Plan for Retirement

To plan for where you are going, you first need to understand where you are today.

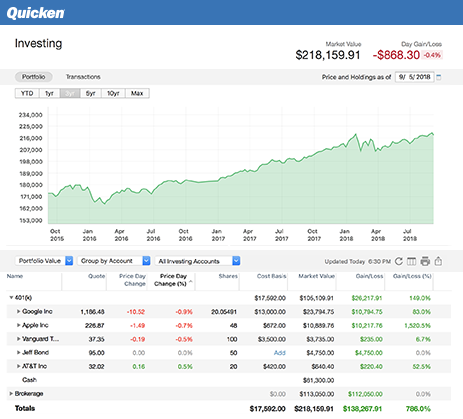

Your retirement accounts all in one place

Planning for your financial future starts with taking stock of where you are today

Connect to your financial institutions to see where you stand with your variouse accounts

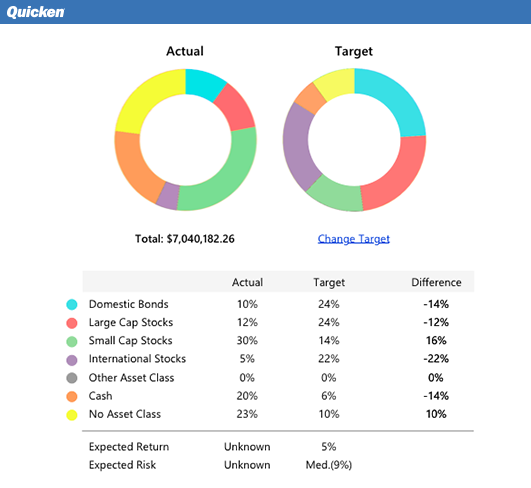

Get a comprehensive view of your holdings and investment portfolio

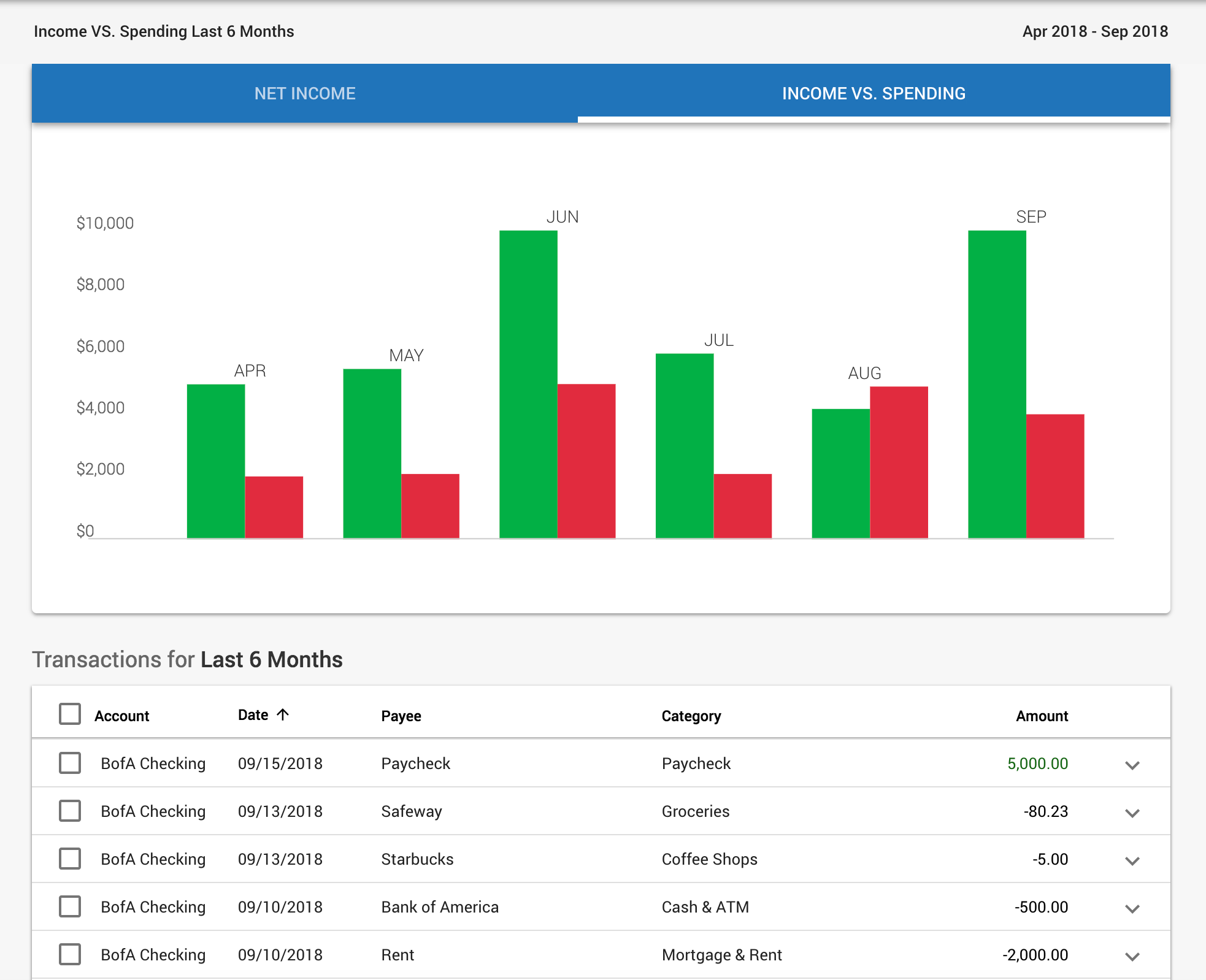

Track your spending and see its impact

Understanding your spending will allow you to create an accurate forecast of what you’ll need in the future

- See detailed breakdown of spending (and income) by category across all of your accounts (checking, savings, credit cards, debit cards)

- Create a customized budget that fits your unique situation

- Stay on top of your bills and other recurring expenses

- Easily generate spending or cash flow reports for yourself or for your financial planner or advisor

Know your net worth-instantly

Get a handle on retirement planning with a tool that considers your complete net worth, including assets and liabilities.

See a single comprehensive view of your holdings and investment portfolio

Explore your optimal investing allocation (Windows only)

Find the Quicken that works for you

Deluxe

Everything in Starter, plus:

- Create a customized budget

- Manage and track your debt

- Create savings goals

- Simplify your taxes and track investments.

$6.99/mo

Billed annually

Home & Business

Everything in Deluxe, plus:

- Separate and categorize business and personal expenses

- Email custom invoices from Quicken

- Simplify and track your business tax deductions and your profit & loss

$9.99/mo

Billed annually

“Quicken gives me peace of mind that my wife and I can live the life we want when we retire.”

Richard W.

Quicken Premier since 2009