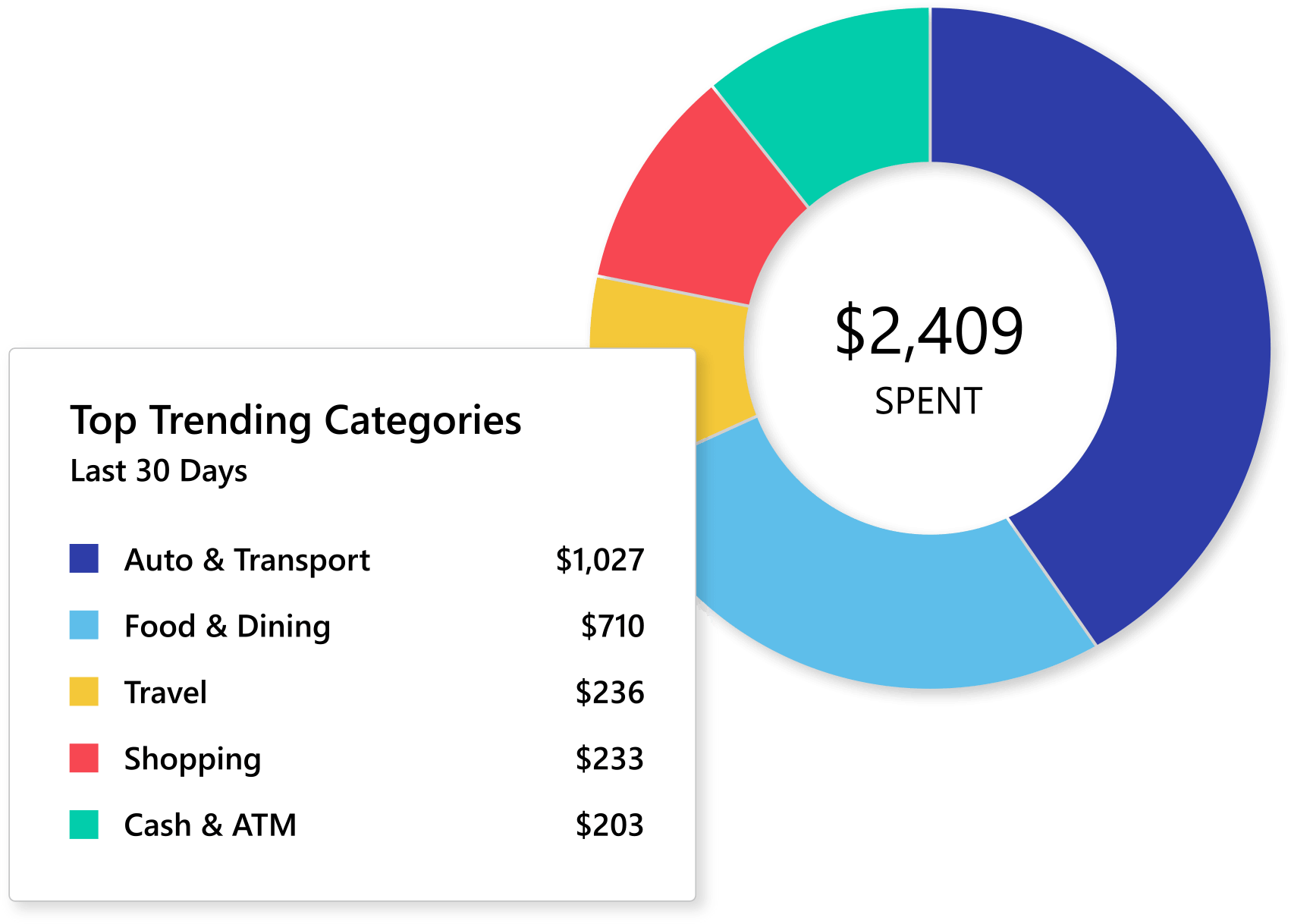

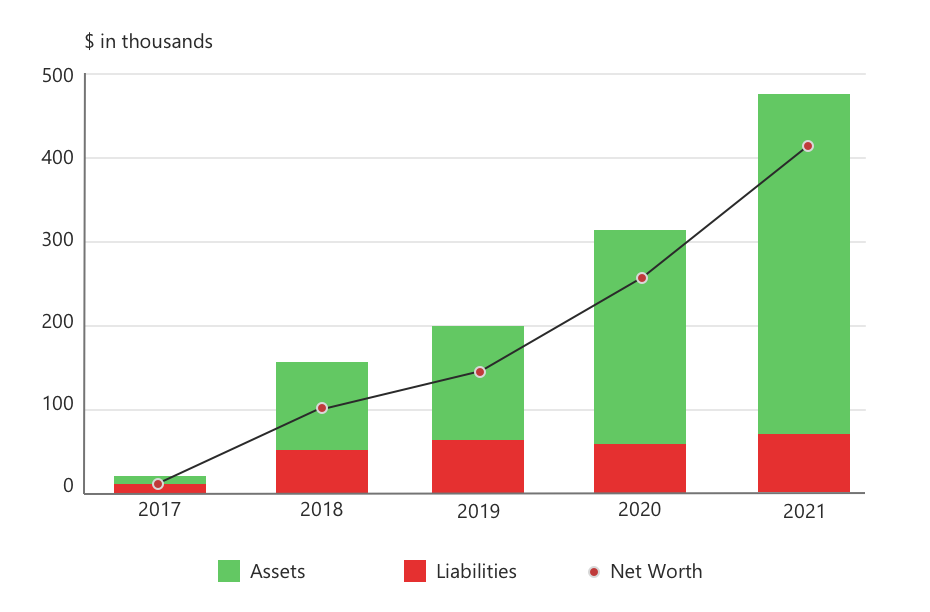

Get a comprehensive picture of your finances

Make better decisions & plan ahead

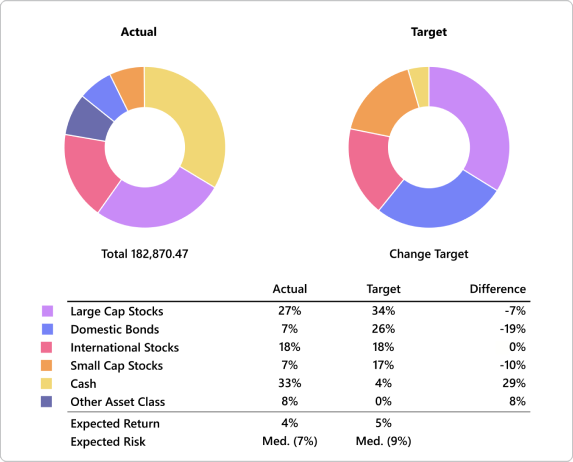

Maximize your investments with the most comprehensive analysis tools on the market

- Watchlists

- Benchmarks

- Target allocations

- Buy/Sell Preview

- Buy/Sell Optimizer

- Investing activity reports

- And much more

Quicken Home & Business also comes with...

