Overview

Quicken uses different connection methods to download from your bank. The method Quicken chooses depends on the services supported by your bank, your preferences, and Quicken's relationship with the bank.

In this article, we'll break down the four connection methods and the differences between them!

There are four ways Quicken interacts with your bank:

- Express Web Connect (Quicken Connect in Quicken for Mac)

- Express Web Connect Plus

- Direct Connect

- Web Connect

Web Connect is, simply put, a way you can download your transactions directly from your bank's website and import them into Quicken.

With the Express Web Connect (EWC)/Quicken Connect and Direct Connect methods, Quicken links up directly with your bank on your behalf. You don't have to sign in to your bank's website and manually download transactions - Quicken does this for you! With Direct Connect, Quicken can even talk back (for bill pay, money transfers, etc.).

With Express Web Connect Plus (EWC+), you are taken from Quicken to the bank's website where, after successfully signing in, a secure token is passed to Quicken and stored by the aggregation service. With this connection method, your bank credentials are never stored and you can revoke the secure token at any time.

This method is becoming increasingly popular and is being adopted by more and more institutions (recently Chase, American Express, Charles Schwab, etc.).

Note: Quicken for Mac currently uses the term “Quicken Connect” instead of “Express Web Connect (EWC)”, but the functionality is the same. Quicken for Mac also supports EWC+ for all the same institutions as Quicken for Windows.

Ok, so how does it work?

Depending on the services supported by your bank, Quicken chooses the best available method to update transactions and balances. Quicken will always start with Direct Connect if your bank supports it. Your bank will typically have you give them a call to establish Direct Connect, since real-time transfers of money are involved. If your bank doesn't support Direct Connect, then you'll be automatically set up to use Express Web Connect/Quicken Connect or Express Web Connect Plus. Express Web Connect/Quicken Connect are the most common connection types.

Note: Most banks make the last 90 days of transactions available for download. If you need transactions from before those 90 days, contact your bank for assistance.

Is my financial information safe?

Of course! To read more about how Quicken protects your financial information, click here.

Instructions

Adding an Express Web Connect Account

For instructions for Quicken for Windows, click here.

For instructions for Quicken for Mac, click here.

Adding an Express Web Connect Plus Account

For instructions for Quicken for Windows, click here.

For instructions for Quicken for Mac, click here.

Adding a Direct Connect Account

For instructions for Quicken for Windows, click here.

For instructions for Quicken for Mac, click here.

Using Web Connect to Download Transactions

For Web Connect instructions, see How To Activate a Web Connect Account.

I've already set up my account. How do I know which method I'm using?

- Choose the Tools menu in the upper left then select Account List. Click Edit next to your account, then choose the Online Services tab at the top.

- On a Mac, choose your account on the left, then click the Settings button on the bottom right. If you need to determine which type of Quicken Connect is being used, it will say "FDP_WSI_OAUTH" next to the bank name.

How do I change the connection method on an account?

For steps to change the connection method, click here.

Here's a summary of the differences:

|

Feature

|

Express Web Connect/Quicken Connect

|

Express Web Connect Plus

|

Direct Connect

|

Web Connect

|

| Automatically download transactions from your financial institution. |

X

|

X

|

X

|

|

| Pay bills and transfer money directly from Quicken. |

|

|

X

|

|

| Your financial institution may require a monthly fee and separate activation for this service. |

|

|

X

|

|

| You must manually download a file from your financial institution's website to update your transactions and account balances. |

|

|

|

X

|

Express Web Connect / Quicken Connect - Details

| |

|

| Availability |

|

| Features |

- Download transactions and update account balances.

|

| Setup |

- Use the website login information as your user ID and password when you add accounts at that bank to Quicken.

|

| Bill Pay |

- Not available from within Quicken.

|

| Use |

- You don't need to leave Quicken to download transactions and update account balances.

- Just update your accounts and your new transactions and balances will be downloaded directly into Quicken.

|

| Fees |

- You are not charged fees to use Express Web Connect.

|

| Data |

- Express Web Connect is a one-way connection. Data is imported into Quicken, but Quicken cannot affect your transactions or balances in any way.

- Access and retrieval of data is automated through the use of nightly updates. During these updates, our aggregation partner logs in to your bank's website on your behalf. Generally, this happens once a day and outside of business hours. Because of this, you may notice login activity on your bank's website overnight.

- Your login credentials are stored on our aggregation partner's servers. This makes updates faster for you.

- Your financial data is stored on Quicken-hosted servers. This provides a more complete history of your financial transactions than is typical for data stored on bank's servers.

- Our aggregation partner uses state-of-the-art security measures to protect your login credentials and your financial data.

- Quicken Connect in Quicken for Mac only: Quicken Connect is also a one-way connection between Quicken and the bank server, but does not use a scheduled aggregation system such as the Express Web Connect method. Also, login credentials are stored in the Mac Keychain, not in Quicken.

|

| |

|

Express Web Connect Plus - Details

| |

|

| Availability |

|

| Features |

- Download transactions and update account balances.

|

| Setup |

- Use the website login information as your user ID and password when you add accounts at that bank to Quicken.

|

| Bill Pay |

- Not available from within Quicken.

|

| Use |

- You don't need to leave Quicken to download transactions and update account balances.

- Just update your accounts and your new transactions and balances will be downloaded directly into Quicken.

|

| Fees |

- You are not charged fees to use Express Web Connect Plus.

|

| Data |

- Express Web Connect Plus is a one-way connection. Data is imported into Quicken, but Quicken cannot affect your transactions or balances in any way.

- A secure is token stored on our aggregation partner's servers. This makes updates faster for you.

- Your financial data is stored on Quicken-hosted servers. This provides a more complete history of your financial transactions than is typical for data stored on bank's servers.

- Our aggregation partner uses state-of-the-art security measures to protect your login credentials and your financial data.

|

| |

|

Direct Connect - Details

| |

|

| Availability |

- Direct Connect is available to customers of Quicken partner banks.

|

| Features |

- Download transactions, update account balances, pay bills, and transfer money between your accounts.

|

| Setup |

- Contact your bank to check on availability and to sign up for Direct Connect with Quicken.

|

| Bill Pay |

- Available from within Quicken.

|

| Use |

- You don't need to leave Quicken to use the features that Direct Connect provides.

- If you signed up for bill payment, you can create payments from within Quicken and send them at the same time you download transactions and update your account balances.

|

| Fees |

- You may need to pay your bank a fee to use Direct Connect.

- Banks pay Quicken a fee to support the services that Direct Connect provides.

- The fee may appear in your account as a Quicken fee.

- Contact your bank for details.

|

| Data |

- Direct Connect is a two-way connection. This means that data flows in both directions. First, a request for data is sent to your bank by Quicken. After the request has been authenticated by your bank's servers, data is then received and presented in Quicken.

- Your financial data is stored on servers controlled by your financial institution or by a third-party they connect with.

- Your financial data is encrypted during download.

- You may be required to use a unique login ID and password that is separate from the ones used with your bank's website.

- Your customer ID and password are not stored on our aggregation partner's servers. If you choose to use the Quicken Password Vault, we encrypt them on your computer's hard drive.

- Web and mobile app users: In order to sync your financial data to web and the mobile app, Quicken connects with our aggregation partner and your login credentials are stored on their encrypted servers. This allows our partner to collect your financial data so it can be synced to web/mobile.

|

| |

|

Web Connect - Details

| |

|

| Availability |

- Web Connect is available to customers of Quicken partner banks.

|

| Features |

- Download transactions and update account balances.

|

| Setup |

- Visit your financial institution website and create a website login if you don’t have one already.

- Use the website login information as your user ID and password when you add accounts at that bank to Quicken.

|

| Bill Pay |

- Not available from within Quicken.

|

| Use |

- Initiate an update by visiting your bank's website and navigate to a “Download” or “History” area (the name will vary). When you see a button or link that says Download to Quicken, click it.

- Initiate an update from within Quicken, open the account you want to update, and then choose Account Actions > Update Now. This will take you to your bank's website. Click Download to Quicken to update your account.

|

| Fees |

- You are not charged fees to use Web Connect.

- Banks pay Quicken a fee to support the services that Web Connect provides.

|

| Data |

- Web Connect is a one-way connection. Data is imported into Quicken, but not exported.

- All imported data is stored on your computer.

- Financial data is encrypted during download.

- Your login information is not stored in Quicken. You must enter it each time you update your account.

|

| |

|

Troubleshooting

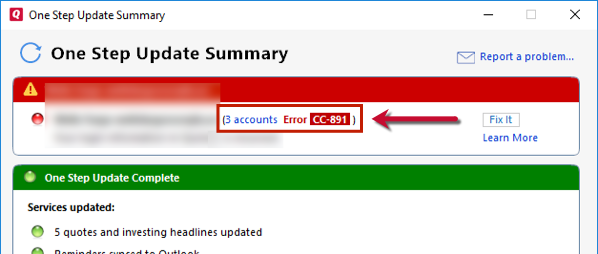

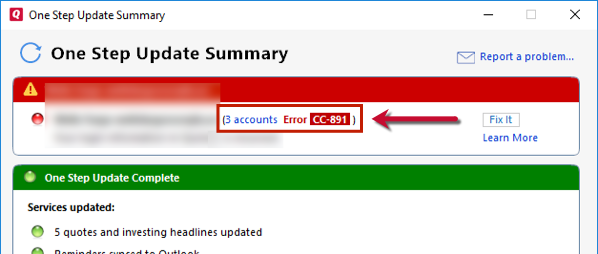

For the online banking troubleshooting guide, click here. You can also find the specific error number in the One Step Update Summary. You can then search for that error number in the Search field at the top of this page.

Community Content