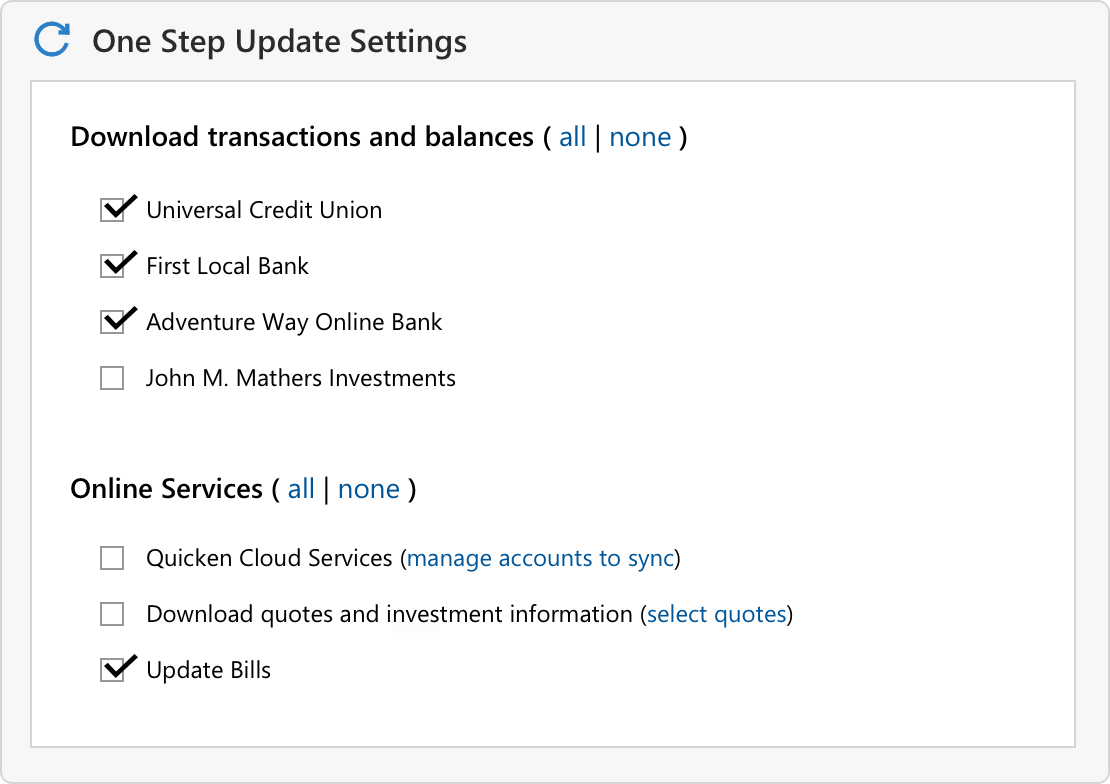

Web & mobile apps

Sync with the Quicken web & mobile apps to manage your money on the go.

Free phone and chat support

Get help if you need it from our dedicated support team.

Trusted for 40 years

#1 best-selling with 20+ million customers over four decades.

30-day money-back guarantee

Get a full refund if you cancel for any reason in the first 30 days.*

Safety & security

Quicken protects your data with robust 256-bit encryption.

See what our customers are saying

See what else Quicken has to offer

Starter

Starter

Organize your basic finances

- Organize your banking and credit cards in one place

- Stay up to date: Quicken downloads & categorizes your transactions automatically

- Create a simple monthly budget and see where your money is going

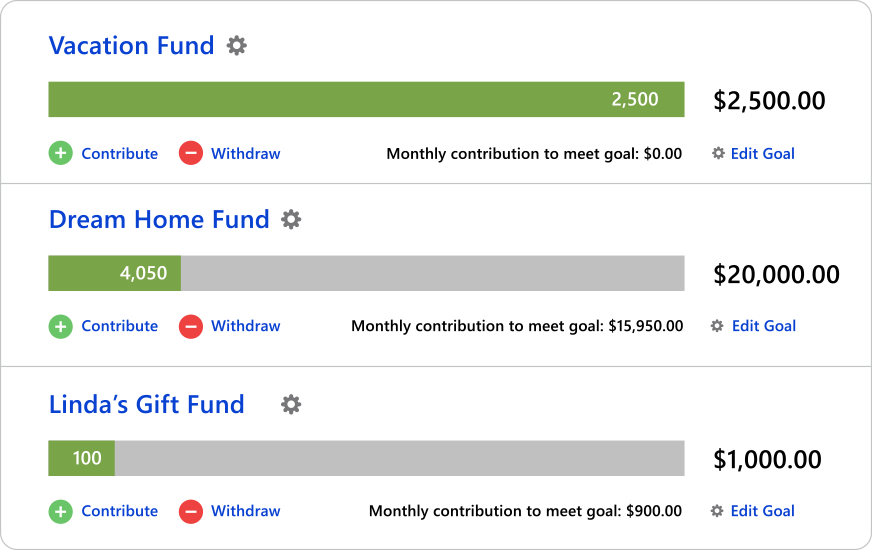

- Grow your savings and make sure you’re on track

- Get web and mobile companion apps

Deluxe

Deluxe

Manage your finances & investments

Everything in Starter, plus:

- Connect banking, credit cards, loans, investments, & property

- Create a customized 12-month budget and ensure you’re spending where you want to be

- Project different scenarios for loans & investments and use built-in calculators to plan ahead

- Make tax prep easier, and create a roadmap for your retirement

Home & Business

Home & Business

Manage home & business

Everything in Deluxe, plus:

- Manage your personal & business finances together with perfect separation

- Generate the reports you need for taxes: Schedule B & D tax reports, profit & loss, cash flow, balance sheets & more

- Customize invoices with your brand & email or print them right from Quickens

- Store business documents where you need them

FAQs

What kinds of investment accounts can Quicken track?

Just about anything. Quicken Home & Business offers the best tools on the market for managing investments and transactions. Use it to monitor all your investments: brokerage, SSRP, RESP, and even private holdings.

Can Quicken also track physical assets?

Yes! Track the value of all your tangible assets: your home, property, vehicles, collectibles, and more.

Which tax-schedule reports does Quicken Home & Business support?

- Schedule B (interest & dividends)

- Schedule D (capital gains & losses)

- T1 Form

- Tax Schedule

- Tax summary

- Capital Gains

Can Quicken help me pay down debt?

Definitely. You can use Quicken Deluxe and Quicken Home & Business to manage & pay down debt from your mortgage and car loans to your student loans and other personal liabilities.